- Monthly Stress Index monitoring legal needs of everyday Americans has tracked past five presidential contests

- In battleground states, consumer legal stress dropped to lowest level this election cycle

- Significant drop in foreclosure inquiries drives down stress in battleground states

- Benchmark Consumer Stress Legal Index dropped 1.0 point nationally

LegalShield’s Consumer Stress Legal Index (CSLI) in battleground states dropped 7% in June to its lowest level this election cycle, deepening an indication that Democrats could hold the White House in November.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240802588613/en/

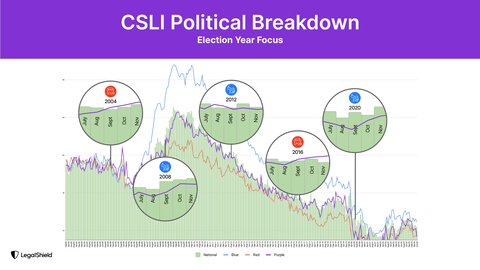

Consumer stress levels in battleground states hint at potential Democratic victory in 2024 election (Graphic: Business Wire)

The latest LegalShield data is based solely on consumer inquiries seeking legal assistance in June, prior to President Biden exiting the election.

“We track 150,000 calls for legal help each month, prompted by everyday Americans facing an issue in their lives,” said Matt Layton, LegalShield senior vice president of consumer analytics. “We aren’t pollsters. Our data reveals exactly what people are dealing with in their lives, and that data has a high correlation to how people vote.”

LegalShield members seek legal help about 5,000 times a day. The topics of those calls have been anonymously tracked for more than 22 years to feed LegalShield’s Consumer Stress Legal Index (CSLI), which comprises three subindices: Bankruptcy, Foreclosure, and Consumer Finance.

This election cycle, LegalShield is reporting consumer stress levels on a politically geographic basis, separating red, blue, and purple battleground states. LegalShield classified states based on the outcome of the 2020 election. Battleground states for 2024 are Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin.

In June, battleground consumer stress dropped to five points below the national average, its largest deviation this election cycle and the fourth month in a row below the national index. In the last five presidential election years, a Democrat secured or maintained the White House when consumer stress in battleground states remained lower than the national average in October and November.

“This election is historic in many ways, as was an election amidst a global pandemic,” said Layton. “Our data is blind to macro influences and carries no political bias. It has held as a steady gauge of voter actions dating back five elections regardless of party. We’ve also seen our data trends shift in the months leading into the election, so we’re watching for any potential movement.”

Foreclosure Fall Outmatches Elevated Bankruptcy and Consumer Finance Issues

“People aren’t asking about foreclosures in battleground states, and that relieved overall consumer stress in those states,” said Layton. “Inquiries about bankruptcy and consumer finance issues in battleground states remain well above the national average, but they’re outweighed by foreclosure inquiries at about half what the rest of the county is experiencing.”

The Bankruptcy subindex in battleground states is 3.6 points above the national average, and the battleground Consumer Finance subindex is 8.4 points above the national level.

“Foreclosure issues continue to fall because of the shortage of housing inventory — if you need to get out from under your mortgage, people are lining up to buy,” said Mike Fiffik of Fiffik Law Group, a LegalShield provider firm in the battleground state of Pennsylvania. “But affordable housing remains an issue. We see an uptick in tenant and landlord issues as renters have trouble with their monthly payment and can’t afford to move.”

National Indices Hold the Line

Nationally, the CSLI held steady in June, dropping only a single point to 61.8, hovering at the same level since March of this year. June marked the first monthly year-over-year decline (0.8%) since July 2023.

The subindices all declined a small amount in June. The Bankruptcy subindex dropped 1.7 points to 29.5, which still represents an 18.6% year-over-year increase. The Foreclosure subindex lost 0.1 points to 36.3. The Consumer Finance subindex receded by 0.4 points to 101.7.

About the LegalShield Consumer Stress Legal Index:

As part of LegalShield’s mission to ensure every person has equal access to justice, we mine our data for insights policymakers can use to make a real, positive impact in their decision making. Released monthly, the LegalShield Consumer Stress Legal Index is comprised of three subindices which reflect the demand for various legal services. LegalShield’s dataset includes more than 35 million consumer requests for legal assistance since 2002, averaging approximately 150,000 calls received monthly. The CSLI uncovers the daily challenges people are facing and provides actionable intelligence to help policymakers and industry leaders bridge those gaps.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to thousands of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240802588613/en/

Contacts

LegalShield Media Contact:

Hollon Kohtz, Director of Communications

hollonkohtz@pplsi.com