While tech stocks have borne the brunt of the recent market sell-off, other sectors have also felt the pain, which has opened up some buying opportunities. Specifically, Citigroup (C)—which gained 66% last year and outperformed most of its U.S. large-cap banking peers—is down over 11% from its 2026 highs. In my previous article, I had noted that Citi’s valuations left little on the table as the risk-reward was quite balanced. Here we’ll discuss whether the stock has entered a buy zone after the recent correction.

Citi’s Turnaround Is Nearing Completion

Citi has been a play on the turnaround under CEO Jason Fraser, who took over the reins in 2021. As part of the turnaround, Citi has flattened its organizational structure, reduced bureaucracy, and is working to address the underlying issues that have put it in the crosshairs with regulators. The bank has consolidated into five core businesses to reduce complexity and focus its energies on key businesses. The bank is now in the final leg of its transformation, and during the Q4 2025 earnings call, management noted that 80% of the “programs are now at or nearly at our target state.”

As part of its turnaround, Citi has exited several international markets and is in the process of divesting from some more. These asset sales have served two purposes. Firstly, it has reduced the complexity in the business and helped streamline management synergies on key businesses, particularly in the U.S. It has also freed up capital, and since many of the international markets that the company exited were underperforming, its return on capital has improved significantly.

Citi’s Return Metrics Have Improved Significantly

For context, Citi’s return on total capital employed (RoTCE) was 7.7% last year, and the management reiterated its optimism over achieving an RoTCE of between 10% and 11% this year, which it expects to further increase in the coming years.

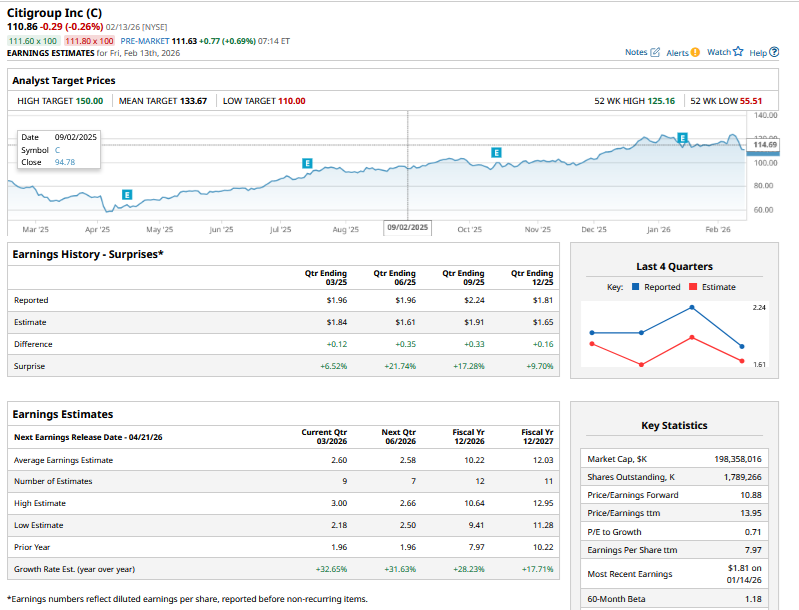

Citi’s earnings should stay buoyant for at least the next couple of years, as its progress in turnaround and investments in technology will help drive efficiencies. The company has been cutting down on costs aggressively and, among others, has laid off thousands of employees, with more cuts expected by the end of this year. Consensus estimates call for Citi’s earnings per share to rise 28.2% in 2026 and 17.7% in 2027. The growth outlook is the most bullish among the top five U.S. banks by assets.

Citi's Dividend Yield Is Over 2%

Thanks to its financial strength, Citi has doubled down on shareholder payouts and repurchased shares worth $13 billion last year. It pays a quarterly dividend per share of 60 cents, which implies a yield of 2.1%. While the yield is not as attractive as it was a couple of years back, it is still healthy when compared to other large banks as well as broader markets. Despite spending generously on share repurchases, Citi had a CET1 capital ratio of 13.1% at the end of 2025, which is 160 basis points higher than the regulatory requirement.

Citi investors can expect higher dividends over the next couple of years as the company’s strong capital ratios and healthy cash flows would allow it the flexibility to increase shareholder returns.

Is C Stock a Buy?

