Washington just put a multi‑billion‑dollar price tag on supply security, and the market is paying attention. President Donald Trump announced on Monday the launch of "Project Vault," a nearly $12 billion initiative to create a strategic reserve of rare earth elements.

This move aims to shield U.S. manufacturers from the kind of supply disruptions China triggered during last year's trade talks, when it restricted exports of metals critical to jet engines, radar systems, and electric vehicles.

The reserve will be seeded by a $10 billion loan from the U.S. Export‑Import Bank and roughly $1.67 billion in private capital. This structure directly addresses the fact that China controls about 70% of global rare earths mining and 90% of processing.

Three companies are contributing to the $12 billion in seed funding, effectively buying a front‑row seat to this government‑backed metals reserve. Those names are General Motors (GM), Stellantis (STLA), and Boeing (BA). Together, they could turn Project Vault from a policy headline into a tangible, long‑term catalyst for shareholders.

General Motors Company

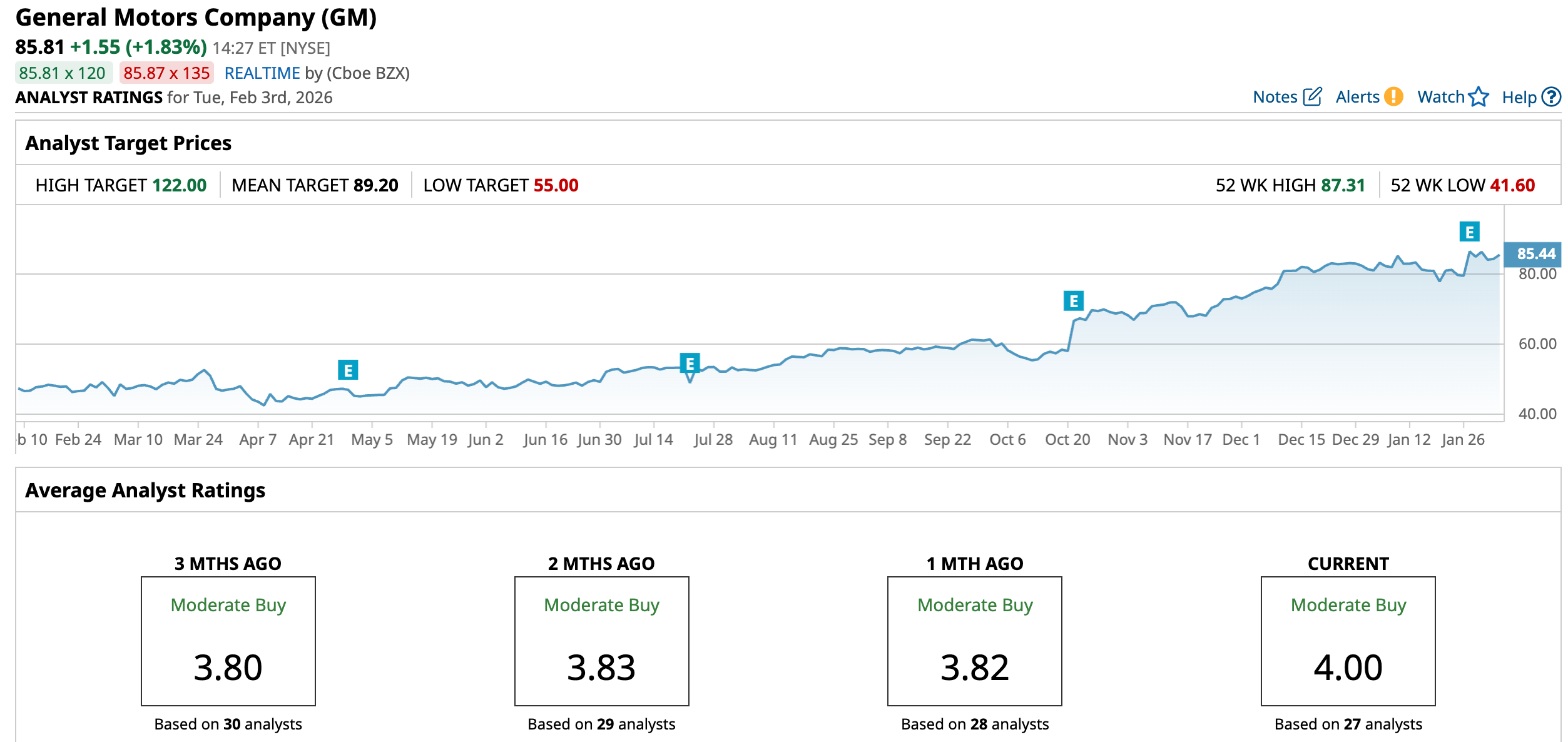

The U.S.-listed auto manufacturer based in Detroit builds mass-market and premium vehicles under the Chevrolet, GMC, Cadillac, and Buick brands. Its shares trade at $85.88 as of Feb. 3, up 5.62% year-to-date (YTD) and 79.31% over the past 52 weeks.

That gives the company a market value of roughly $75.9 billion and a forward P/E of 6.88 times versus a 19.53 times sector median and price-to-cash-flow of 3.68 times compared with about 11.98 times for peers.

GM released its 2025 financial results on Jan. 27, reporting full‑year 2025 net income attributable to stockholders of $2.7 billion and EBIT‑adjusted of $12.7 billion. These numbers were heavily shaped by more than $7 billion in one‑off charges tied to EV capacity resets and international restructuring.

This left the fourth quarter of 2025 with a net loss to common shareholders of $3.3 billion, even though EBIT‑adjusted for the quarter came in at a solid $2.8 billion. GM nevertheless delivered Q4 adjusted EPS of $2.51, ahead of the $2.20 consensus by roughly 14%, showing that the underlying business continues to execute even as it absorbs those strategic clean‑up costs.

The earnings outlook is equally important as General Motors is expected to report its next results on May 5, with current estimates calling for EPS of $2.65 in Q1 2026 and $3.19 in Q2 2026, versus 2.78 and 2.53 in the same quarters a year earlier. This implies a modest year‑over‑year (YOY) dip for the current quarter, followed by more than 26% growth in the next, and about 17% EPS growth for full‑year 2026 from $10.60 to $12.42.

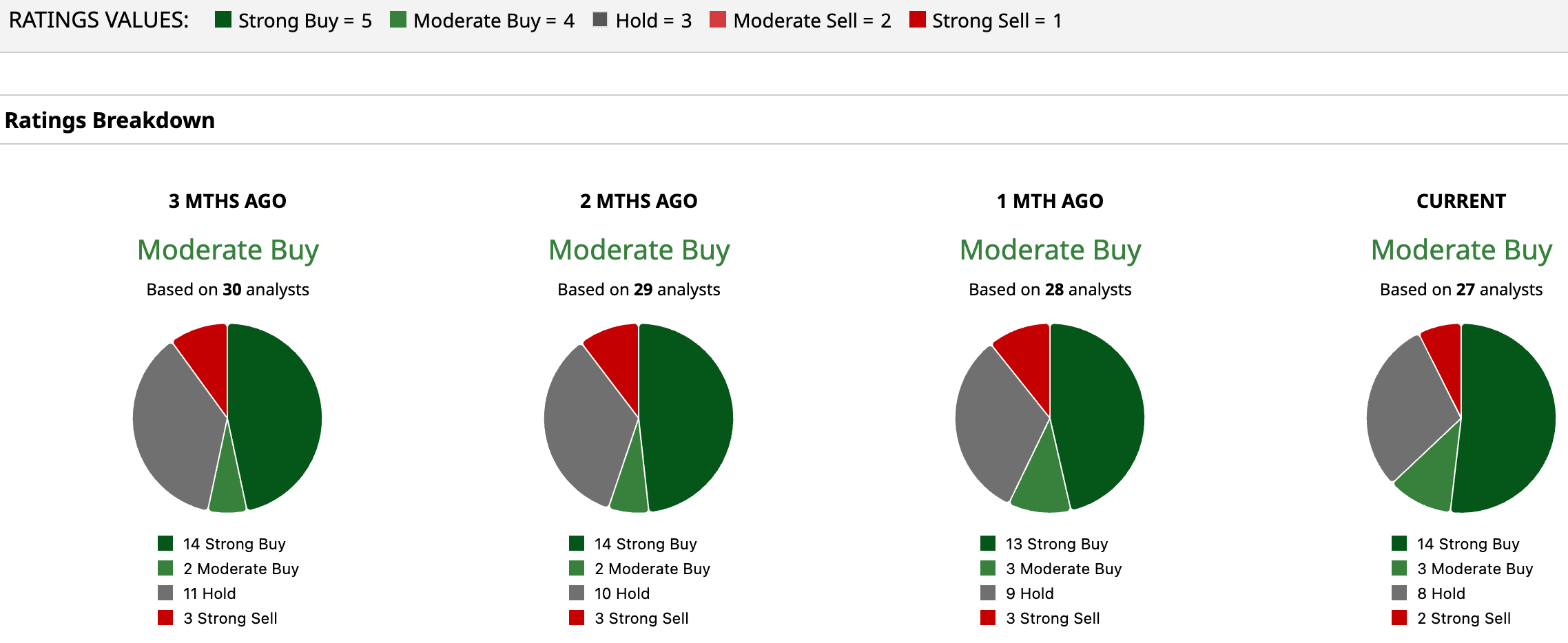

Analysts are uniformly constructive, with 27 surveyed giving GM a consensus "Moderate Buy" rating, with an average price target of $89.20 showing 4% room to grow from current levels.

Stellantis

Stellantis is a Netherlands‑domiciled automotive group with U.S. and European listings, manufacturing global mass‑market and premium vehicles across multiple storied brands.

STLA trades up a mere 0.62% over the past five-day period, down 9.92% YTD and 22.27% over the past 52 weeks.

This price implies a market value of about $29.8 billion and a compressed valuation, with price‑to‑sales at 0.16x versus a 0.97x sector median and price‑to‑cash‑flow at 12.31X versus 11.98x for peers.

The company also announced the adoption of the North American Charging System and future access to more than 28,000 Tesla Superchargers across North America, Japan, and South Korea, with network access beginning in early 2026 in the U.S. and 2027 in Asia. The product story is being reinforced on the showroom floor as Stellantis, in January 2026, outlined a $13 billion U.S. investment plan that will fund five new products and create 5,000 jobs.

This shows up in recent financials, as the company reported that for the quarter ended June 2025, Stellantis generated sales of $33.25 billion, up 10.20% YOY. That quarter also delivered net income of $1.65 billion, up 17.58%, highlighting solid operating leverage despite a soft share price.

The next earnings release is scheduled for Feb. 25, and current estimates call for full‑year 2025 EPS of $0.66 versus $2.68 a year earlier. That would then rebound to a projected $1.56 in 2026, implying a 75.37% drop followed by a 136.36% increase.

Analyst sentiment captures that mix of caution and recovery. This coverage counts 24 analysts and arrives at a consensus “Hold” rating, with an average price target of $10.76 that implies about 9.68% upside from the current price.

Boeing Company

Boeing is a U.S.-based aerospace and defense manufacturer listed in New York, producing commercial jets, military aircraft, and space systems.

