Make way; the technology bulls are charging again! Already up more than 20% this year, the global information technology sector is leading the market higher in 2023. Signs of bank stabilization and muted inflation data helped U.S. stocks end the first quarter on a high note Friday, with some familiar industries leading the way. Semiconductors, internet content providers and consumer electronics makers finished the day (and quarter) with big gains.

The sector’s 2023 leadership is a major reversal from last year when investors avoided tech bulls like anxious matadors. Supply chain improvements and moderating interest rate hikes are paving the way. And with demand outlooks improving in many areas, investors are getting comfortable with higher technology valuations.

As fears turn into confidence, tech stocks aren’t as cheap as they were at the start of the year. For some, the easy money has been made and the near-term upside appears limited. For others, like these three bulls, the run may have only begun.

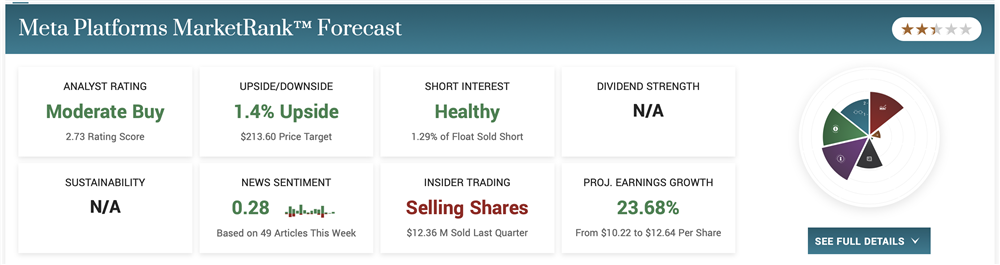

Is Meta Platforms Stock in a Long-Term Uptrend?

Meta Platforms, Inc. (NASDAQ: META) surged 76% in Q1. The main catalyst was the former Facebook’s fourth quarter earnings report. Although revenue continued to be impacted by weak advertising demand and Apple’s ad tracking transparency policy, cost pressures are subsiding. Management’s revised 2023 guidance slashed $5 billion from total expenses. Metaverse spending is still expected to climb rapidly but layoffs and efficiency gains are having a positive impact on Meta’s profit outlook.

Mark Zuckerberg and company are also turning to red-hot artificial intelligence technologies to target and measure digital advertising — and circumvent Apple’s roadblock. At the same time, Meta’s Reels streaming product is gaining momentum just as the competitive threat of Tik-Tok faces scrutiny from U.S. lawmakers.

The surprisingly bullish outlook caused Meta shares to gap up in good volume February 2nd. After a market-led pullback, the stock closed the first quarter at its highest level since May 2022 by breaking out of a consolidation period. Last month, the 50-day average crossed the 200-day moving average. This “golden cross” chart pattern holds the potential for a sustained rally. As Meta enters Q2 on a five-month winning streak, this uptrend looks for “Reel.”

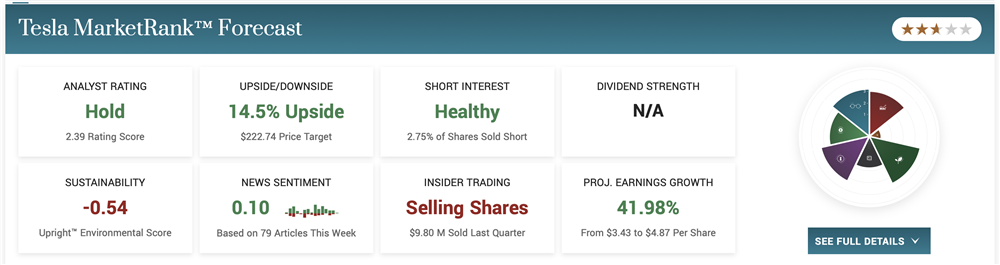

Does Tesla Have Good Growth Prospects?

After ending 2022 on a five-month losing streak, Tesla, Inc. (NASDAQ: TSLA) finished higher in January, February and March of this year. Like Meta, the country’s leading electric vehicle (EV) maker got a boost from its fourth-quarter earnings release, highlighted by a 40% jump in profits. Although management signaled a challenging year ahead, Tesla has an exciting growth engine that could drive better than expected results — new trucks.

The future is now for the futuristic Cybertruck. Last week, the radical, stainless steel-paneled EV was spotted taking part in a pre-production test in California. Production is on track to start later this year, and early customers could be getting a spiffy Christmas gift. Starting around $40,000, the Cybertruck will generate huge buying interest, given the social media frenzy surrounding Tesla’s debut truck.

Meanwhile, the Tesla Semi is getting set to revolutionize the commercial transportation industry. Production and delivery of the all-electric tractor-trailer are underway. At a cost per mile that is an estimated 2.5 times lower than that of a traditional diesel truck, Semi will undoubtedly find demand from fleet operators.

As its truck business launches, demand for Tesla’s passenger vehicles isn’t slowing down either. Deliveries of Models S, X, 3 and Y grew 31% in Q4 despite a weak macro backdrop. Price cuts and positive customer reviews should keep these vehicles popular throughout the year.

Historically, Tesla has commanded P/E ratios well over 100x. At 38x consensus 2024 earnings, it will remain popular with growth investors as well.

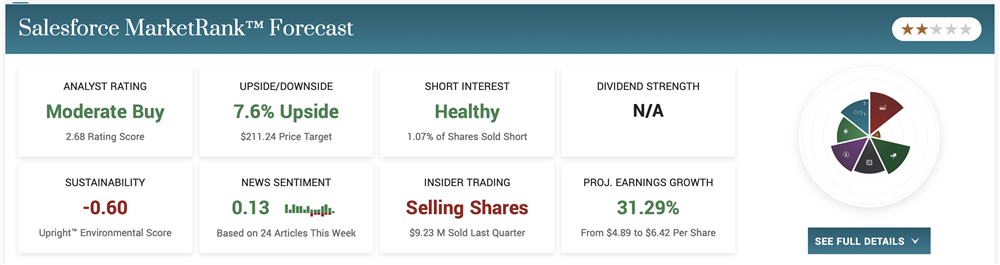

Is Salesforce a Good Momentum Stock?

Salesforce, Inc. (NYSE: CRM) was the best-performing software stock in Q1. For momentum traders, the good news is that a 51% advance recouped only a fraction of its 2022 losses. Better yet, analysts continue to offer bullish sentiment.

Last week, Jeffries reiterated its buy rating and offered a $250 price target that implies 25% upside. The analyst there envisions a path to at least $10 earnings per share (EPS) representing a major acceleration. Last year, the customer relationship management SaaS provider grew EPS by 10% to $5.24. This was impressive for two reasons: 1) it faced a soft demand environment tied to economic uncertainty and 2) it demonstrated management’s commitment to profitability, something the market is increasingly seeking from tech companies as revenue pressures persist.

As its operating environment weakened in 2022, the growth drivers remained in place for Salesforce — enterprises shifting to cloud computing and the digital transformation. So even after its market value plunged by nearly 60%, there was little reason for long-term investors to panic. Tech stocks were selling off everywhere, making Salesforce cheaper in the process. And with Wall Street projecting 45% EPS growth in fiscal 2024, Salesforce’s 28x forward P/E multiple should keep expanding.