The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Workiva (NYSE: WK) and the rest of the finance and hr software stocks fared in Q2.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 15 finance and HR software stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 8.4% on average since the latest earnings results.

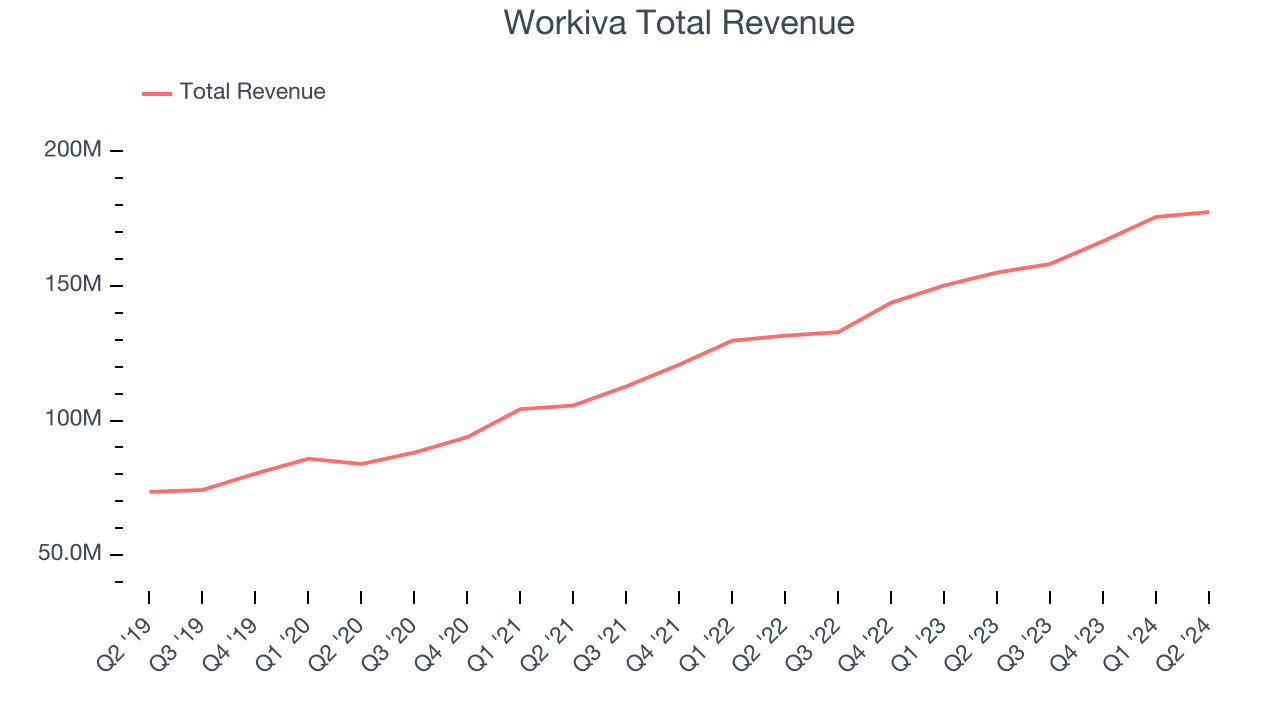

Workiva (NYSE: WK)

Founded in 2010, Workiva (NYSE: WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Workiva reported revenues of $177.5 million, up 14.5% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a strong quarter for the company with accelerating customer growth and an impressive beat of analysts’ EBITDA estimates.

"In Q2, we saw a healthy improvement in the buying environment marked by broad-based demand across our entire solution portfolio," said Julie Iskow, President & Chief Executive Officer.

Workiva scored the highest full-year guidance raise of the whole group. The company added 72 enterprise customers paying more than $100,000 annually to reach a total of 1,768. Unsurprisingly, the stock is up 8.7% since reporting and currently trades at $78.78.

Is now the time to buy Workiva? Access our full analysis of the earnings results here, it’s free.

