After artificial intelligence (AI) stormed the tech world, the story is starting to shift. What once appeared to be an unstoppable AI gold rush is now being viewed by some experts as a boom that may be financially fragile. Experts and investors are becoming increasingly concerned about rising AI-related expenses, while the money companies earn from selling AI services isn’t rising fast enough to cover those costs. To fund the buildout, companies are taking on more debt and issuing more stock, and that’s making investors very nervous.

One of the latest signs of this cooling sentiment involves AI favorite Nvidia Corporation (NVDA). The chip giant had previously announced plans to invest up to $100 billion in OpenAI to help train and run its latest AI models. That blockbuster deal was supposed to give the ChatGPT maker both the cash and the advanced chips it needs to stay ahead in a fast-intensifying AI race. But now, according to reports, the plan has stalled, with both sides rethinking the structure of their partnership.

The latest talks reportedly involve a much smaller, though still sizable, equity investment in the tens of billions as part of OpenAI’s ongoing funding round. In fact, behind the scenes, Nvidia CEO Jensen Huang has reportedly been reminding industry contacts that the original $100 billion figure was non-binding and never finalized. Huang has also privately raised concerns about what he sees as a lack of business discipline at OpenAI and has questioned how well it can hold its edge against rivals like Alphabet's Google (GOOGL) (GOOG) and Anthropic.

Given this backdrop, with doubts creeping into the AI investment story, should investors be concerned about NVDA stock now?

About Nvidia Stock

Founded in 1993, Nvidia has grown from a graphics card trailblazer into a global leader in accelerated computing. Its game-changing graphics processing units (GPUs) back in 1999 didn’t just level up the gaming world. They helped shape the future of modern computing. Today, Nvidia’s technology extends well beyond graphics, powering breakthroughs in AI, autonomous driving, and healthcare.

These days, the California-based chipmaker is basically the poster child of the AI revolution, regularly grabbing headlines for its role in pushing the technology forward. Its high-performance GPUs are the muscle behind AI workloads and a must-have in nearly every major AI data center. While competitors hustle to catch up in the red-hot AI market, Nvidia is still out front, backed by strong fundamentals and nonstop demand for its powerful AI chips.

Nevertheless, even though Nvidia remains the undisputed heavyweight of the AI world, and one of the most valuable companies on the planet, its stock hasn’t been sprinting like it used to. After a historic surge, shares have been moving more sideways lately as investors weigh rising competition, sky-high expectations, and growing concerns about the sheer scale of AI spending.

Now sitting on an eye-popping market capitalization of around $4.6 trillion, Nvidia is slightly down so far in 2026, trailing the broader S&P 500 Index ($SPX) which has edged up about 2% over the same period. The company’s fundamentals remain strong, but investor worries about ballooning AI investment costs have pressured the stock in the near term. Still, the bigger picture shows Nvidia’s strength. Shares are up 54.9% over the past year, comfortably beating the broader market’s 15.8% gain during that stretch.

Nvidia’s Growth Story Is Still Very Much Alive

Nvidia’s fiscal 2026 third-quarter results, reported on Nov. 19, were nothing short of eye-popping. The company once again beat Wall Street on both revenue and earnings, delivered record overall sales and record data center revenue, and even gave stronger-than-expected Q4 sales guidance, all clear signs that the chip giant is still firmly in control of the AI race. Total revenue hit a record $57 billion, jumping 62% year-over-year (YOY), thanks to insatiable demand for its AI GPUs. That figure easily topped analysts’ expectations of $55.5 billion.

The star of the show is, of course, Nvidia’s data center business. In the quarter, data center revenue surged to a record $51.2 billion, up 66% from a year ago. It’s a dramatic evolution for a company that, before the AI boom, was best known for powering 3D video games. That legacy gaming segment is still growing too, bringing in $4.3 billion in revenue, up 30% YOY. Another long-standing unit, professional visualization, generated $760 million in sales, marking a 56% annual increase.

Profitability climbed just as fast. Adjusted earnings per share came in at $1.30, up 60% from a year earlier and slightly ahead of Wall Street’s $1.25 estimate. The chipmaker also continued to reward shareholders. During the first nine months of fiscal 2026, the company returned nearly $37 billion through share repurchases and cash dividends. As of the end of the third quarter, it still had a hefty $62.2 billion left under its existing buyback authorization.

Talking about the momentum, CEO Jensen Huang said demand for Nvidia’s new Blackwell chips is “off the charts,” with cloud GPUs basically sold out. He noted that demand for computing power is accelerating quickly across both AI training and inference, with growth in each area compounding at an exponential pace. In his words, the industry has entered a “virtuous cycle” where expanding AI capabilities are driving even more need for powerful chips.

Looking ahead, management expects the strength to continue. For the fourth quarter of fiscal 2026, the company forecasts revenue of about $65 billion, plus or minus 2%, showing that demand for its AI hardware and platforms remains strong. Margins are also expected to stay healthy, with GAAP gross margins projected at 74.8% and non-GAAP margins at 75%, each with a possible swing of 50 basis points either way.

How Are Analysts Viewing Nvidia Stock?

On Feb. 2, Bank of America stuck with its “Buy” rating on Nvidia and kept a $275 price target, telling investors to take advantage of any dips in the stock. The firm said its target is based on a valuation of about 28 times expected 2027 earnings, a level that sits comfortably within Nvidia’s historical forward P/E range of 25x to 56x.

In their view, that premium is justified by Nvidia’s dominant position in the fast-growing AI computing and networking markets, even after accounting for potential headwinds such as uneven timing of global AI projects, the cyclical nature of the gaming business, and ongoing concerns about power availability for large-scale AI infrastructure.

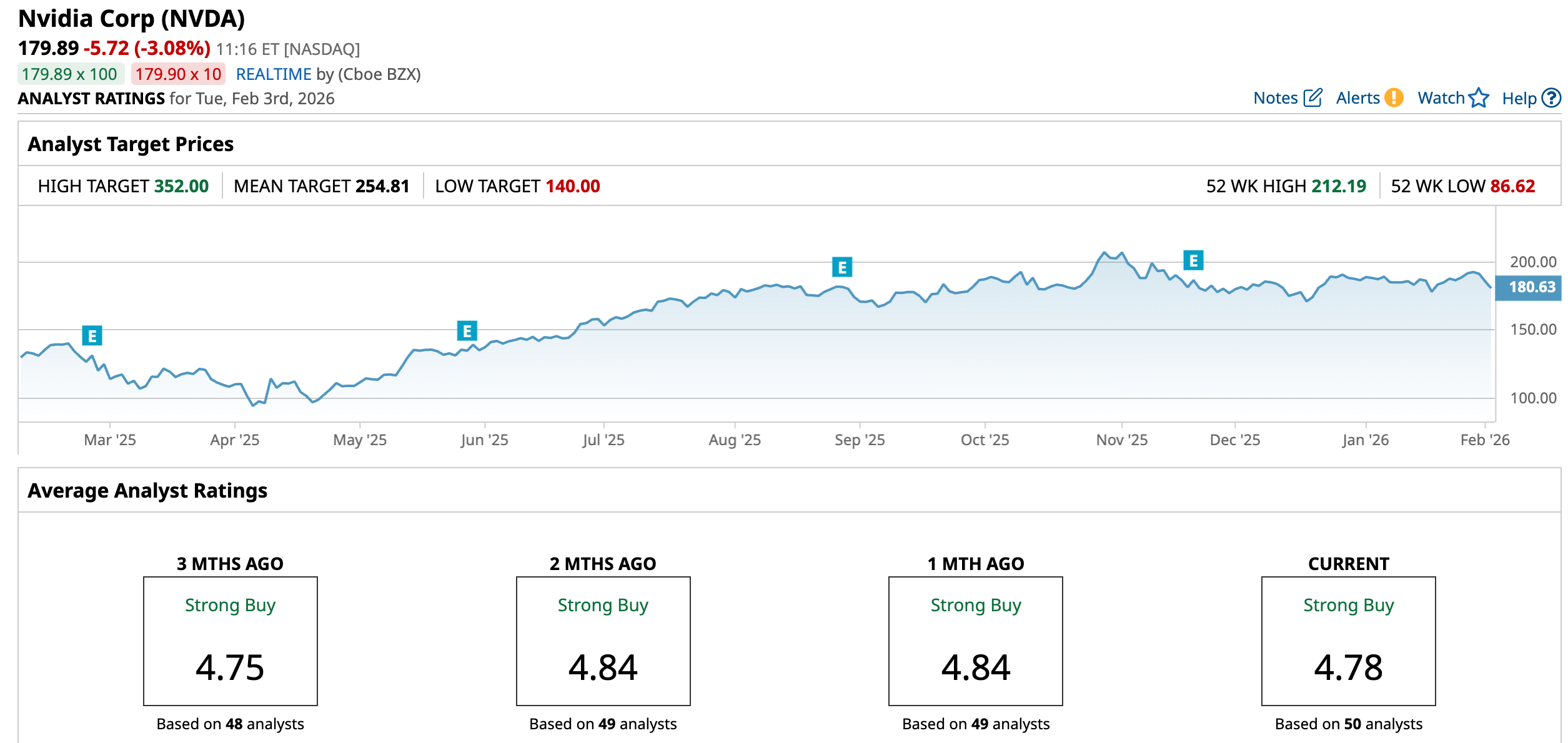

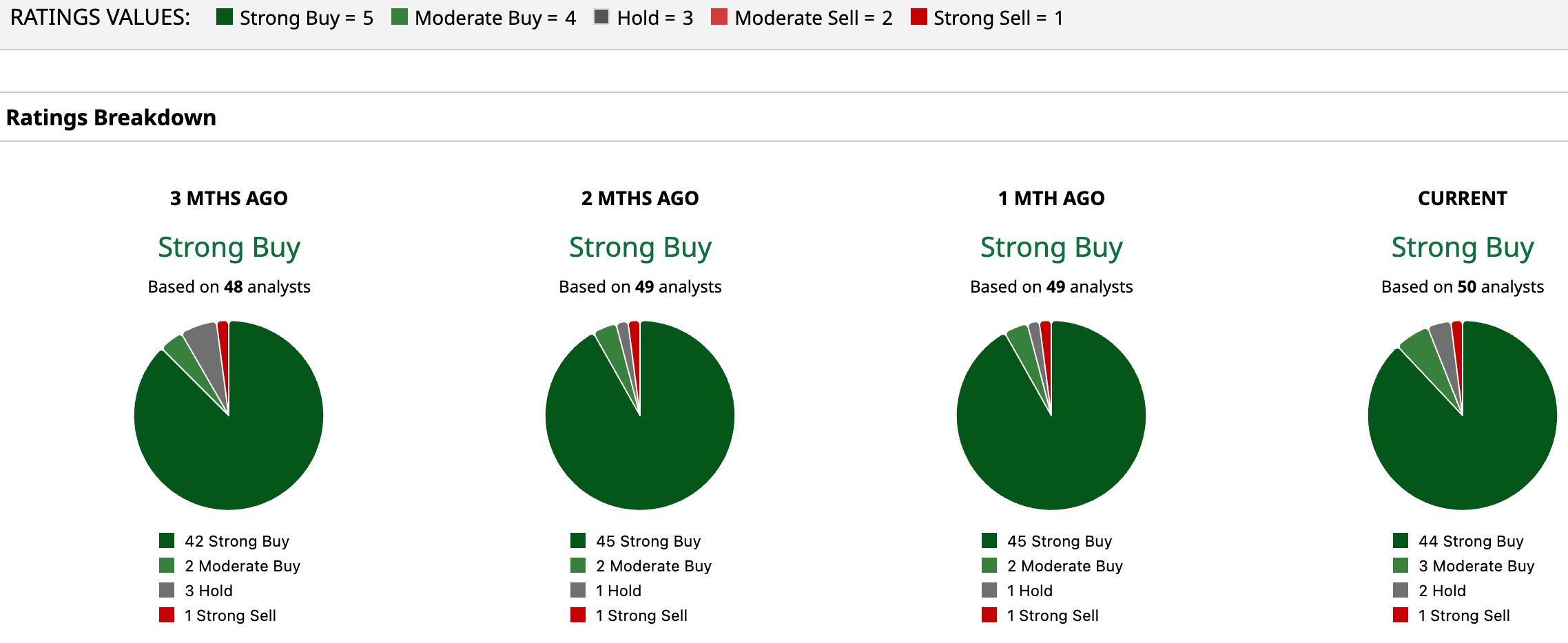

In fact, despite the growing debate around AI spending, overall Wall Street’s confidence in Nvidia remains hard to ignore. The stock currently carries a powerful consensus “Strong Buy” rating, showing that most analysts still believe the company is well positioned to ride out any bumps in the AI investment cycle.

Out of 50 analysts covering the stock, a striking 44 rate it a “Strong Buy.” Another three lean bullish with “Moderate Buy” ratings, while only two sit on the sidelines with a “Hold.” Just one analyst has taken a clearly bearish stance with a “Strong Sell.”

The optimism is also evident in price targets. The average target of $254.81 points to potential upside of about 41.65% from current levels. And at the high end, the most bullish analyst sees shares reaching $352, implying a massive 95.7% rally could still be on the table. In other words, while near-term volatility may stick around, many analysts believe Nvidia’s long-term AI dominance story is far from over.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart