Manufacturing company Leggett & Platt (NYSE: LEG) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 6.3% year on year to $1.10 billion. The company expects next quarter’s revenue to be around $1.02 trillion, slightly above analysts’ estimates. Its non-GAAP profit of $0.32 per share was 2.3% below analysts’ consensus estimates.

Is now the time to buy Leggett & Platt? Find out by accessing our full research report, it’s free.

Leggett & Platt (LEG) Q3 CY2024 Highlights:

- Revenue: $1.10 billion vs analyst estimates of $1.10 billion (in line)

- Adjusted EPS: $0.32 vs analyst expectations of $0.33 (2.3% miss)

- Revenue Guidance for Q4 CY2024 is $1.02 trillion at the midpoint, above analyst estimates of $1.07 billion

- Management lowered its full-year Adjusted EPS guidance to $1.05 at the midpoint, a 10.6% decrease

- Gross Margin (GAAP): 18.2%, in line with the same quarter last year

- Operating Margin: 7.1%, in line with the same quarter last year

- Free Cash Flow Margin: 7%, down from 10.3% in the same quarter last year

- Market Capitalization: $1.63 billion

President and CEO Karl Glassman commented, "We continued to make solid progress on our restructuring and operating efficiency improvement initiatives, although demand headwinds were more challenging than anticipated in the third quarter. Despite weaker than expected results, we paid down $124 million of debt and adjusted EBIT margin improved by 60 basis points sequentially this quarter.

Company Overview

Founded in 1883, Leggett & Platt (NYSE: LEG) is a diversified manufacturer making products for various industries.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Sales Growth

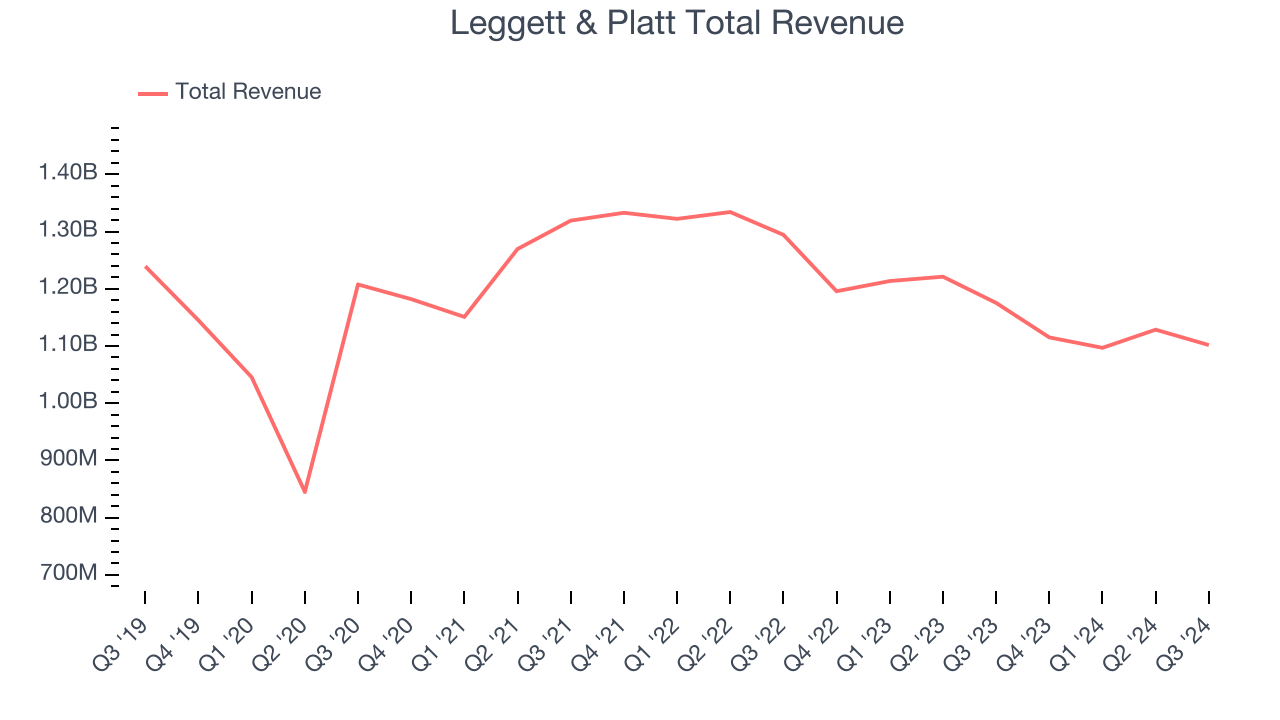

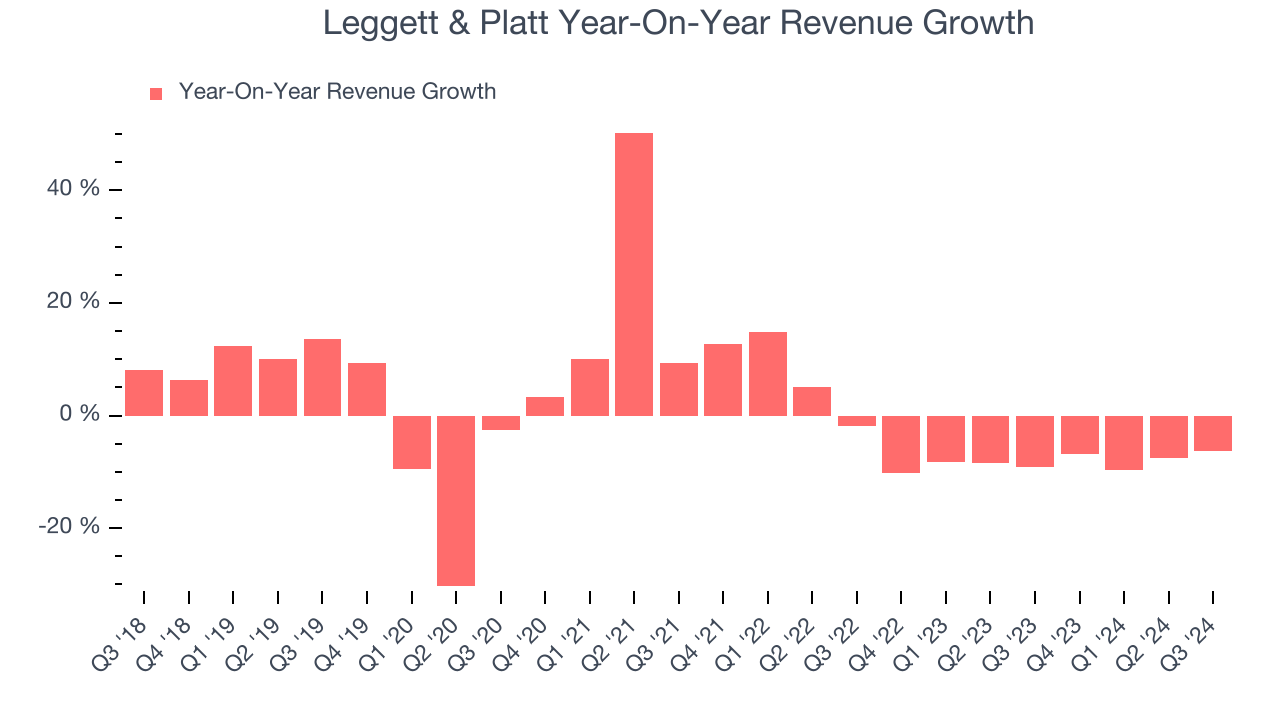

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Leggett & Platt’s sales were flat. This shows demand was soft and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Leggett & Platt’s recent history shows its demand has stayed suppressed as its revenue has declined by 8.3% annually over the last two years.

This quarter, Leggett & Platt reported a rather uninspiring 6.3% year-on-year revenue decline to $1.10 billion of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 91,641% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection shows the market believes its newer products and services will fuel better performance, it is still below the sector average.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

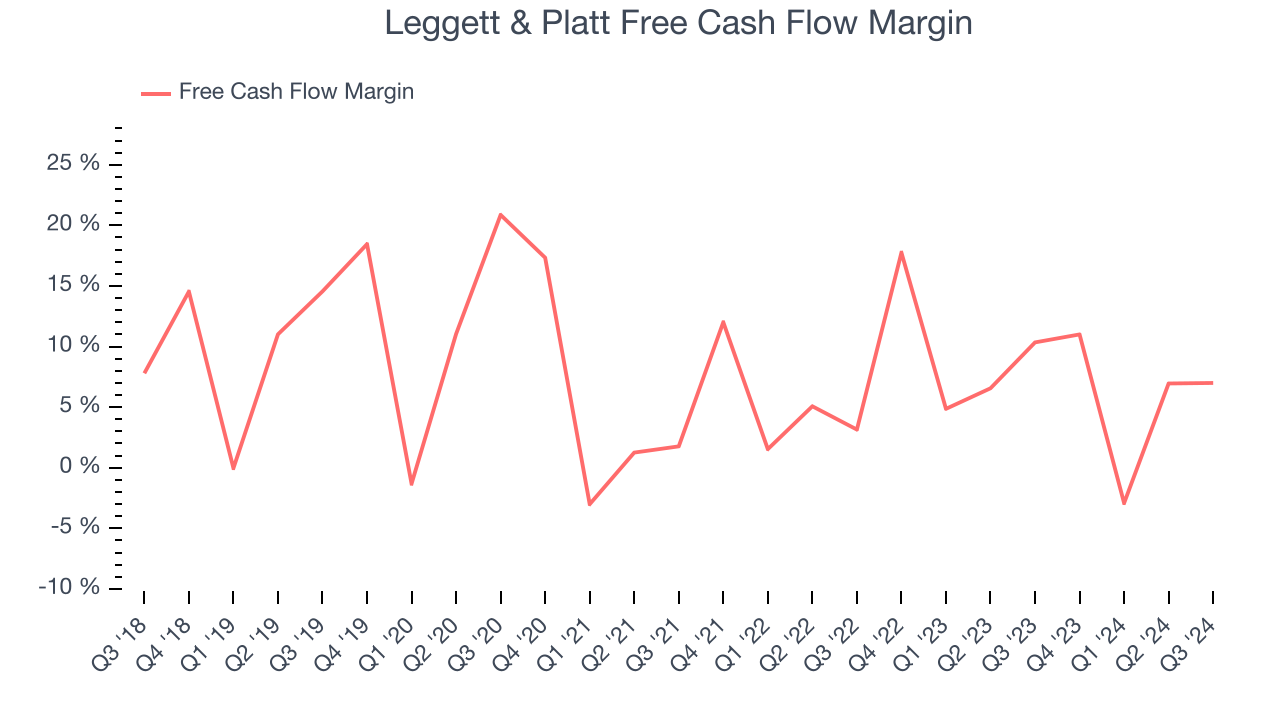

Leggett & Platt has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.8%, subpar for a consumer discretionary business.

Leggett & Platt’s free cash flow clocked in at $77.1 million in Q3, equivalent to a 7% margin. The company’s cash profitability regressed as it was 3.3 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Leggett & Platt’s Q3 Results

We were impressed by Leggett & Platt’s revenue guidance for next quarter, which blew past analysts’ expectations. On the other hand, its EPS forecast for next quarter missed and its EPS guidance for the full year fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.8% to $11.45 immediately following the results.

Leggett & Platt’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.