Headquartered in Eindhoven, the Netherlands, NXP Semiconductors N.V. (NXPI) designs and delivers advanced chips across processors, connectivity, analog, security, and sensor technologies. With a market cap of roughly $56.5 billion, the company forms the invisible backbone of vehicles, factories, Internet of Things (IoT) ecosystems, mobile devices, and modern communications infrastructure.

While the business footprint looks expansive, stock performance has introduced a more restrained narrative. Over the past 52 weeks, NXPI stock gained 3.5%, trailing the S&P 500 Index ($SPX) 14% gain. Year-to-date (YTD), however, the stock rose 3.3%, edging past the broader index’s modest 1.3% increase.

Placing that performance within the sector sharpens perspective. The State Street SPDR S&P Semiconductor ETF (XSD) surged 45.3% over the same 52-week period and added 11.6% YTD.

On Feb. 2, NXP Semiconductors reported its Q4 2025 earnings results, immediately lifting the stock 2.2%. Revenue grew 7.2% year over year to $3.34 billion, topping the $3.3 billion analyst estimates. Adjusted EPS rose 5.3% to $3.35, clearing Wall Street’s $3.30 forecast with room to spare.

Despite beating headline estimates, NXPI stock slid 4.5% in the next trading session as investors focused on elevated inventories and emerging signs of long-term margin pressure. However, management countered with a strategic reset anchored in “physical artificial intelligence (AI),” emphasizing accelerating demand for industrial products with built-in intelligence at the edge.

Leadership also cited stronger regional manufacturing amid geopolitical pressure. As automakers stop trimming orders and inventory correction fades, management now sees visibility into growth from next-generation, AI-enabled products.

The outlook carries into the forward estimates. For fiscal year 2026, ending in December, analysts project diluted EPS of $12.37, implying 21.3% year-over-year growth. Importantly, NXP Semiconductors has beaten EPS expectations in three of the past four quarters, missing only once.

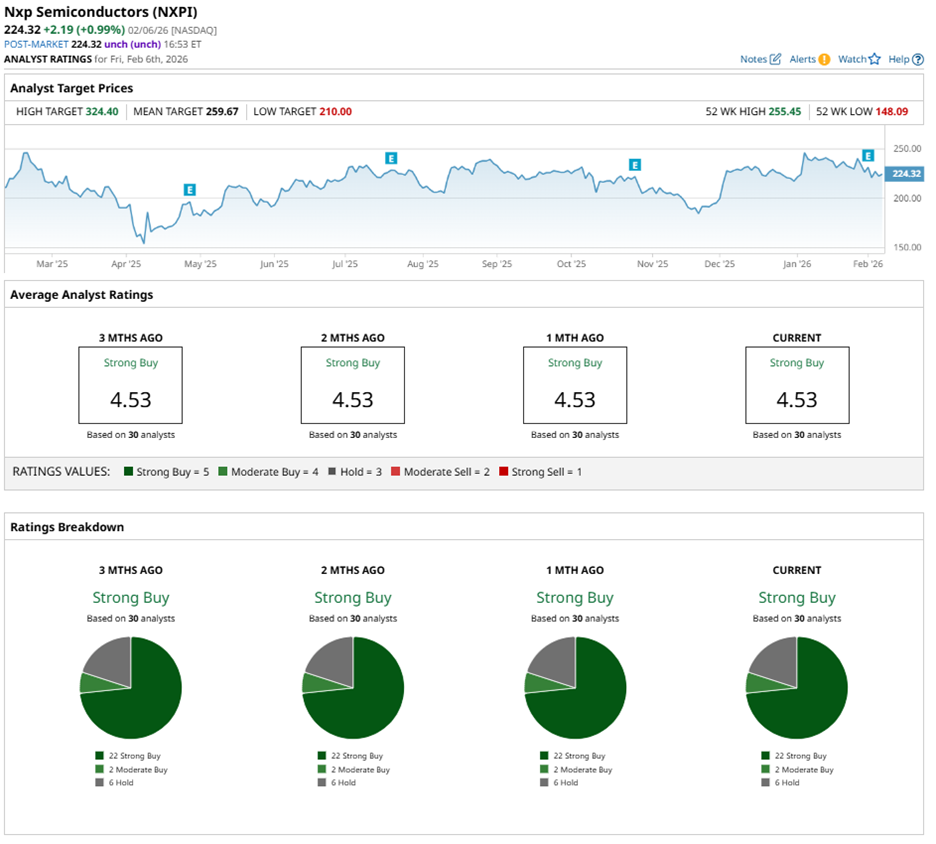

Wall Street sentiment remains firmly supportive, assigning NXPI stock an overall “Strong Buy” rating. Out of 30 analysts, 22 rate NXPI stock a “Strong Buy,” two recommend “Moderate Buy,” and six suggest “Hold.”

Importantly, the outlook remains unchanged from three months ago, when 22 analysts also labeled the stock a “Strong Buy.”

While NXPI stock has lagged peers from a growth standpoint, recent demand commentary appears stronger than that of many competitors. Reinforcing this view, TD Cowen raised its price target to $285 from $260 on Jan. 16 while maintaining a “Buy” rating on the stock.

Looking ahead, analyst targets paint a clearer picture of what the market believes the stock can deliver. NXPI’s average price target of $259.67 implies potential upside of 15.8%. Meanwhile, the Street-high target of $324.40 suggests a gain of 44.6% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart