Popular chip developer Advanced Micro Devices (AMD) is gearing to report its fourth-quarter results for fiscal 2025 today, after the market closes. Prior to the earnings release, Wall Street analysts expect AMD’s Q4 EPS to increase by 26.1% year-over-year (YOY) to $1.11 on a diluted basis.

AMD had a significant 2025, with product developments and strategic partnerships. The semiconductor firm reportedly nearly sold out its CPU capacity for 2026 and is looking at further growth based on AI accelerator demand. The company struck a notable multi-year strategic partnership with OpenAI, which is expected to power the next-generation of AI innovation.

On Financial Analyst Day in November, the company highlighted its products and unveiled an ambitious growth plan. AMD expects to expand its data center and AI leadership, with a revenue CAGR above 35% and a non-GAAP EPS target above $20. It also plans to lead the $1 trillion compute market.

However, tariff pressures remain. New tariffs were announced by the Trump administration on the import of chip equipment, which affects AMD’s MI325X chips. The 25% tariffs may not be the last of their kind, as Chinese authorities have shown reluctance to use U.S. technology, which could be a concern for the company.

About AMD Stock

Headquartered in Santa Clara, California, AMD develops cutting-edge semiconductors that drive computing across the globe. It specializes in high-performance processors designed for data centers, personal computers, gaming platforms, and AI applications. As a fabless firm, AMD collaborates with manufacturers to design and manufacture graphics processors, server components, and flexible computing solutions.

Recent efforts emphasize AI accelerators and broader data center adoption, intensifying competition in the tech market. The company pioneers embedded systems and visual computing innovations to address major global issues through adaptive tech. AMD’s activities encompass research, design, and international collaboration to pioneer digital advancements. The company has a market capitalization of $385.4 billion.

Strong demand for AMD’s AI accelerators and data center processors has fueled gains, as the company captures more market share from rivals. Expanded partnerships and product launches in adaptive computing have boosted investor confidence.

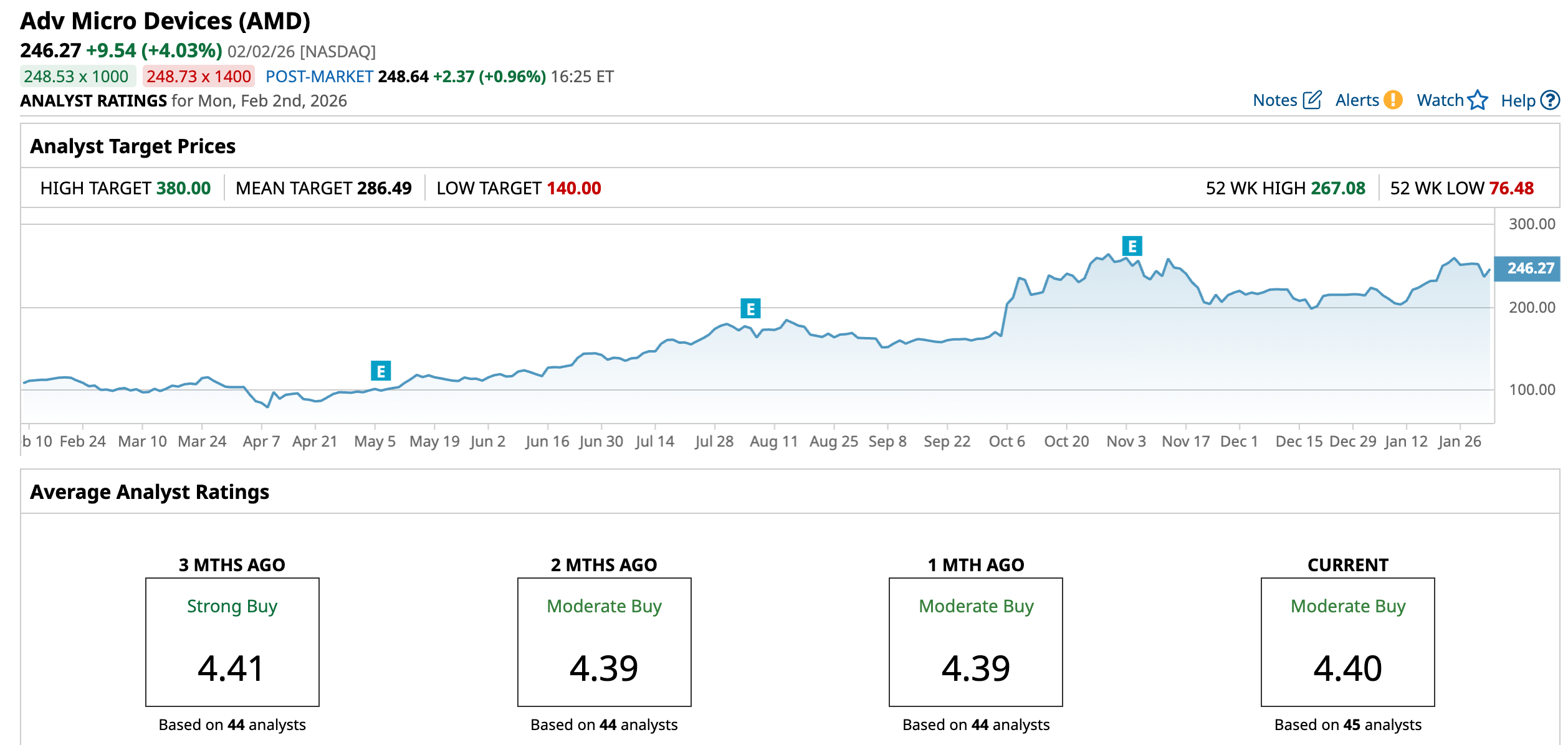

Over the past 52 weeks, AMD’s stock has gained 11.94%, while it has risen 43.13% over the past six months. The stock reached a 52-week high of $267.08 in October 2025, but is down 8.5% from that level.

The stock is trading at a high valuation. Its price-to-earnings ratio of 123.95x is significantly higher than the industry average of 29.76x.

AMD Records Solid Growth Based on AI and Data Center Surge

On Nov. 4, AMD reported its third-quarter results for fiscal 2025, posting a record quarterly revenue of $9.25 billion, up 36% YOY, reflecting a widespread demand for the company’s EPYC and Ryzen processors, and Instinct AI accelerators. Its data center segment’s revenue climbed 22% YOY to $4.30 billion. AMD’s profitability also reaped the gains from this top line surge. The company’s non-GAAP EPS increased 30% YOY to $1.20.

For the fourth quarter of 2025, AMD expects revenue of approximately $9.60 billion, plus or minus $300 million. The range represents a 25% YOY growth at the midpoint. Neither the company’s Q3 results nor its outlook includes any revenue from its Instinct MI308 shipments to China.

For fiscal 2025, analysts expect AMD’s EPS to grow by 19.37% YOY to $3.13, followed by a 77% expansion to $5.54 in fiscal 2026.

Here’s What Analysts Think About AMD’s Stock

Recently, analysts at Wells Fargo reiterated an “Overweight” rating on the stock and a $345 price target, amid rumors of potential delays in the release of AMD’s MI450-series chips, the company’s next generation of accelerator chips. Wells Fargo analyst Aaron Rakers kept a positive outlook on the stock despite the concerns, indicating confidence in AMD’s production ramp.

Just a few days earlier, UBS analyst Timothy Arcuri maintained a “Buy” rating on AMD’s stock while raising the price target from $300 to $330, indicating robust sentiments and optimism about its future potential.

In the same month, Piper Sandler analyst Harsh Kumar raised the price target on the stock from $280 to $300, while maintaining an “Overweight” rating. The analyst expects meaningful revenue and earnings upside, along with benefits from increased production of its Helios rack and its OpenAI partnership, as several of OpenAI’s partners and customers potentially sign contracts with AMD.

