Video game publisher Electronic Arts (NASDAQ: EA) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 5.8% year on year to $2.03 billion. On the other hand, next quarter’s revenue guidance of $1.95 billion was less impressive, coming in 12% below analysts’ estimates. Its GAAP profit of $1.11 per share was also 24.9% above analysts’ consensus estimates.

Is now the time to buy Electronic Arts? Find out by accessing our full research report, it’s free.

Electronic Arts (EA) Q3 CY2024 Highlights:

- Revenue: $2.03 billion vs analyst estimates of $1.98 billion (2.3% beat)

- EPS: $1.11 vs analyst estimates of $0.89 (24.9% beat)

- EBITDA: $680 million vs analyst estimates of $713.9 million (4.7% miss)

- The company lifted its revenue guidance for the full year to $7.55 billion at the midpoint from $7.3 billion, a 3.4% increase

- EPS (GAAP) guidance for the full year is $4.08 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 77.5%, up from 76.2% in the same quarter last year

- Operating Margin: 19%, in line with the same quarter last year

- EBITDA Margin: 33.6%, up from 29.4% in the same quarter last year

- Free Cash Flow Margin: 9.1%, up from 3.2% in the previous quarter

- Market Capitalization: $38.09 billion

Company Overview

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ: EA) is one of the world’s largest video game publishers.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Sales Growth

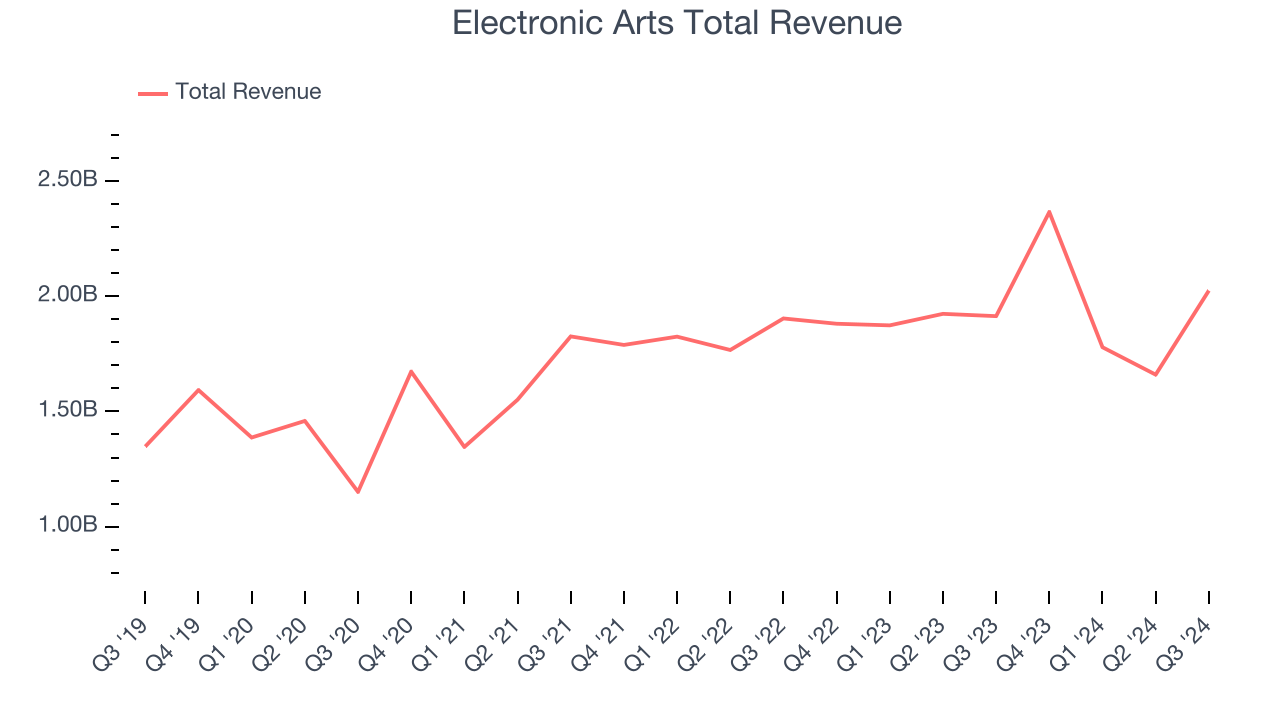

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Regrettably, Electronic Arts’s sales grew at a tepid 7% compounded annual growth rate over the last three years. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Electronic Arts reported year-on-year revenue growth of 5.8%, and its $2.03 billion of revenue exceeded Wall Street’s estimates by 2.3%. Management is currently guiding for a 17.6% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to decline 5.1% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and shows the market thinks its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Electronic Arts’s Q3 Results

It was great to see Electronic Arts beat analysts’ revenue and EPS expectations this quarter. We were also glad it raised its full-year revenue guidance. Overall, this was a solid quarter. The stock traded up 1.4% to $147.57 immediately after reporting.

Is Electronic Arts an attractive investment opportunity right now?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.