Investments exceeded $230 million

Raised approximately $170 million, a 27% increase over 2022

Palladius Capital Management (“Palladius”), a vertically-integrated real estate investment manager focused on pursuing multifamily, student housing, hospitality and select thematic investment strategies, today provided a recap of its investment and capital raising activities in 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240131230528/en/

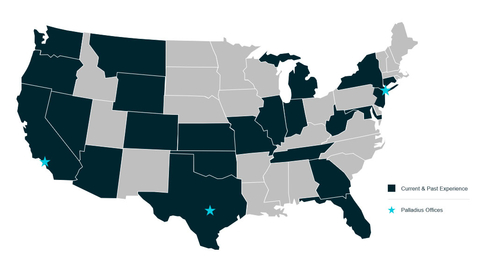

Map of Palladius Capital Management's current and past footprint across the United States. (Graphic: Business Wire)

In a challenging and largely illiquid market defined by uncertainty, Palladius was highly active in 2023, demonstrating its multi-strategy investment platform’s flexibility and the team’s ability to successfully navigate economic cycles. Palladius deployed approximately $230 million across multiple equity and loan investments throughout the capital stack, ending the year with its AUM reaching more than $800 million. The firm’s rapid AUM growth since its inception in July 2021 reflects the evolution of its platform, extensive network of relationships, and compelling value proposition.

Throughout 2023, Palladius acquired more than $100 million value-add student housing and dislocated Class A multifamily assets situated along Texas’ I-35 Innovation Corridor, an area defined by consistently strong job, wage and population growth. With significantly fewer sources of capital available due to the widespread pullback of regional banks and higher cost of capital, Palladius strategically ramped up lending in 2023, deploying new capital into more than $100 million in loan opportunities across property types. The firm was particularly active in the hospitality space, originating loans for various attractive hotel projects with strong fundamentals, including the construction of the Cambria Hotel Hillsboro in Oregon and structuring a programmatic lending partnership with Choice Hotels to support the growth of its new Everhome brand. Moving into 2024, Palladius expects to also be working on distressed hospitality opportunities.

Palladius and its affiliates accelerated capital raising activities in 2023, securing approximately $170 million from a variety of capital sources, representing a year-over-year increase of 27%. Reflecting the depth of its relationships, Palladius raised capital from through RIAs, broker-dealers and crowdfunding platforms. The diversity of the firm’s capital sources is a competitive advantage and supports its flexibility, helping to ensure it is well-positioned to take advantage of attractive investment opportunities throughout every phase of the economic cycle. Palladius anticipates remaining highly active in 2024 as market participants are forced to refinance, recapitalize or exit investments.

Commenting on Palladius’ highly productive year, Chief Executive Officer Nitin Chexal stated, “Palladius is structured in a way that enables us to seamlessly pivot our attention and resources based on where we believe we can achieve the best risk-adjusted returns. Our expertise and nimbleness, as well as our ability to raise funds from diverse capital sources, are primary reasons why we were able to consistently transact throughout 2023 while many of our competitors were forced to sit on the sidelines. We are proud of the results we have been able to achieve over the past year and look forward to maintaining our position of strength throughout 2024 with significant liquidity and a growing investment pipeline. Our success is a function of the quality of our people and I could not be prouder of their dedication to advancing Palladius’ long-term goals.”

About Palladius Capital Management

Palladius is a diversified real estate investment manager that leverages institutional best practices, technology and operational expertise to drive value creation for institutional and individual investors. Led by a team of commercial real estate, finance, and corporate operations veterans, Palladius pursues value-add and core-plus strategies targeting multifamily, student housing, hospitality and other thematic investment strategies through its affiliates. Palladius also originates debt investments through it's non-traded REIT, Palladius Income Fund. Based in Austin, TX, Palladius manages and operates approximately $800 million of real estate across the U.S. and is focused on building a highly progressive platform that promotes diversity and inclusion. To learn more, visit www.palladius.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240131230528/en/

Contacts

Media

ICRPalladius@icrinc.com