The shipping world can be much like the real estate industry, where agents and brokers come and go as the cycle of "hot" markets inevitably comes and goes. By the same token, this cycle births the demand for their services. Just as properties are traded more often and more aggressively depending on the outlook of construction, migration, and overall interest rates that affect the valuation of the underlying asset class, the global list of basic materials experiences the same dynamic.

As the global economy ground to a halt in 2020 due to the effects of the COVID-19 pandemic, the global demand for basic materials cooled down, just as it did for real estate and other industries. The main difference in this comparison is the middle agent of these interchanges. Basic materials that trade and ship globally also have agents and brokers, though the exchange is not through a mortgage for a property, but rather through a vessel bound for a destination.

As the supply of these products dries up and markets realize that trading and transporting these products becomes of utmost importance, everyone turns to vessel and tanker providers to fill this ensuing demand and supply imbalance. One of the main commodities that is traded and shipped globally is the liquid gold of our century: oil. While many other commodities may give way to the ins and outs of the underlying supply and demand environment, oil always leads the way. Without a need for it, there is no consumer activity, nor is there travel or construction, etc.

Awaken The Sleeping Giant

As Warren Buffett likes to say, "The stock market is a voting machine in the short term, and a weighing machine in the long term." Investors can turn to the crude futures market to gauge the popularity of the commodity in the open market, which serves as a proxy for its perceived demand across the global economy.

A bizarre event occurred in 2020 as oil prices went negative, reflecting the lack of future demand that would come from a long list of major cities closing down businesses, travel and construction until further notice. The voting machine took a poll, and it came back, well, negative. What is interesting is the fact that the average weighted daily earnings for all tanker operators increased from $15,000 per day in 2019 to a high of $48,000 during the pandemic, this reflects the contrarian profiteering view of countries and industries that are heavily dependent on oil.

While the oil "outlook" taken by markets was extremely bearish, cheap oil meant increased trade in order to stock up before the eventual reopening of economies and resumed demand across the board. The daily rate for VLCCs (Very Large Crude Carriers) increased by 220% due to the extreme need to trade and ship oil compared to the outstanding number of operational vessels in the market. This trend could soon repeat itself, though on a smaller scale.

Frontline is in... The Front Line

Frontline PLC (NYSE: FRO) closed the year 2022 by representing a total 3% of the global VLCC fleet, according to earnings presentations and claims by Clarksons Research. This proxy for market share will be a very important metric for investors when breaking down the future tailwinds incoming for the business.

The same metric that broke out during the oil price collapse of 2020, weighted average daily vessel rates, is on the rise once again. Rates have gone from roughly $12,000 per day in 2021 and the first half of 2022 (a time when oil prices rose above $80 per barrel), translating into compressed demand for shipping the commodity, to current levels as of the fourth quarter of 2022 of $48,500 per day, just as oil prices retract to ranges below $80 and are expected to decline further as the global economy enters a potential recession. This can further push these rates and profitability for companies like Frontline.

A global recession has its caveats; however, countries like China and Brazil seem to be well-positioned to welcome a new bull cycle for their respective economies. As is often the case, Chinese imports of oil have increased to levels near their 2020 highs (when, again, oil prices were at their lowest). In fact, one of the largest contributors to Frontline's 90.9% revenue growth in 2022 was China's reopening and resumption of oil imports and subsequent demand.

Sustainable?

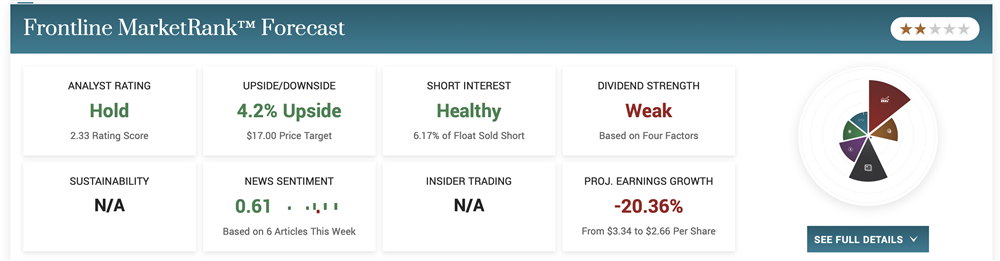

While commodity cycles can be unpredictable, they always involve risk. Frontline's operating margins jumped from 1.6% in 2021 (when rates reached almost $10,000 per day) to 31% in 2022 when rates nearly reached $50,000 per day. This allowed management to pay out a quarterly dividend of $0.30 per share, or an annualized yield of 7%. However, this dividend payout, based on past measures, may not be sustainable as it represents 62% of the company's highest free cash flow level in 2020, when shipping volumes and rates were at their all-time highs.

A contrarian, risk-hungry view would see this payout as a vote of confidence by management, expecting similar cash flows to the times when rates and volumes were high enough to sustain such dividends. Further economic stimulus in China may provide just the push these rates need for Frontline to ride major tailwinds into profitable operations.

With China and Brazil being a major transatlantic route served by Frontline, and recent economic ties between the two nations pointing to further beneficial oil exchanges, the firm is well positioned for exposure in China's VLCC import market.

Safety Margin

Frontline has relatively low debt, as it only composes 51.1% of the company's total capital, and investors seem to be comfortable with an industry average of 65% plus. This flexibility, coupled with $255 million USD in cash as of 2022, allows the company to pivot during these volatile commodity cycles, showcasing a total return on invested capital of 10.8% in 2020 and 10.2% in 2022, providing a benchmark for management and investors going forward in an elevated daily VLCC rate environment.

A Net Asset Value (NAV) computed as total assets minus total debt would suggest, Frontline has a bottom value of $11.22 per share which also represents a very strong support level on the stock's chart. Using this value as a pullback target and as a sensible entry point, investors looking to ride the oil tanker tailwind can enjoy an even larger upside than the current analyst consensus.