With a market cap of $51.4 billion, MetLife, Inc. (MET) is a global financial services company that provides insurance, annuities, employee benefits, and asset management solutions to individuals and institutions worldwide. Operating across six business segments, the company offers a broad portfolio of protection, retirement, and investment products.

The New York-based company's shares have underperformed the broader market over the past 52 weeks. MET stock has decreased 7.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14%. Moreover, shares of MetLife are down 1.2% on a YTD basis, compared to SPX’s marginal rise.

In addition, the insurer stock has also lagged behind the State Street Financial Select Sector SPDR ETF’s (XLF) 5.5% return over the past 52 weeks.

MetLife reported strong Q4 2025 results on Feb. 4, driven by stronger investment portfolio returns amid a strong market following U.S. Federal Reserve rate cuts, with net investment income rising to $5.92 billion and higher private equity returns. Adjusted premiums, fees, and other revenues surged 29% to $18.61 billion, while adjusted EPS increased 19% to $2.49. The insurer also benefited from strong volume growth, improved expense margins, disciplined premium pricing, and solid consumer spending trends.

For the fiscal year ending in December 2026, analysts expect MetLife’s adjusted EPS to grow 10.9% year-over-year to $9.86. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

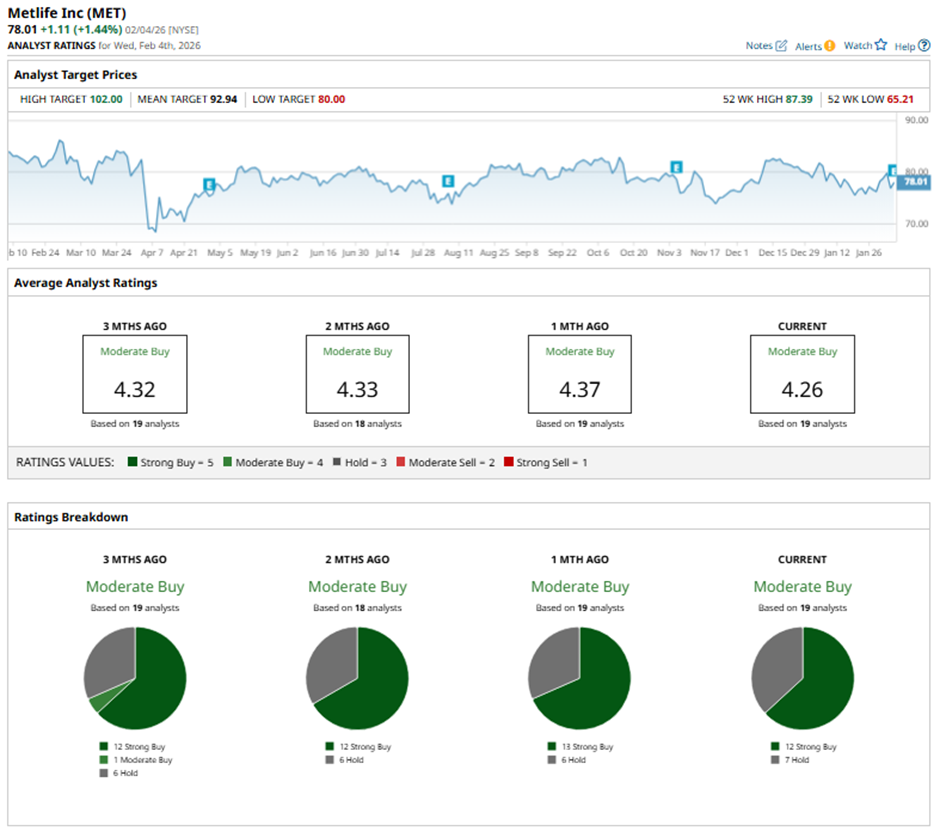

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings and seven “Holds.”

On Jan. 13, Wells Fargo analyst Elyse Greenspan raised MetLife’s price target to $97 and maintained an “Overweight” rating.

The mean price target of $92.94 represents a premium of 19.1% to MET's current levels. The Street-high price target of $102 implies a potential upside of 30.8% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A ‘Boring’ Posture by the Smart Money Makes Meta Platforms (META) an Intriguing Discount

- 3 Rare Earths Stocks to Buy as Trump Announces Project Vault

- Bank of America Predicted Silver Prices Could Hit $309 in 2026. Is That Still in Play?

- Bearish Outlook? Try These 2 Bear Call Spread Trades on Thursday