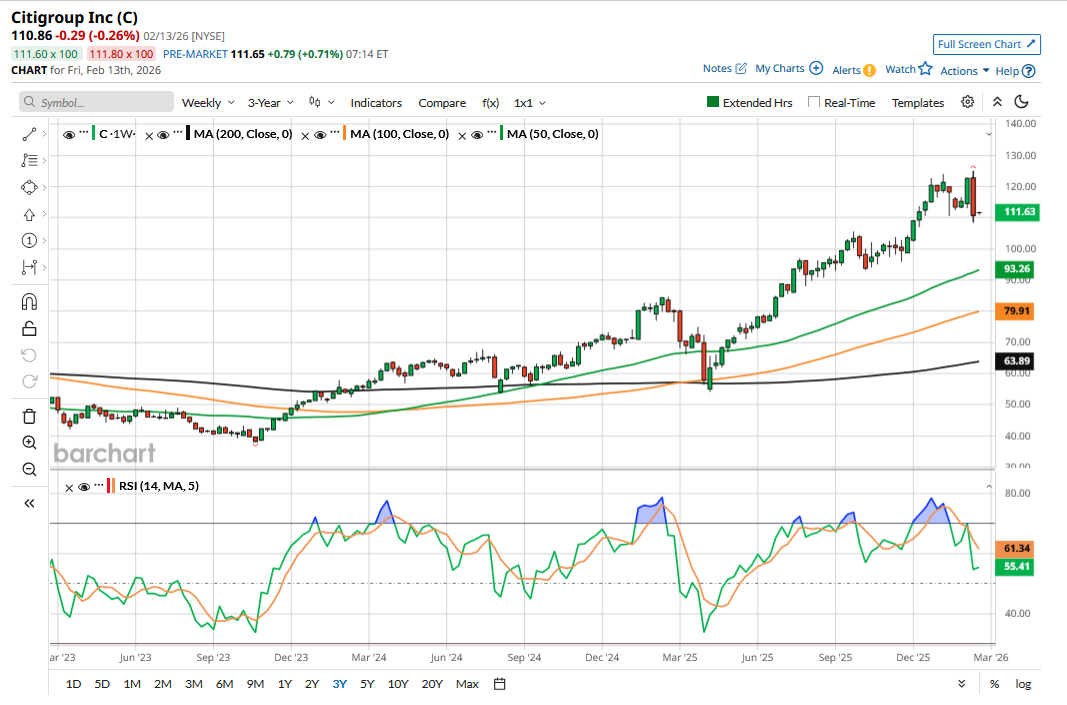

While I have been generally bullish on Citi, I have used rallies to book profits while promptly adding shares when the stock crashes in broader market meltdowns.

Looking at valuation metrics, Citi had a tangible book value of $97.06 at the end of 2025, while the total book value per share was $110.01, which is similar to where C stock currently trades. While the stock's valuation is not as attractive as a couple of years back, when it was trading below the tangible book value, it is a decent buy near its book value.

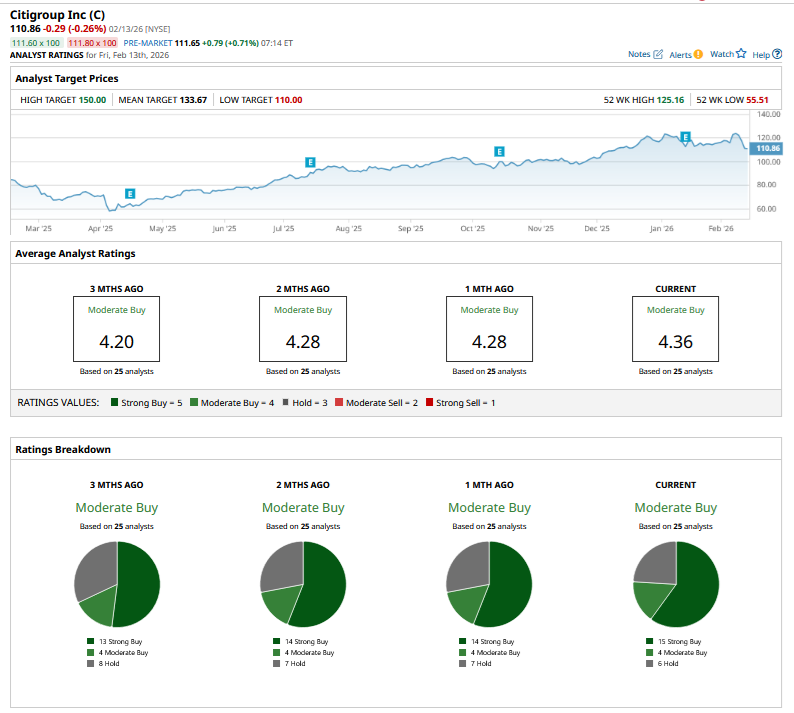

From a capital appreciation perspective, Citi might not be able to repeat last year’s stellar performance as its valuation gap with banking peers has narrowed. However, there is a reasonable margin of safety in buying the stock near its book value. Sell-side analysts seem to share the same view, and Citi trades near its Street low target price of $110, while the mean target price of $133.67 is 20.5% higher than the current price levels.

On the date of publication, Mohit Oberoi had a position in: C . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart