PRESS RELEASE

US November election results could decelerate energy transition, with $1 trillion in energy investment on the line

A Republican victory in 2024 could roll back decarbonisation policies and usher in a delayed energy transition for the US. Low carbon supply investment occurs, just not at the pace for net zero

LONDON/HOUSTON/SINGAPORE, 16 May 2024 - The Infrastructure Investment and Jobs Act (IIJA) of 2021 and the Inflation Reduction Act (IRA) of 2022 catapulted the US to global leadership in decarbonisation. But a victory for former President Donald Trump in the November 2024 election, combined with long-standing issues around the US relationship with China and US government deficits, could significantly alter the path of US energy policy and usher in a delayed transition scenario, according to a new Horizons report from Wood Mackenzie.

While investments for technologies that support the energy transition and low carbon technology may decelerate, the opposite effect might take place for fossil fuels, which could see expanded investment and push out peak fossil fuel demand, according to the report, “Hitting the brakes: how the energy transition could decelerate in the US."

“This election cycle will really influence the pace of energy investment, both in the next five years and through 2050. Investments in low carbon supply need to be made in the near term to realize longer-dated decarbonization targets. US carbon emissions could grow, putting net zero out of reach in our delayed transition scenario,” according to David Brown, director of Wood Mackenzie’s Energy Transition Research.

“It is not likely that the IRA will be fully repealed,” said Brown. “However, a second Trump presidency would likely issue executive orders that would abandon the 2035 net zero target for the power sector, establish softer emissions goals from the EPA, and issue tax credit regulations that could favour blue hydrogen.”

Brown added that the fiscal environment may prove challenging as well, as US government spending could be limited to address the country’s debt burden – the US Congressional Budget Office expects the US debt-to-GDP ratio to reach 109% by 2030 and hit 155% by 2050.

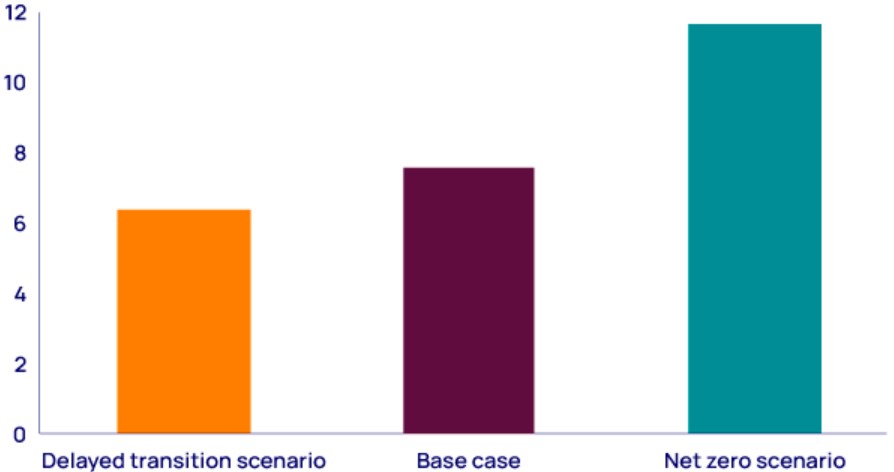

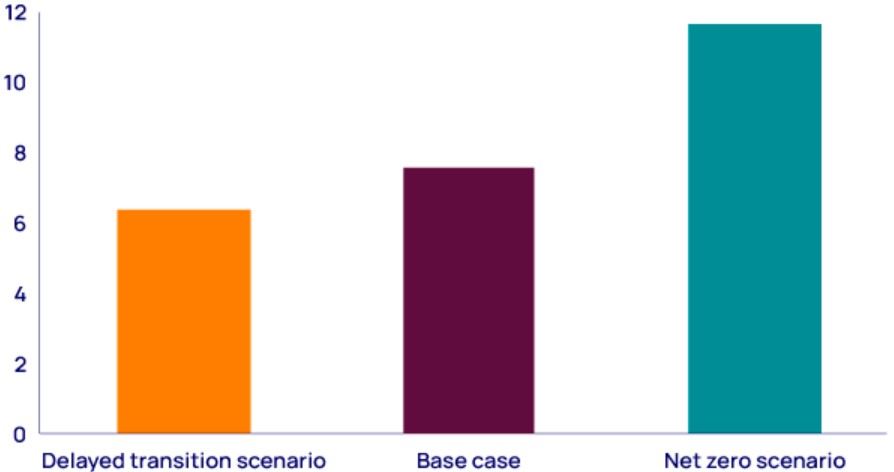

Wood Mackenzie’s base case projects about US$7.7 trillion in investment for the US energy sector over 2023-50. However, in the delayed transition scenario in the US, less policy support for things such as low-carbon energy and infrastructure improvements decreases investment for the US energy sector by US$ 1 trillion compared to the base case.

US capital investment in the energy sector, cumulative, 2023-2050, in US$ trillion.

Source: Wood Mackenzie. Total capital investment for the US includes upstream oil and gas, power generation, power grid and EV infrastructure, hydrogen and CCUS. US$11.8 trillion dollars in capital investment in US energy is required on a cumulative basis from 2023-2050 to reach our net zero scenario. Investment is 55% lower in our delayed transition scenario

According to the report, where policy support for low-carbon energy is cut back, CCUS and low-carbon hydrogen would face a slower investment pathway. Total US natural gas demand would rise to be 6 billion cubic feet per day (bcfd) higher than our base case by 2030, a jump of 6%.

“It is important to note that peak fossil fuel demand does occur – it is just around 10 years later than the 2030 prediction in our base case. With a peak still on the horizon, companies will need to continue diversifying into low carbon technologies to build a business model that is resilient through the energy transition. Each sector, from transport to power and emerging technologies, will be affected by a nuanced set of drivers.”

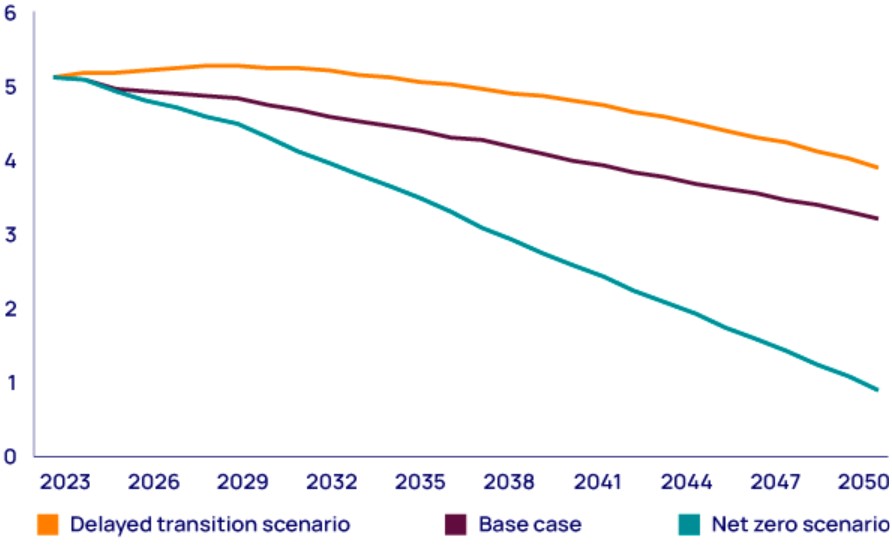

US net energy-related CO2 emissions by outlook, in billions of tonnes

Sector impacts:

- EV sales stumble: A look at new car sales in the US so far in 2024 offers clear indications that a slower energy transition is plausible. While sales of hybrids have leapt 57%, EV sales have undershot expectations, growing by only 19%. Weakening federal greenhouse gas (GHG) emissions and fuel economy regulations continue this trend, and the total stock of EVs by 2050 would be 50% lower than in Wood Mackenzie’s base case.

- Zero carbon power supply faces strong headwinds: With less financial support from the Department of Energy Loan Program Office, fewer grid improvements, and continued trade tension with China, the delayed transition scenario for the US projects that wind and solar and energy storage capacity would be about 500 gigawatts (GW) by 2050, 25% lower than the base case.

- Coal would remain in the mix for longer. In the delayed energy transition scenario, the pace of electrification would ease in the near term. However, industrial, residential, electrolytic hydrogen and EV usage would still combine to increase power demand by 2.0 petawatt-hours (PWh), a 45% jump from 2030 to 2050. With less policy support for renewables and continued load growth, there would be no way out of using coal. As a result, by 2040, coal generation capacity would be four times higher than the base case, with 104 GW on the system.

- Low-carbon hydrogen could falter. The lack of federal demand-side targets, reductions in federal funding and cost inflation would challenge the investment case for low-carbon hydrogen. Eligibility for tax credits under the IRA could be adjusted to tilt incentives towards blue hydrogen. Near-term growth shifts to export markets in Europe and Asia; Wood Mackenzie’s delayed transition scenario would still foresee a two million tonne export market emerging by 2050.

