Industrial conglomerate Crane Company (NYSE: CR) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 12.7% year on year to $597.2 million. Its non-GAAP profit of $1.38 per share was 4.5% above analysts’ consensus estimates.

Is now the time to buy Crane Company? Find out by accessing our full research report, it’s free.

Crane Company (CR) Q3 CY2024 Highlights:

- Revenue: $597.2 million vs analyst estimates of $594.5 million (in line)

- Adjusted EPS: $1.38 vs analyst estimates of $1.32 (4.5% beat)

- EBITDA: $121.1 million vs analyst estimates of $118.3 million (2.4% beat)

- Management raised its full-year Adjusted EPS guidance to $5.13 at the midpoint, a 1.5% increase

- Gross Margin (GAAP): 39.9%, up from 38.3% in the same quarter last year

- Operating Margin: 17.6%, up from 14.4% in the same quarter last year

- EBITDA Margin: 20.3%, up from 17% in the same quarter last year

- Free Cash Flow Margin: 12.2%, down from 14.7% in the same quarter last year

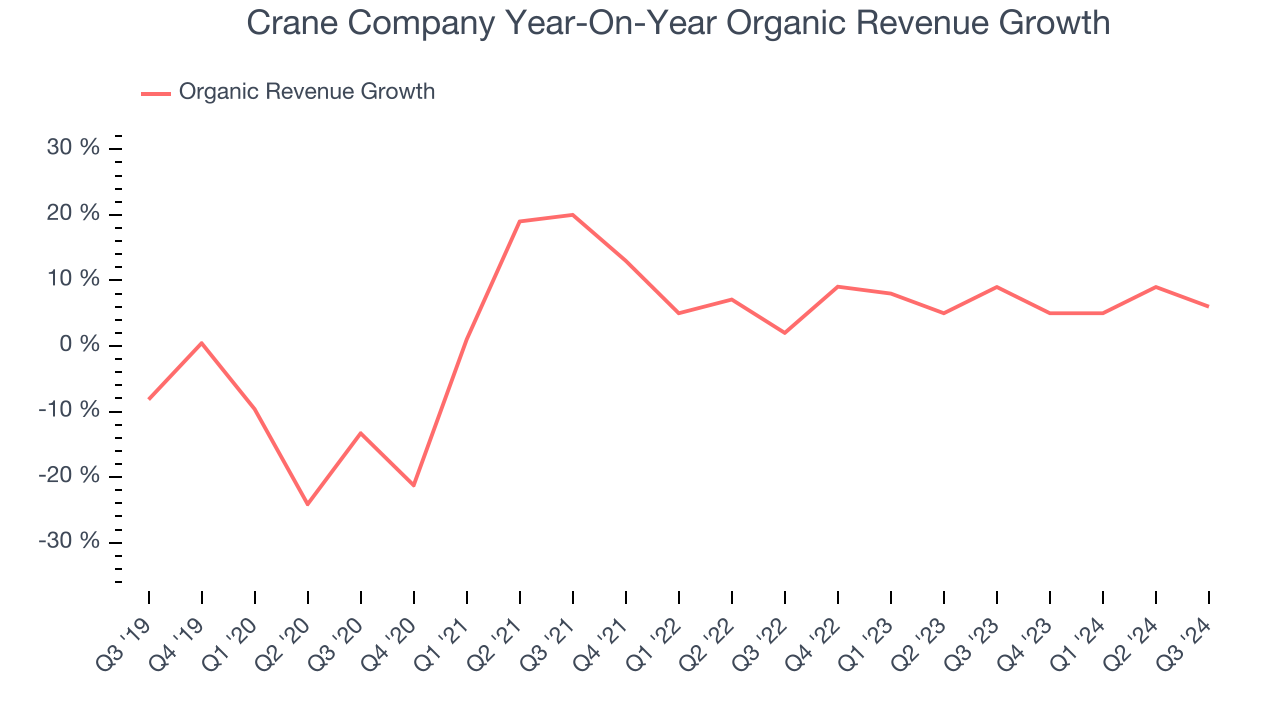

- Organic Revenue rose 6% year on year (9% in the same quarter last year)

- Market Capitalization: $8.53 billion

Max Mitchell, Crane's Chairman, President and Chief Executive Officer, stated: "We delivered another quarter of excellent results, with 34% adjusted EPS growth driven by 6% core sales growth, reflecting continued strong execution by our teams globally. Furthermore, demand trends across our strategic growth platforms were also encouraging in the quarter, with 6% year-over-year core order growth and 10% year-over-year core backlog growth, giving us confidence as we close out the year and increasingly look toward 2025. Taken together, we are raising our 2024 adjusted EPS outlook to a range of $5.05-$5.20, up from our prior view of $4.95-$5.15.”

Company Overview

Based in Connecticut, Crane Company (NYSE: CR) is a diversified manufacturer of engineered industrial products, including fluid handling, and aerospace technologies.

General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

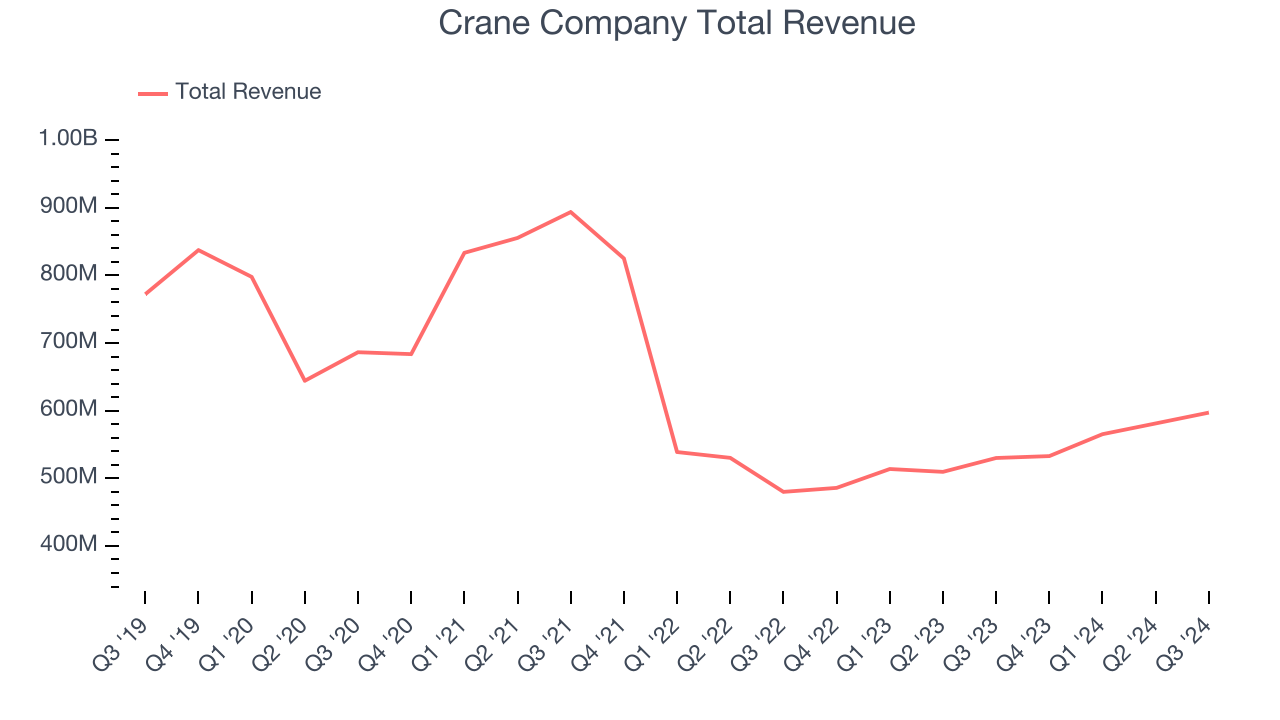

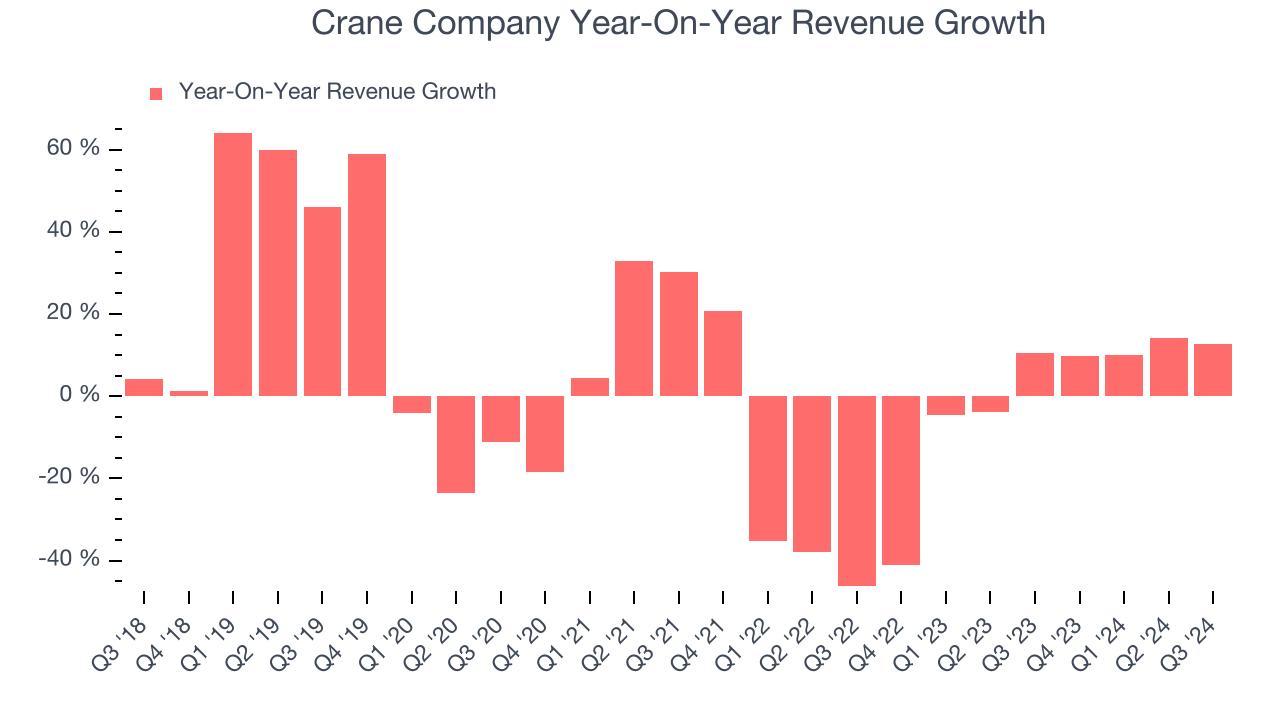

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, Crane Company’s revenue declined by 5.2% per year. This shows demand was weak, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Crane Company’s annualized revenue declines of 2.1% over the last two years suggest its demand continued shrinking.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Crane Company’s organic revenue averaged 7% year-on-year growth. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline performance.

This quarter, Crane Company’s year-on-year revenue growth was 12.7%, and its $597.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.2% over the next 12 months. While this projection indicates the market thinks its newer products and services will fuel better performance, it is still below the sector average.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

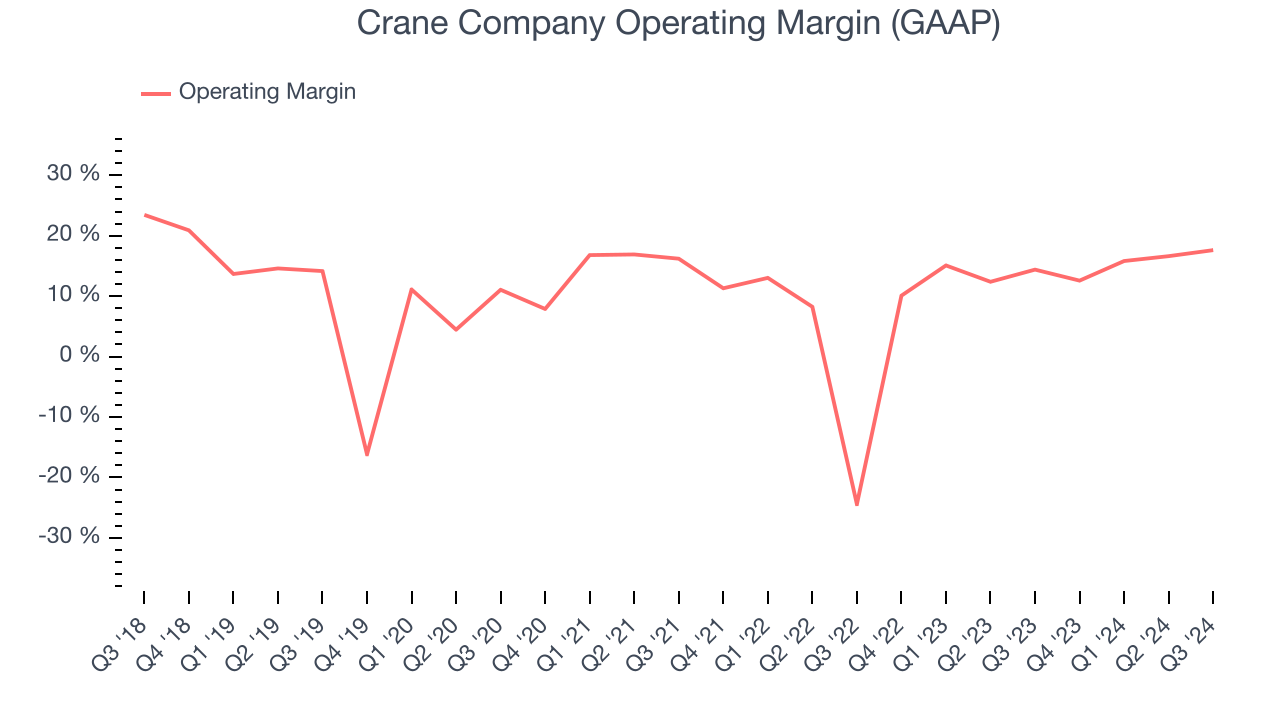

Crane Company has done a decent job managing its cost base over the last five years. The company produced an average operating margin of 9.7%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Crane Company’s annual operating margin rose by 13.8 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q3, Crane Company generated an operating profit margin of 17.6%, up 3.2 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

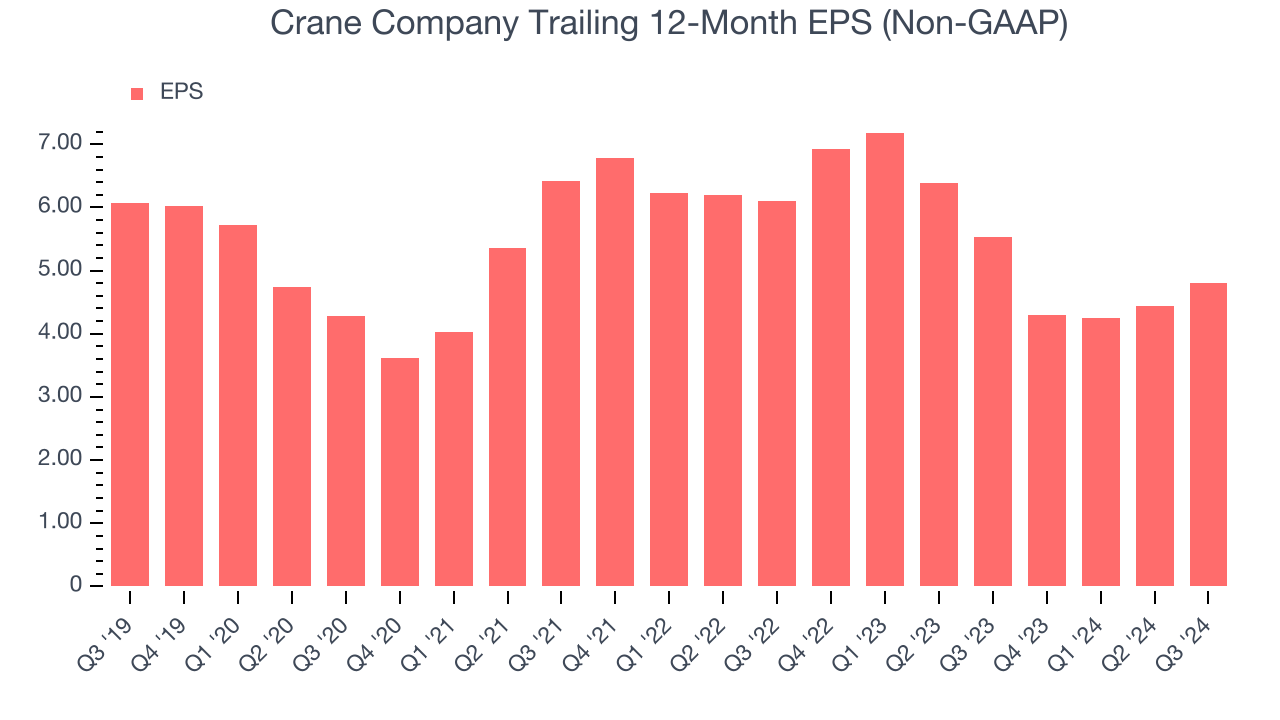

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Crane Company, its EPS and revenue declined by 4.6% and 5.2% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Crane Company’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Crane Company’s two-year annual EPS declines of 11.3% were bad and lower than its two-year revenue performance.In Q3, Crane Company reported EPS at $1.38, up from $1.03 in the same quarter last year. This print beat analysts’ estimates by 4.5%. Over the next 12 months, Wall Street expects Crane Company’s full-year EPS of $4.80 to grow by 17.6%.

Key Takeaways from Crane Company’s Q3 Results

It was good to see Crane Company beat analysts’ EBITDA and EPS expectations this quarter. We were also glad it raised its full-year EPS guidance. On the other hand, its organic revenue missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 2% to $155.50 immediately after reporting.

So should you invest in Crane Company right now?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.