Based on the expectation of the company facing increasing hyperscaler demand, stronger-than-expected server demand, and better visibility in the CPU and GPU operations, KeyBanc analyst John Vinh upgraded AMD’s stock from “Sector Weight” to “Overweight” and gave a $270 price target.

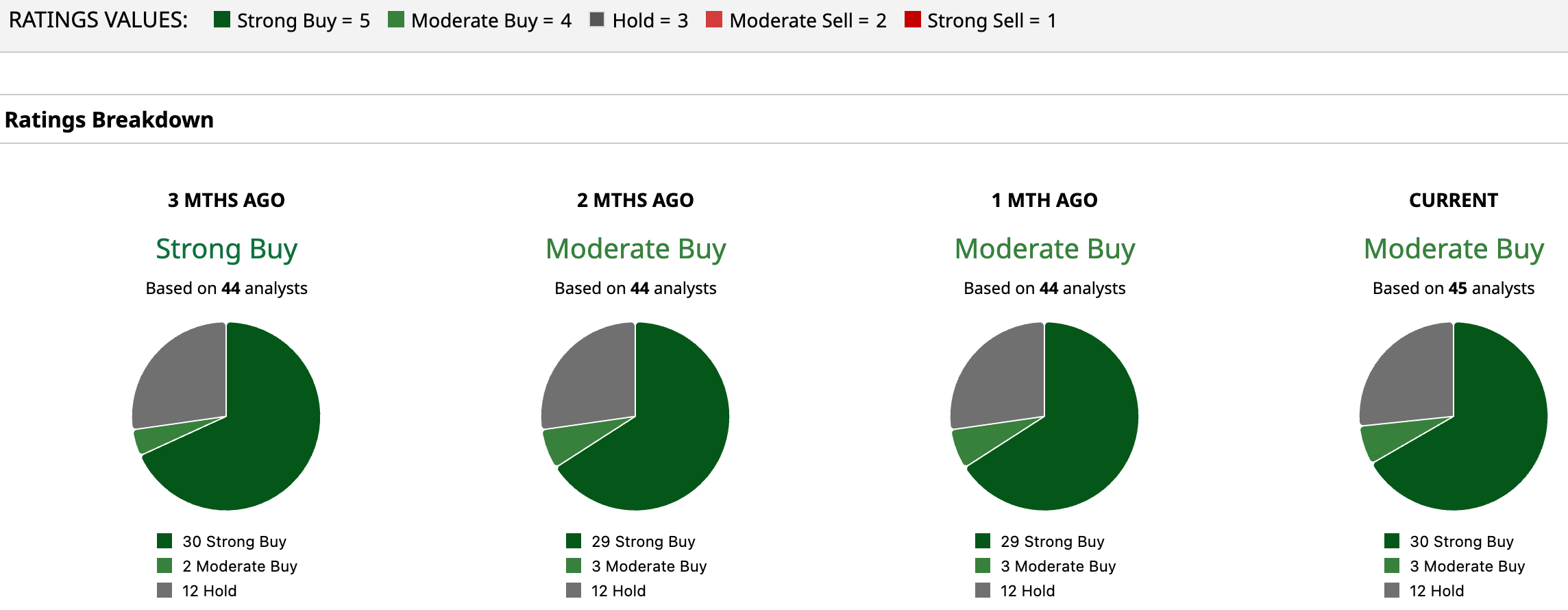

AMD has been a popular on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 45 analysts rating the stock, a majority of 30 analysts have rated it a “Strong Buy,” three analysts suggest a “Moderate Buy,” while 12 analysts are playing it safe with a “Hold” rating. The consensus price target of $286.49 represents 16.3% upside from current levels. However, the Street-high price target of $380 indicates a 54.3% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy AMD Stock Before Q4 Earnings?

- After the Silver Futures Price Crash, This Technical Demand Zone Marks the Next Buy Opportunity

- Nio Just Broke Below Its 20-Day Moving Average Despite Nearly Doubled Deliveries. How Should You Play NIO Stock Here?

- 1 Promising Stock That Just Hit New 52-Week Highs