States would be the future

A look at state-level policies shows that momentum for low-carbon investment can be independent of federal policy. Since 2020, California’s utility-scale battery capacity has expanded eight-fold to 8.4 GW. By the end of the year, Wood Mackenzie expects battery capacity to reach 11.7 GW.

State-level renewable portfolio standards and voluntary renewable energy targets supported wind and solar capacity expansions of over 13% a year on average between 2016 and 2020, during the last Trump administration. California’s Low Carbon Fuel Standard (LCFS) will help underpin investments in low-carbon hydrogen, direct air capture (DAC) and bioenergy across the country.

“A slower transition scenario for emerging technologies does not mean the story is over,” said Brown. “The emerging technology sector in the US will need to reassess costs, project sizes, and subsidy reliance. This should be approached through a position of confidence. The US has a track record of innovation – the US went from a net LNG importer to the world’s largest LNG exporter over the last decade.”

Read the entire report here.

ENDS

Kevin Baxter

+44 330 124 9400

Kevin.Baxter@woodmac.com

Vivien Lebbon

+44 330 174 7486

Vivien.lebbon@woodmac.com

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

Hla.MyatMon@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

PRESS RELEASE

US November election puts $1 trillion in energy investment on the line

A Republican victory in 2024 could roll back decarbonisation policies and usher in a delayed energy transition for the US. Low carbon supply investment occurs, just not at the pace for net zero

LONDON/HOUSTON/SINGAPORE, 16 May 2024 - The Infrastructure Investment and Jobs Act (IIJA) of 2021 and the Inflation Reduction Act (IRA) of 2022 catapulted the US to global leadership in decarbonisation. But a victory for former President Donald Trump in the November 2024 election, combined with long-standing issues around the US relationship with China and US government deficits, could significantly alter the path of US energy policy according to a new Horizons report from Wood Mackenzie.

While investments for technologies that support the energy transition and low carbon technology may decelerate, the opposite effect might take place for fossil fuels, which could see expanded investment and push out peak fossil fuel demand, according to the report, “Hitting the brakes: how the energy transition could decelerate in the US."

“This election cycle will really influence the pace of energy investment, both in the next five years and through 2050. Investments in low carbon supply need to be made in the near term to realize longer-dated decarbonization targets. US carbon emissions could grow, putting net zero out of reach in our delayed transition scenario,” according to David Brown, director of Wood Mackenzie’s Energy Transition Research.

“It is not likely that the IRA will be fully repealed,” said Brown. “However, a second Trump presidency would likely issue executive orders that would abandon the 2035 net zero target for the power sector, establish softer emissions goals from the EPA, and issue tax credit regulations that could favour blue hydrogen.”

Brown added that the fiscal environment may prove challenging as well, as US government spending could be limited to address the country’s debt burden – the US Congressional Budget Office expects the US debt-to-GDP ratio to reach 109% by 2030 and hit 155% by 2050.

Wood Mackenzie’s base case projects about US$7.7 trillion in investment for the US energy sector over 2023-50. However, in the delayed transition scenario in the US, less policy support for low-carbon energy decreases investment for the US energy sector by US$ 1 trillion compared to the base case.

US capital investment in the energy sector, cumulative, 2023-2050, in US$ trillion.

Source: Wood Mackenzie. Total capital investment for the US includes upstream oil and gas, power generation, power grid and EV infrastructure, hydrogen and CCUS. US$11.8 trillion dollars in capital investment in US energy is required on a cumulative basis from 2023-2050 to reach our net zero scenario. Investment is 55% lower in our delayed transition scenario

