Data backup provider Commvault (NASDAQ: CVLT) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 16.1% year on year to $233.3 million. On top of that, next quarter’s revenue guidance ($245 million at the midpoint) was surprisingly good and 3.6% above what analysts were expecting. Its non-GAAP profit of $0.83 per share was also 9.7% above analysts’ consensus estimates.

Is now the time to buy Commvault Systems? Find out by accessing our full research report, it’s free.

Commvault Systems (CVLT) Q3 CY2024 Highlights:

- Revenue: $233.3 million vs analyst estimates of $220.9 million (5.6% beat)

- Adjusted EPS: $0.83 vs analyst estimates of $0.76 (9.7% beat)

- Adjusted Operating Income: $47.75 million vs analyst estimates of $43.17 million (10.6% beat)

- The company lifted its revenue guidance for the full year to $954.5 million at the midpoint from $920 million, a 3.8% increase

- Gross Margin (GAAP): 81.6%, in line with the same quarter last year

- Operating Margin: 0%, down from 8.8% in the same quarter last year

- Free Cash Flow Margin: 23%, up from 19.5% in the previous quarter

- Annual Recurring Revenue: $853.3 million at quarter end, up 19.9% year on year

- Billings: $235.7 million at quarter end, up 14.9% year on year

- Market Capitalization: $5.99 billion

"Keeping customers resilient and their businesses continuous has never been more critical than it is today," said Sanjay Mirchandani, President and CEO.

Company Overview

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

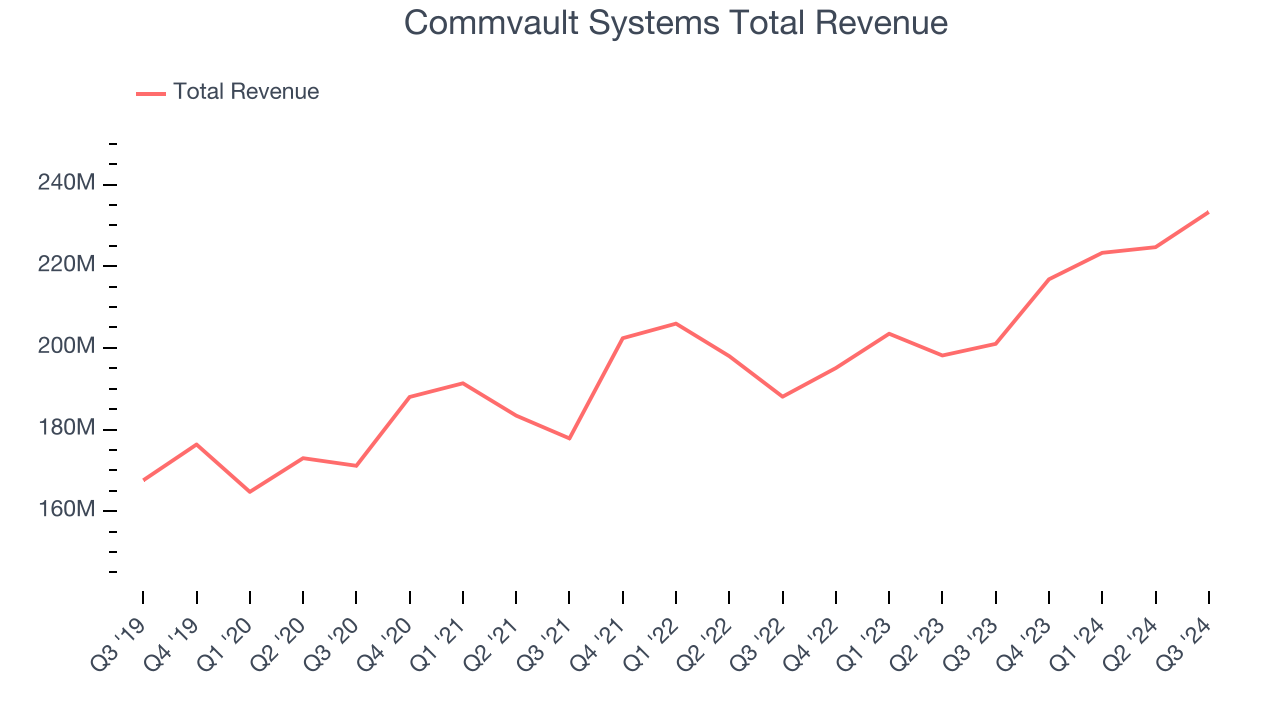

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Commvault Systems’s sales grew at a weak 6.6% compounded annual growth rate over the last three years. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Commvault Systems reported year-on-year revenue growth of 16.1%, and its $233.3 million of revenue exceeded Wall Street’s estimates by 5.6%. Management is currently guiding for a 13% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months. While this projection illustrates the market believes its newer products and services will catalyze better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

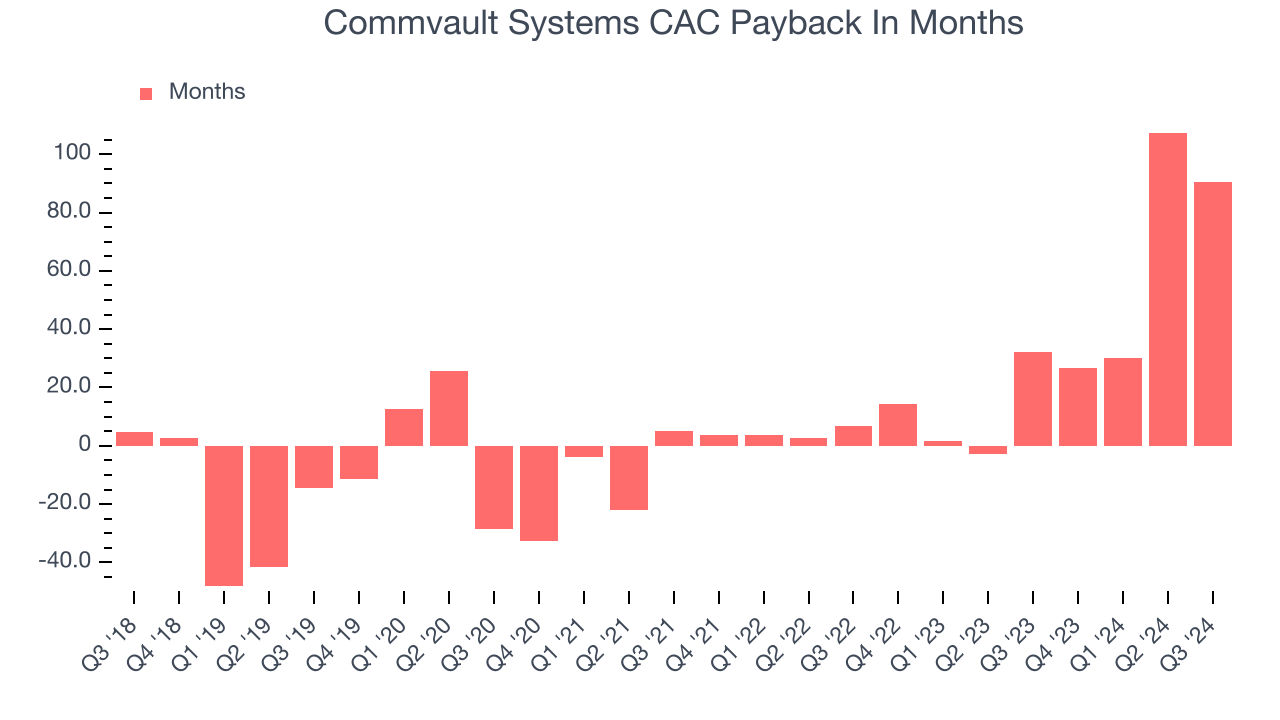

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for Commvault Systems to acquire new customers as its CAC payback period checked in at 90.4 months this quarter. The company’s performance indicates that it operates in a competitive market and must continue investing to maintain its growth trajectory.

Key Takeaways from Commvault Systems’s Q3 Results

We were impressed by how strongly Commvault Systems blew past analysts’ ARR (annual recurring revenue) expectations this quarter. We were also excited its billings outperformed Wall Street’s estimates. EPS beat convincingly, and guidance also came in ahead of expectations. Zooming out, we think this was a very strong quarter. The stock traded up 10.4% to $151.25 immediately after reporting.

Commvault Systems put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment.When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.