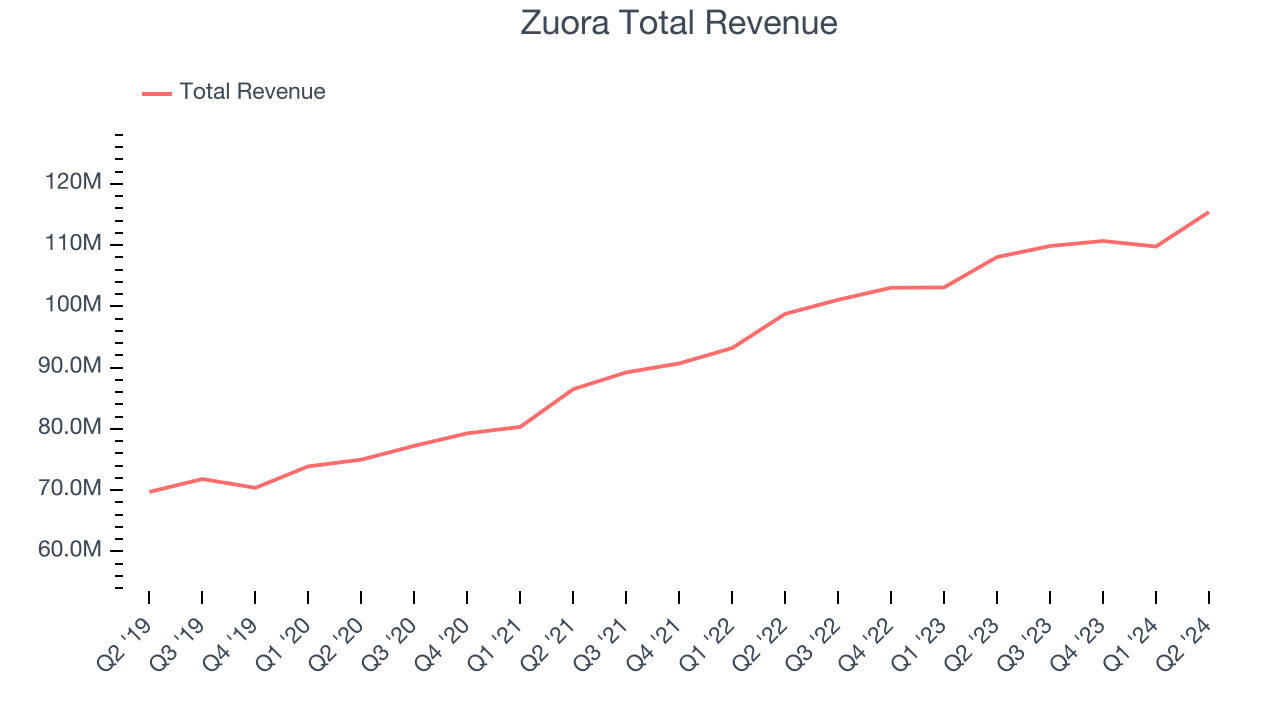

Best Q2: Zuora (NYSE: ZUO)

Founded in 2007, Zuora (NYSE: ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $115.4 million, up 6.8% year on year, outperforming analysts’ expectations by 2.5%. The business had a very strong quarter with an impressive beat of analysts’ billings estimates and optimistic earnings guidance for the next quarter.

The market seems happy with the results as the stock is up 15.9% since reporting. It currently trades at $9.86.

Is now the time to buy Zuora? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Asure (NASDAQ: ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ: ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $28.04 million, down 7.8% year on year, falling short of analysts’ expectations by 2%. It was a softer quarter as it posted a miss of analysts’ EBITDA estimates and a decline in its gross margin.

Asure delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 7.6% since the results and currently trades at $9.23.

Read our full analysis of Asure’s results here.

Intuit (NASDAQ: INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $3.18 billion, up 17.4% year on year. This print beat analysts’ expectations by 3.1%. Aside from that, it was a slower quarter as it recorded a decline in its gross margin and underwhelming earnings guidance for the next quarter.

The stock is down 8.6% since reporting and currently trades at $608.89.

Read our full, actionable report on Intuit here, it’s free.

Flywire (NASDAQ: FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ: FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $99.9 million, up 17.7% year on year. This number was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it also produced an impressive beat of analysts’ EBITDA estimates but a decline in its gross margin.

Flywire achieved the fastest revenue growth among its peers. The stock is down 2.6% since reporting and currently trades at $17.32.

Read our full, actionable report on Flywire here, it’s free.

Market Update

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and them to your watchlist. These companies are posied for grow regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.