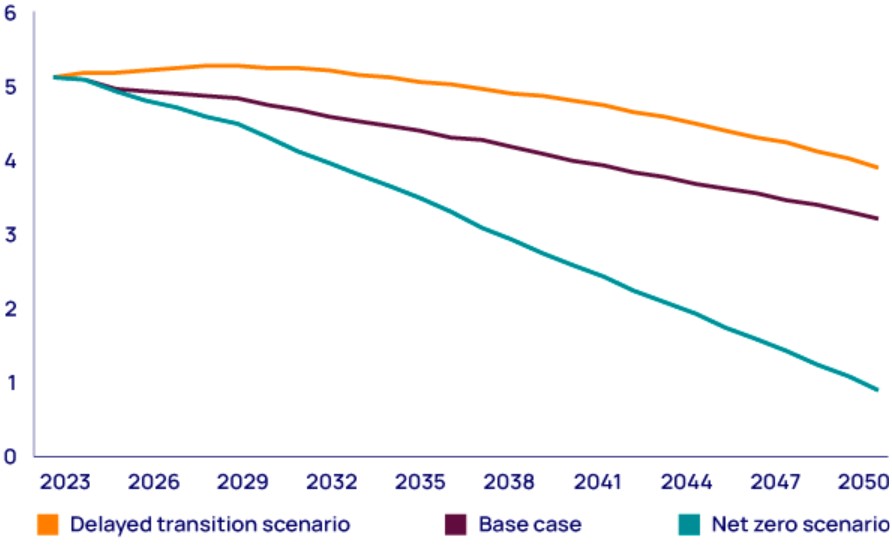

Net zero out of reach. Peak fossil fuels delayed, not eliminated

“In our delayed transition scenario, net zero quickly becomes out of reach, and a new, slower pathway emerges for the energy transition,” said Brown.

According to the report, where policy support for low-carbon energy is cut back, CCUS and low-carbon hydrogen would face a slower investment pathway. Total US natural gas demand would rise to be 6 billion cubic feet per day (bcfd) higher than our base case by 2030, a jump of 6%.

“It is important to note that peak fossil fuel demand does occur – it is just around 10 years later than the 2030 prediction in our base case. With a peak still on the horizon, companies will need to continue diversifying into low carbon technologies to build a business model that is resilient through the energy transition. Each sector, from transport to power and emerging technologies, will be affected by a nuanced set of drivers.”

US net energy-related CO2 emissions by outlook, in billions of tonnes

Sector impacts:

- EV sales stumble: A look at new car sales in the US so far in 2024 offers clear indications that a slower energy transition is plausible. While sales of hybrids have leapt 57%, EV sales have undershot expectations, growing by only 19%. Weakening federal greenhouse gas (GHG) emissions and fuel economy regulations continue this trend, and the total stock of EVs by 2050 would be 50% lower than in Wood Mackenzie’s base case.

- Zero carbon power supply faces strong headwinds: With less financial support from the Department of Energy Loan Program Office, fewer grid improvements, and continued trade tension with China, the delayed transition scenario for the US projects that wind and solar and energy storage capacity would be about 500 gigawatts (GW) by 2050, 25% lower than the base case.

- Coal would remain in the mix for longer. In the delayed energy transition scenario, the pace of electrification would ease in the near term. However, industrial, residential, electrolytic hydrogen and EV usage would still combine to increase power demand by 2.0 petawatt-hours (PWh), a 45% jump from 2030 to 2050. With less policy support for renewables and continued load growth, there would be no way out of using coal. As a result, by 2040, coal generation capacity would be four times higher than the base case, with 104 GW on the system.

- Low-carbon hydrogen could falter. The lack of federal demand-side targets, reductions in federal funding and cost inflation would challenge the investment case for low-carbon hydrogen. Eligibility for tax credits under the IRA could be adjusted to tilt incentives towards blue hydrogen. Near-term growth shifts to export markets in Europe and Asia; Wood Mackenzie’s delayed transition scenario would still foresee a two million tonne export market emerging by 2050.

States would be the future

A look at state-level policies shows that momentum for low-carbon investment can be independent of federal policy. Since 2020, California’s utility-scale battery capacity has expanded eight-fold to 8.4 GW. By the end of the year, Wood Mackenzie expects battery capacity to reach 11.7 GW.

State-level renewable portfolio standards and voluntary renewable energy targets supported wind and solar capacity expansions of over 13% a year on average between 2016 and 2020, during the last Trump administration. California’s Low Carbon Fuel Standard (LCFS) will help underpin investments in low-carbon hydrogen, direct air capture (DAC) and bioenergy across the country.

“A slower transition scenario for emerging technologies does not mean the story is over,” said Brown. “The emerging technology sector in the US will need to reassess costs, project sizes, and subsidy reliance. This should be approached through a position of confidence. The US has a track record of innovation – the US went from a net LNG importer to the world’s largest LNG exporter over the last decade.”

Read the entire report here.

ENDS

Kevin Baxter

+44 330 124 9400

Kevin.Baxter@woodmac.com

Vivien Lebbon

+44 330 174 7486

Vivien.lebbon@woodmac.com

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

Hla.MyatMon@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.