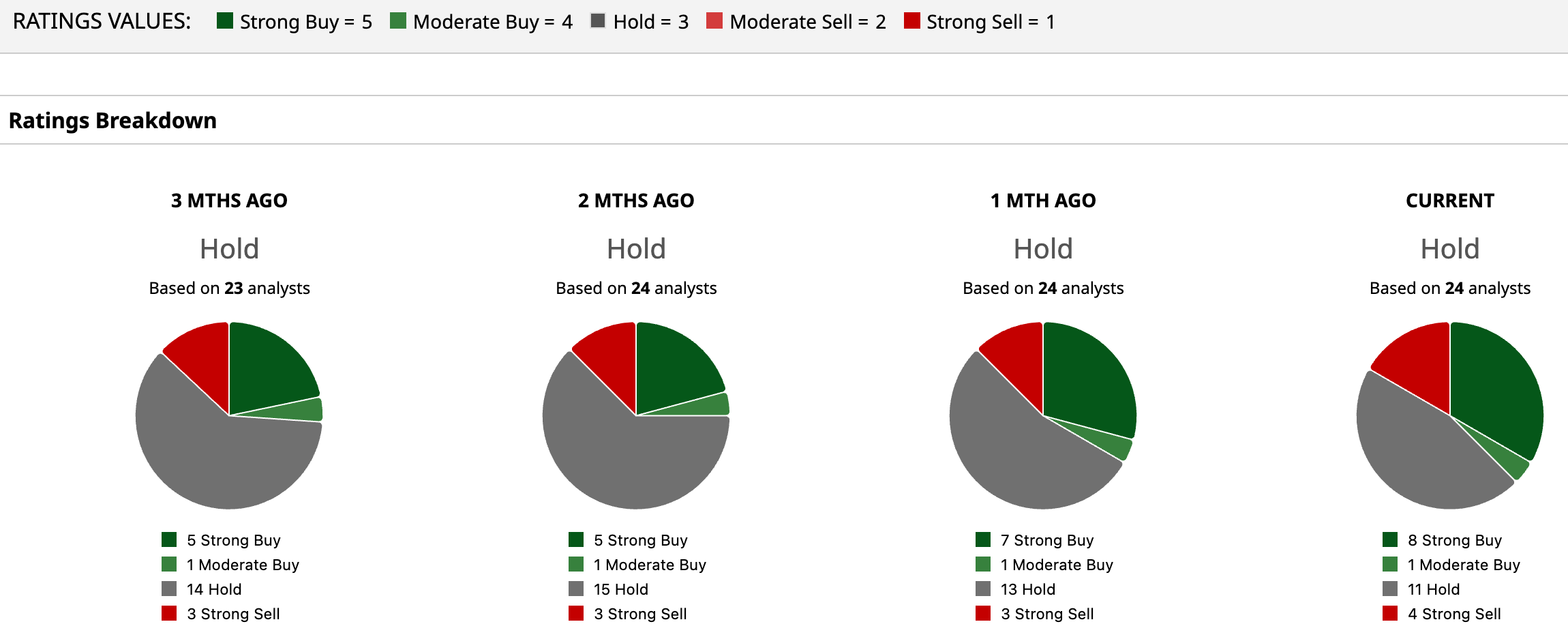

Over the past five-day period, BA sits at -5.90%, but up 5.99% YTD and 30.85% over the past 52 weeks.

This equates to a market value of about $177.6 billion and a stretched but nuanced valuation, with price-to-sales (TTM) at 1.98x versus a 1.97x sector median and a non-GAAP forward P/E near 147.07x versus 21.73x for peers.

BA’s lofty multiple sits as the company secured a Foreign Military Sales contract worth nearly $4.7 billion to build 96 AH-64E Apache helicopters for Poland, the largest Apache order outside the U.S., with deliveries expected to start in 2028.

This past quarter, ending December 2025, BA reported EPS of -$1.91 versus a consensus estimate of -$0.40, a negative surprise of -$1.51 that highlighted how production and cost issues still weigh on reported results even as the stock trends higher.

The next earnings release is scheduled for April 22, and the average estimate calls for Q1 2026 EPS of -0.55 compared with -0.49 a year earlier, followed by Q2 2026 EPS of -0.13 versus -1.24 in the prior year and full-year 2026 EPS of 0.61 versus -10.64 in 2025. That trajectory implies an estimated YOY change of -12.24% for the current quarter, an almost 89.52% improvement in the next, and a swing of more than 100% into positive territory for the full year.

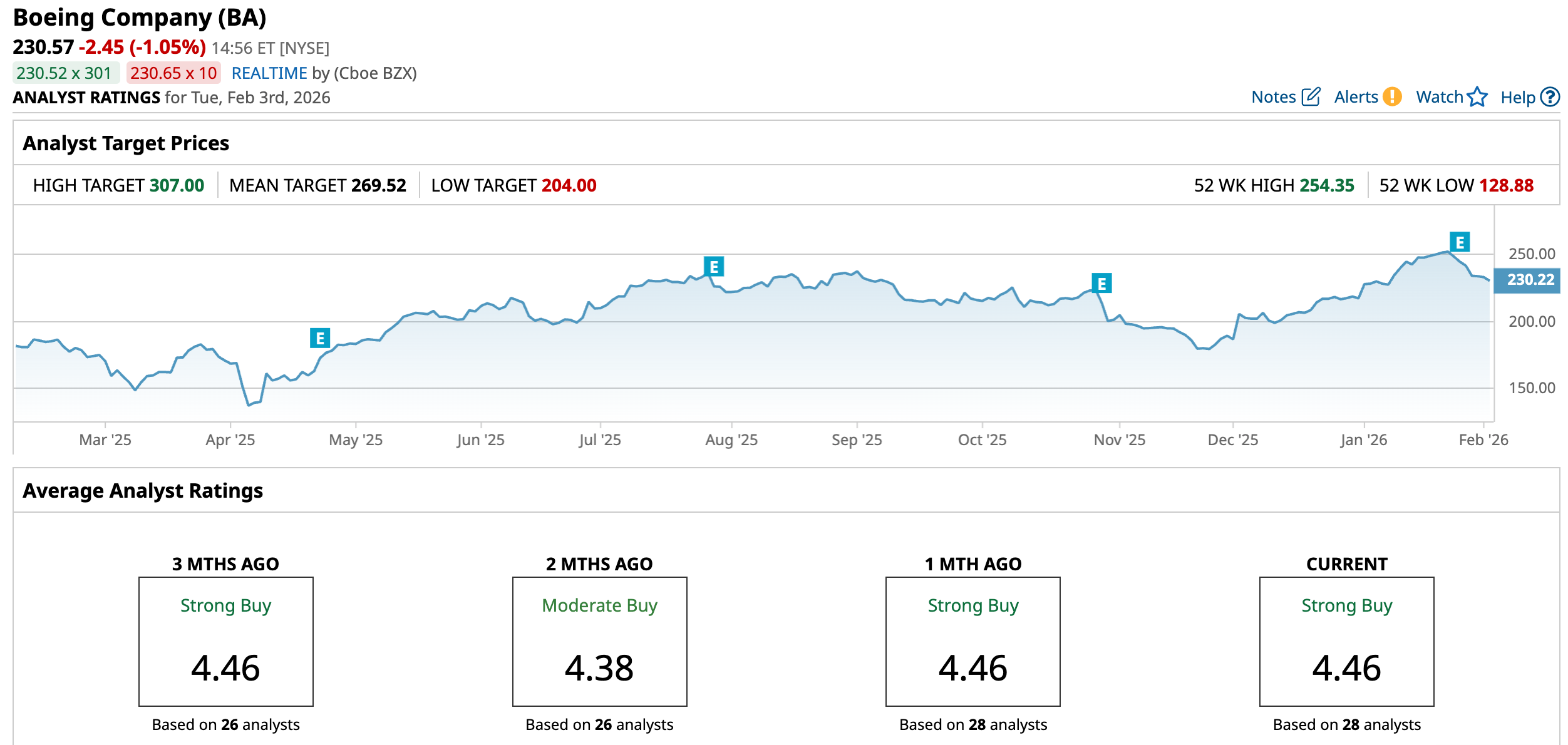

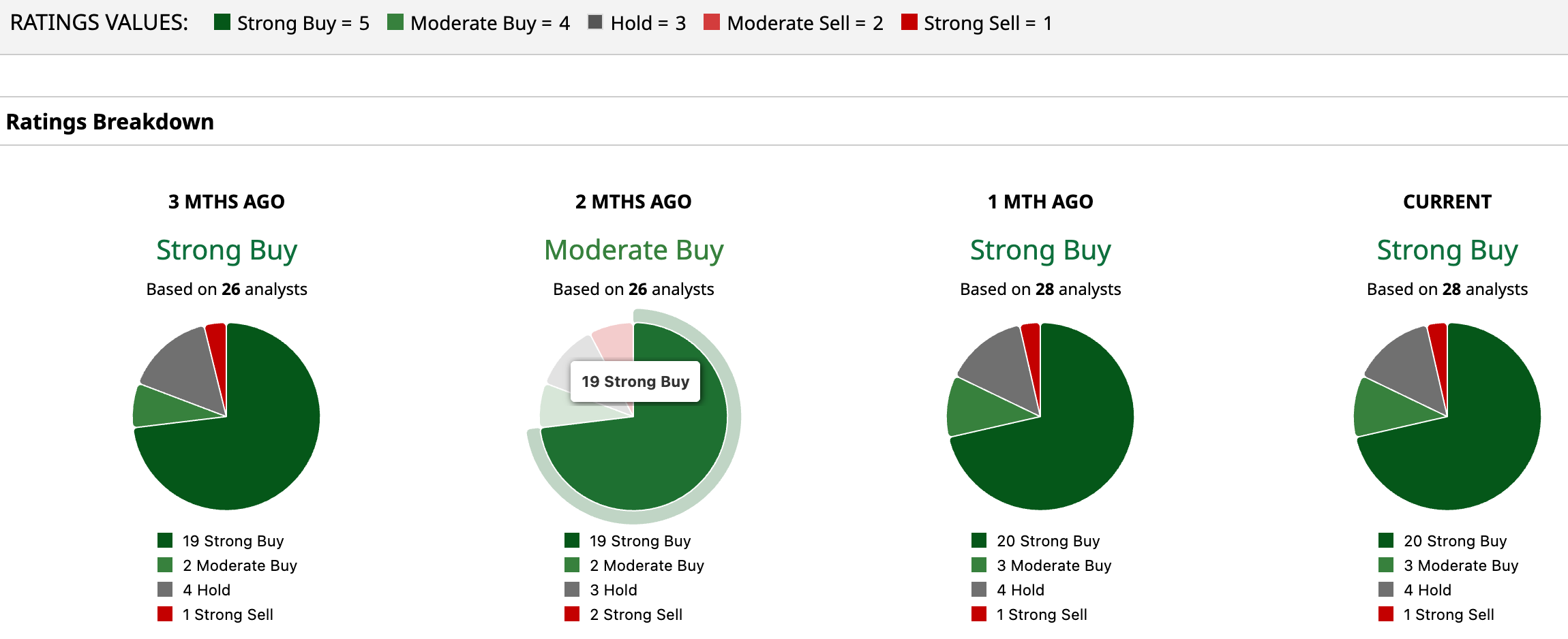

Analyst expectations mirror that narrative. This coverage comprises 28 analysts, and the collective view has settled on a consensus “Strong Buy” rating. The average price target of $269.52 sits about 16.89% above the current quote.

Conclusion

Project Vault is quietly tilting the field toward industrial names that can secure minerals, manage capital, and turn policy tailwinds into durable earnings. Together, GM, Stellantis, and Boeing offer a blend of discounted valuations, earnings recovery potential, and strategic access to a government-backed stockpile that strengthens their long-term narratives. From here, their shares look more likely to drift higher in step with execution and policy clarity than to deliver a one-way melt-up, rewarding patient accumulation.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 4 Reasons To Buy the Dip in SoFi Stock Right Now

- PayPal Stock Is Now Deep in Oversold Territory. Should You Buy the Dip After 8-Day Losing Streak?

- Snowflake Just Struck a $200 Million Deal with OpenAI. What Does That Mean for SNOW Stock Here?

- 3 Blue-Chip Stocks to Buy to Benefit from Trump’s ‘Project Vault’