Footwear company Crocs (NASDAQ: CROX) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 1.6% year on year to $1.06 billion. Its non-GAAP profit of $3.60 per share was also 15.9% above analysts’ consensus estimates.

Is now the time to buy Crocs? Find out by accessing our full research report, it’s free.

Crocs (CROX) Q3 CY2024 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $1.05 billion (1% beat)

- Adjusted EPS: $3.60 vs analyst estimates of $3.11 (15.9% beat)

- EBITDA: $288 million vs analyst estimates of $272.9 million (5.5% beat)

- Management lowered its full-year revenue guidance to 3% year on year growth vs 3-5% previously

- Gross Margin (GAAP): 59.6%, up from 55.6% in the same quarter last year

- Operating Margin: 25.4%, in line with the same quarter last year

- EBITDA Margin: 27.1%, down from 29.7% in the same quarter last year

- Free Cash Flow Margin: 26.3%, up from 20.6% in the same quarter last year

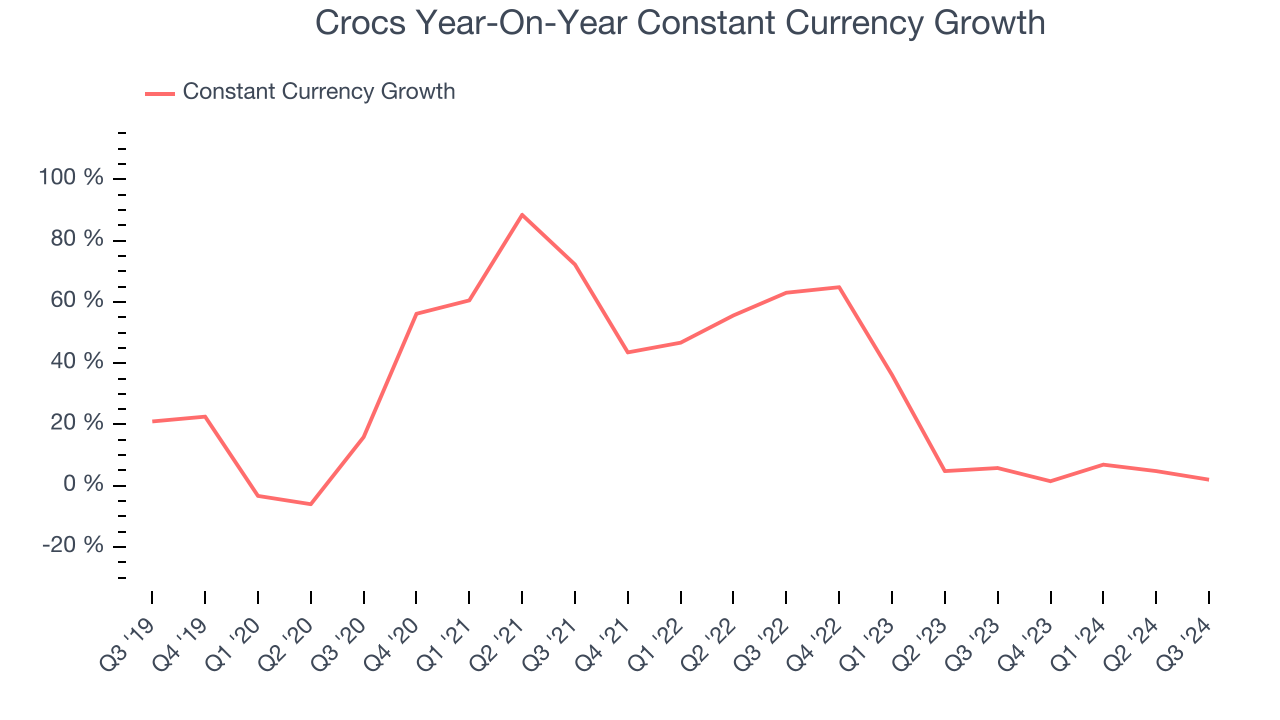

- Constant Currency Revenue rose 2% year on year(compared to 5.8% in the same quarter last year)

- Market Capitalization: $8.20 billion

"We reported third quarter results which exceeded our Enterprise guidance on sales and profitability," said Andrew Rees, Chief Executive Officer.

