- Negative equity share fell to 2.3% in Q2 2021, the lowest share in at least 12 years

- Compared to the previous quarter, 163,000 residential properties regained equity in Q2 2021

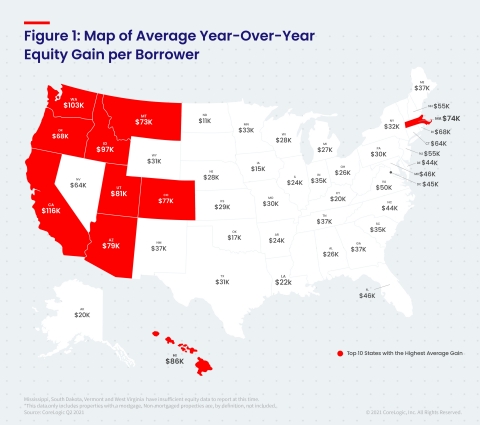

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report for the second quarter of 2021. The report shows U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 29.3% year over year, representing a collective equity gain of over $2.9 trillion, and an average gain of $51,500 per borrower, since the second quarter of 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210923005238/en/

CoreLogic Map of Average Year-over-Year Equity Gain per Borrower (Graphic: Business Wire)

By June 2021, consumer confidence had risen to its highest level since the onset of the pandemic. This positive sentiment was echoed by current mortgage holders in a recent CoreLogic consumer survey, which found that 59% of respondents feel extremely confident in their ability to keep current on their mortgage payments in the coming year.

Thanks to ongoing government provisions, increased vaccine availability — enabling many to return to work and a steady income — and record homeowner equity gains, most borrowers have been able to remain current on their mortgage payments. Additionally, the majority of borrowers that fell behind on payments have a large home equity cushion that will help them avoid foreclosure.

“The growth in homeowner equity provides a strong financial cushion for tens of millions Americans. For those most impacted by the pandemic, equity gains will help play a critical role in staving off foreclosure,” said Frank Martell, president and CEO of CoreLogic. “Based on projected increases in economic activity and home values over the next year, we expect to see further gains in equity and a corresponding drop in negative equity, forbearance rates and foreclosure.”

“Home equity wealth is at a record level and will bolster economic activity in the coming year,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Higher wealth spurs additional consumer expenditures and also supports room additions and other investments in homes, adding to overall economic activity.”

Negative equity, also referred to as underwater or upside down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the second quarter of 2021, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

- Quarterly change: From the first quarter of 2021 to the second quarter of 2021, the total number of mortgaged homes in negative equity decreased by 12% to 1.2 million homes, or 2.3% of all mortgaged properties.

- Annual change: In the second quarter of 2020, 1.8 million homes, or 3.3% of all mortgaged properties, were in negative equity. This number decreased by 30%, or 520,000 properties, in the second quarter of 2021.

- National aggregate value: The national aggregate value of negative equity was approximately $268 billion at the end of the second quarter of 2021. This is down quarter over quarter by approximately $5.2 billion, or 1.9%, from $273.2 billion in the first quarter of 2021, and down year over year by approximately $18.9 billion, or 6.6%, from $286.8 billion in the second quarter of 2020.

Because home equity is affected by home price changes, borrowers with equity positions near (+/- 5%) the negative equity cutoff are most likely to move out of or into negative equity as prices change, respectively. Looking at the second quarter of 2021 book of mortgages, if home prices increase by 5%, 160,000 homes would regain equity; if home prices decline by 5%, 211,000 would fall underwater.

The next CoreLogic Homeowner Equity Report will be released in December 2021, featuring data for Q3 2021. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence.

Methodology

The amount of equity for each property is determined by comparing the estimated current value of the property against the mortgage debt outstanding (MDO). If the MDO is greater than the estimated value, then the property is determined to be in a negative equity position. If the estimated value is greater than the MDO, then the property is determined to be in a positive equity position. The data is first generated at the property level and aggregated to higher levels of geography. CoreLogic uses public record data as the source of the MDO, which includes more than 50 million first- and second-mortgage liens, and is adjusted for amortization and home equity utilization in order to capture the true level of MDO for each property. Only data for mortgaged residential properties that have a current estimated value are included. There are several states or jurisdictions where the public record, current value or mortgage data coverage is thin and have been excluded from the analysis. These instances account for fewer than 5% of the total U.S. population. The percentage of homeowners with a mortgage is from the 2019 American Community Survey. Data for the previous quarter was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results.

About the CoreLogic Consumer Housing Sentiment Study

3,000+ consumers were surveyed by CoreLogic via Qualtrics. The study is an annual pulse of U.S. housing market dynamics concentrated on consumers looking to purchase a home, consumers not looking to purchase a home, and current mortgage holder. The survey was conducted in April 2021 and hosted on Qualtrics.

The survey has a sampling error of ~3% at the total respondent level with a 95% confidence level.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Amy Brennan at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210923005238/en/

Contacts

Amy Brennan

CoreLogic

newsmedia@corelogic.com