Company Overview

Founded in 2002, Crocs (NASDAQ: CROX) sells casual footwear and is known for its iconic clog shoe.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

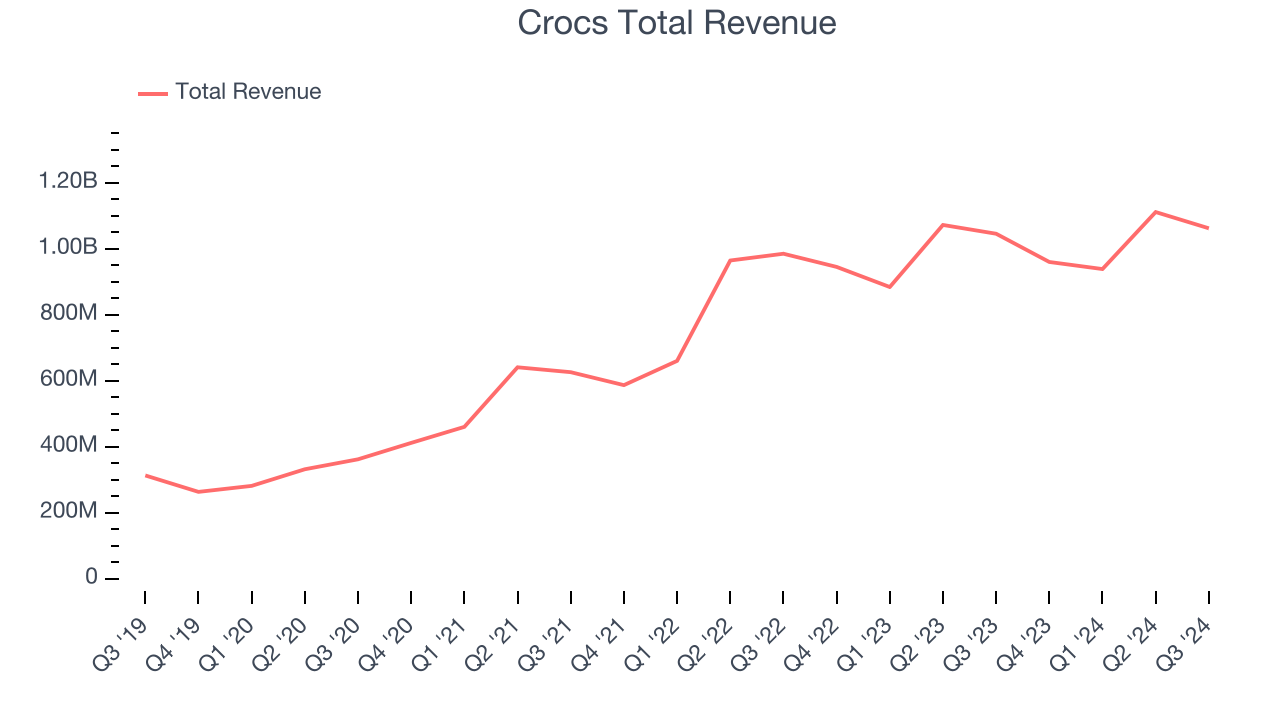

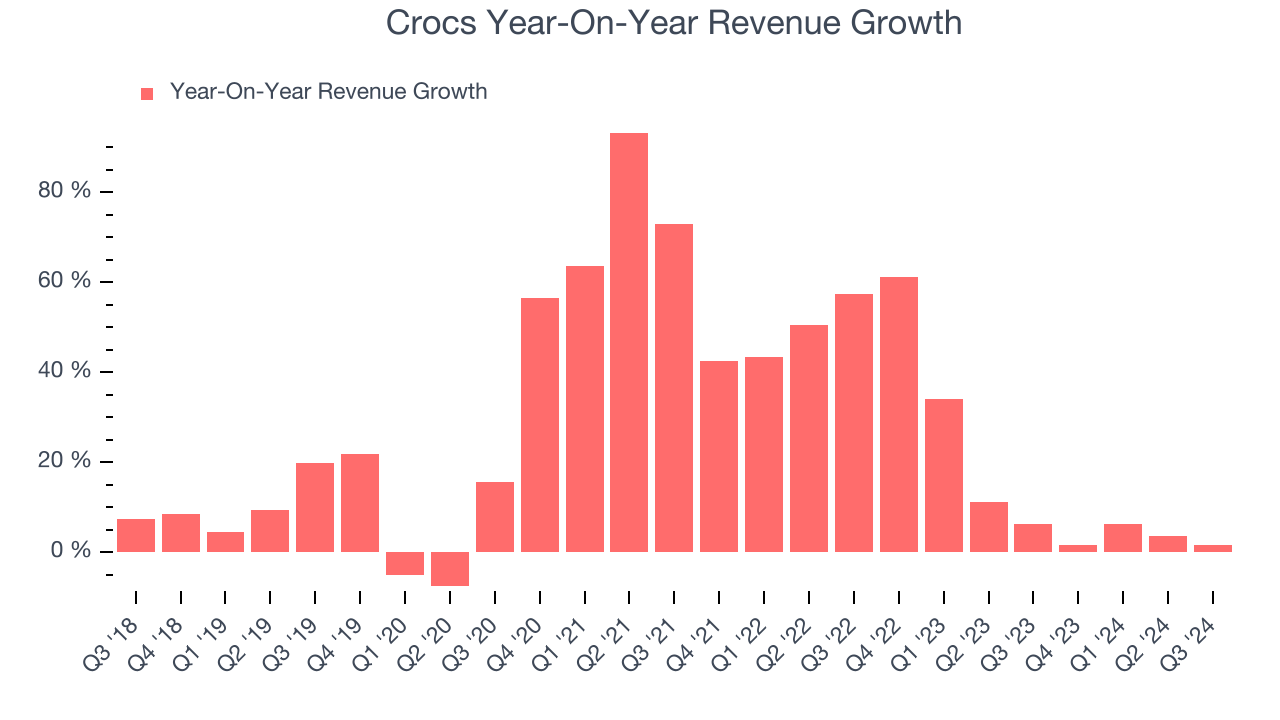

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Crocs’s sales grew at an exceptional 28% compounded annual growth rate over the last five years. This is encouraging because it shows Crocs’s offerings resonate with customers, a helpful starting point.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Crocs’s recent history shows its demand slowed significantly as its annualized revenue growth of 12.9% over the last two years is well below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 15.9% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Crocs.

This quarter, Crocs reported modest year-on-year revenue growth of 1.6% but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and illustrates the market thinks its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

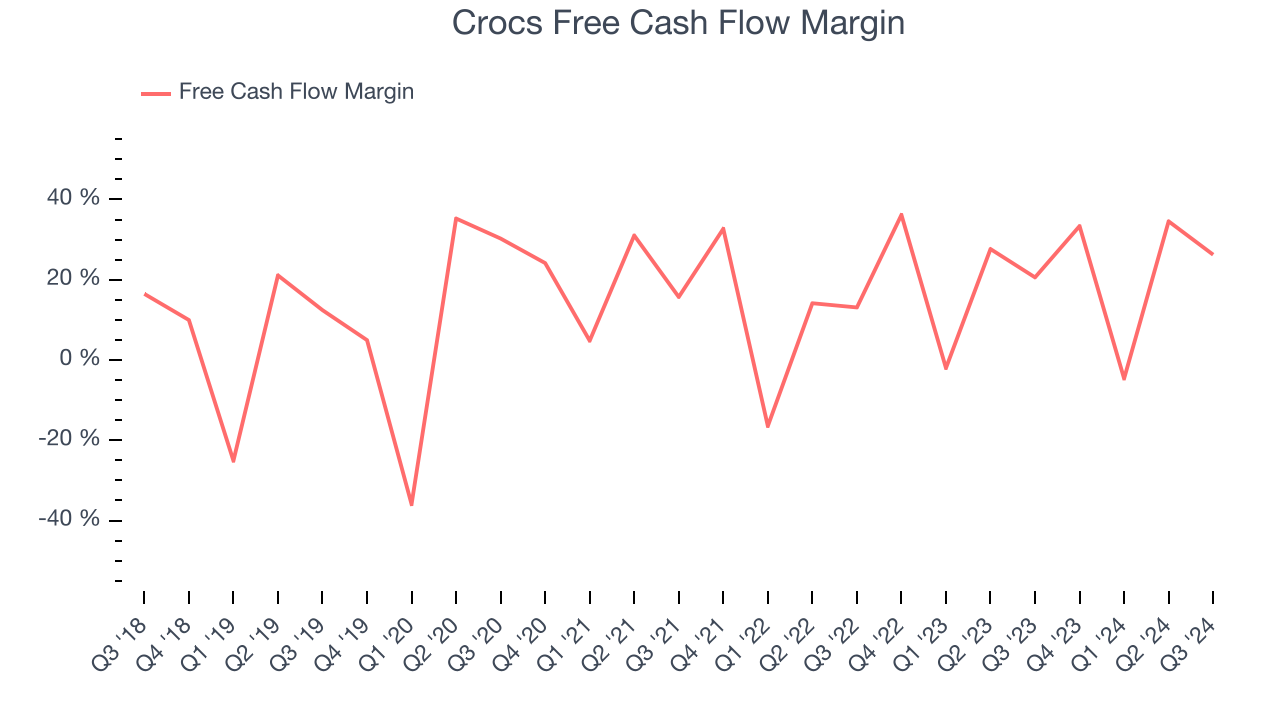

Crocs has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer discretionary sector, averaging 22.1% over the last two years.

Crocs’s free cash flow clocked in at $278.8 million in Q3, equivalent to a 26.3% margin. This result was good as its margin was 5.7 percentage points higher than in the same quarter last year. Its cash profitability was also above its two-year level, and we hope the company can build on this trend.

Over the next year, analysts’ consensus estimates show they’re expecting Crocs’s free cash flow margin of 23.1% for the last 12 months to remain the same.

Key Takeaways from Crocs’s Q3 Results

We enjoyed seeing Crocs exceed analysts’ constant currency revenue expectations this quarter. We were also excited its EPS outperformed Wall Street’s estimates. On the other hand, management lowered its full year revenue guidance and its EPS forecast for next quarter missed. Zooming out, we think this was a decent quarter, but guidance is weighing on shares. The stock traded down 10.2% to $124 immediately following the results.

So do we think Crocs is an attractive buy at the current price?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.