The broader software sector has been under pressure to start 2026, rattled by what Wall Street has labeled the “SaaSpocalypse.” The fear is that autonomous artificial intelligence agents could disrupt traditional subscription-based models and compress long-standing revenue streams. That anxiety has translated into real damage. The world’s largest software ETF by assets, iShares Expanded Tech-Software Sector ETF (IGV), slid sharply as investors headed for the exits.

Among the names pulled into the slide was Snowflake (SNOW), the cloud data platform. But it soon staged a rebound as investors rotated back into durable, deeply embedded enterprise names. Now attention turns to fundamentals. Snowflake will report its fiscal fourth-quarter and full-year of fiscal 2026 results on Wednesday, Feb. 25, 2026. While management seems bullish, Wall Street is modeling double-digit growth on both revenue and earnings for fiscal 2026.

Earnings season is more than a routine disclosure cycle. Quarterly reports offer a forward-looking signal, revealing not just what a company earned, but where it may be headed next. For investors, this report could set the tone ahead. So keep that date circled.

About Snowflake Stock

Founded in 2012 and headquartered in Montana, Snowflake has grown into one of the most influential names in cloud data infrastructure, with a market capitalization of roughly $60.6 billion. The company operates its Data Cloud, a unified platform that allows organizations to store, manage, analyze, and securely share data at scale. Businesses use Snowflake to power real-time analytics, AI-driven applications, and cross-company collaboration.

Its reach spans financial services, media, retail, healthcare, manufacturing, technology, telecom, travel, and the public sector – essentially any industry where data is central to decision-making.

Plus, strategically, Snowflake has leaned deeper into artificial intelligence (AI). A $200 million agreement with OpenAI, alongside its partnership with Anthropic, positions the company to capture more AI-related workloads. And this could potentially draw revenue away from traditional cloud infrastructure giants.

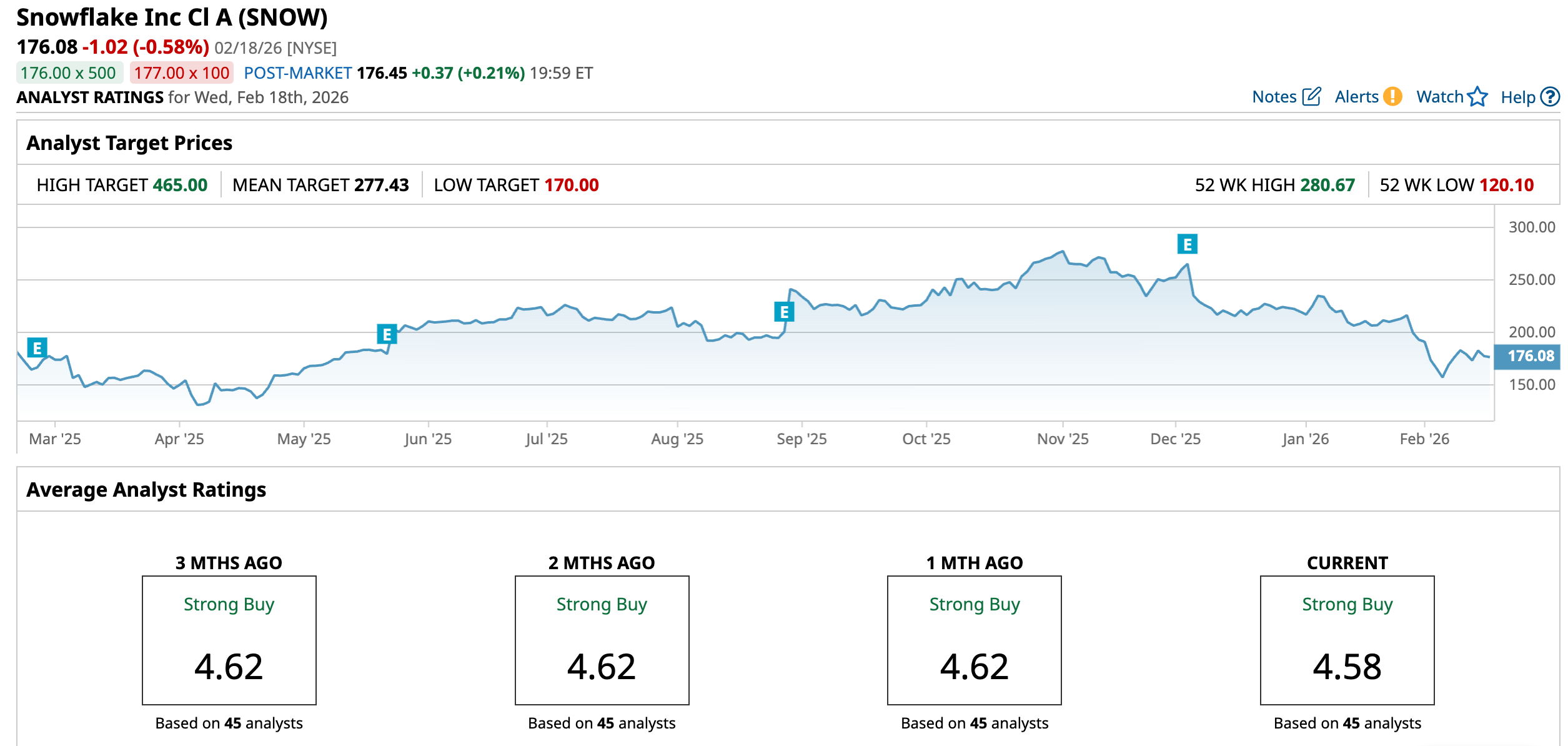

Despite its scale and strategic positioning, Snowflake’s stock price performance has been far from impressive. Shares of the cloud computing company are down 8.66% over the past 52 weeks. Over the past six months, SNOW has declined by 11.18%, signaling lingering pressure. The near-term trend has been sharper, down 30.82% in the past three months alone. Even early 2026 has offered little relief, with the stock slipping 19.73% on a year-to-date (YTD) basis.

In terms of valuation, SNOW stock is priced at 147.07 times forward adjusted earnings and 13.02 times sales, which is quite high. Yet those multiples sit below its five-year averages. Plus, after the “SaaSapocalypse” selloff dragged shares into oversold territory and triggered opportunistic buying.

Plus, with analysts projecting strong revenue growth this year and next, and new enterprise deals expected to further accelerate momentum, many growth investors might still see justification for the premium.

Snowflake’s Q3 Earnings Results Beat Estimates

Snowflake dropped its third-quarter numbers on Dec. 3. Revenue came in at $1.21 billion, up 28.7% year-over-year (YOY). Product revenue did most of the heavy lifting, rising 29% annually to $1.16 billion as more enterprises leaned into data infrastructure and AI workloads.

It reported a net loss of $293.9 million, or -$0.87 per share, narrower than last year's figures. Non-GAAP EPS landed at $0.35, up 75% from the year-ago quarter and comfortably ahead of Wall Street’s projections. It also marked the sixth straight earnings beat.

Then there’s the forward signal. Remaining performance obligations rose 37% YOY to $7.88 billion, pointing to long-term contracts stacking up. Snowflake added a record 615 new customers in the quarter, while net revenue retention held strong at 125%. Existing customers are not just staying – they are spending more.

But AI makes the picture more interesting. Over 7,300 customers are now using Snowflake’s AI capabilities weekly, with Snowflake Intelligence became the fastest-adopted product in company history, reaching 1,200 customers. AI-related offerings hit a $100 million revenue run rate a quarter ahead of schedule; less pilot programs, more production deployments. Plus, partnerships widened the moat. Tie-ups with SAP (SAP), Google Cloud (GOOG), and Anthropic expanded model choice and enterprise-grade AI integration.

While the company is all set to release its fiscal 2026 numbers next week, Management nudged full-year product revenue guidance up to around $4.446 billion, indicating 28% year-over-year growth. Plus, management anticipates a product gross margin of 75%, an operating margin of 9%, and a free cash flow margin of 25%.

Analysts tracking Snowflake predict a loss of $2.32 per share, gaining 33.7% in fiscal 2026, followed by a - 5.6% loss of -$2.45 in fiscal 2027.

What Do Analysts Expect for Snowflake Stock?

The mood around software may be heavy, but the tone from some corners of Wall Street is more measured. Analyst Gregg Moskowitz of Mizuho lowered SNOW’s price target to $220 from $285, reflecting the sharp multiple compression that has swept across the enterprise software space. Still, he kept an “Outperform” rating intact.

Mizuho trimmed targets broadly across the group, acknowledging that AI disruption fears have pushed sentiment to extreme lows. Yet, beneath the surface, its recent quarterly software checks came in solid. In that gap between fear and fundamentals, the brokerage firm sees selectively attractive opportunities for investors who are patient enough to wait.

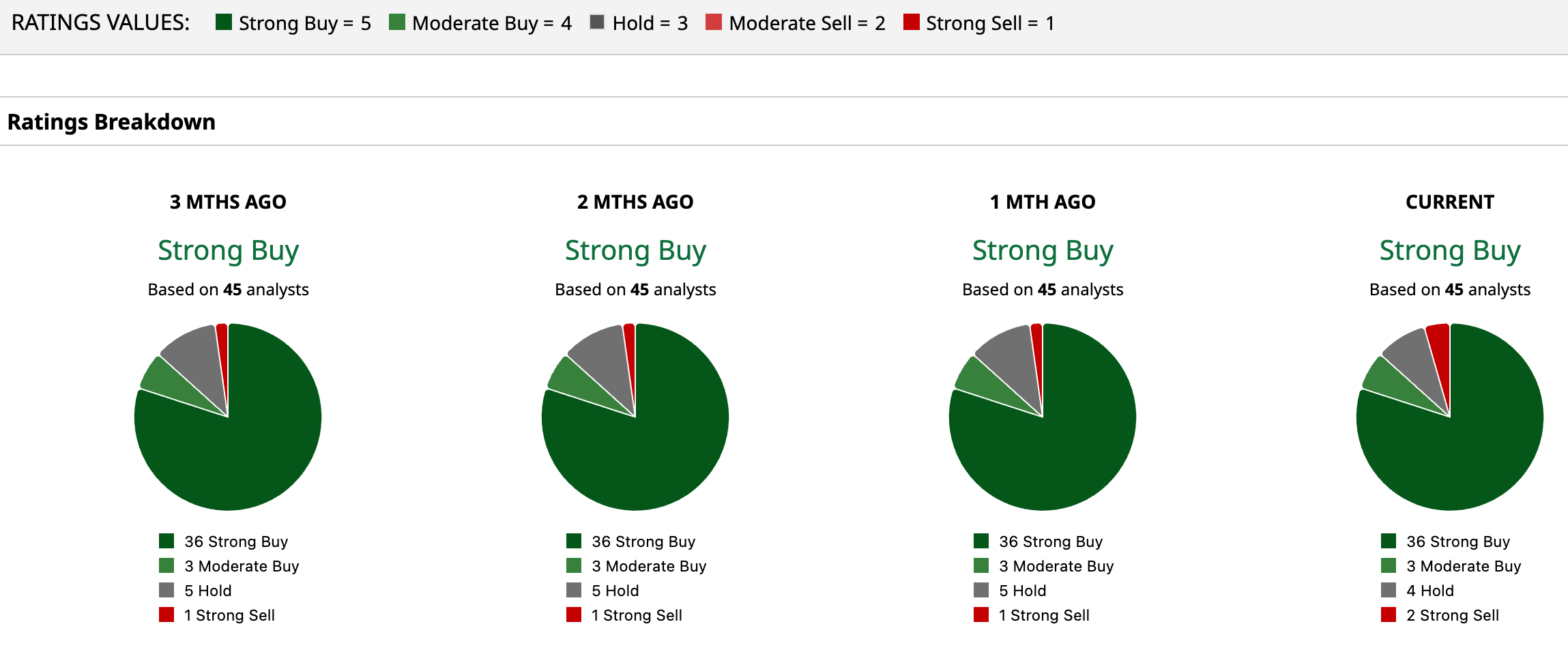

Snowflake has a consensus “Moderate Buy” rating overall. Of the 45 analysts covering the stock, 36 advise a “Strong Buy,” three recommend a “Moderate Buy,” four suggest a “Hold,” and the remaining two give a “Strong Sell” rating.

The mean price target of $277.43 suggests an upside potential of 57.6% from the current price levels. The Street-high target price of $465 for Snowflake implies the stock could rally as much as 164%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Pentagon Could Blacklist Alibaba. Does That Make BABA Stock a Buy Now?

- The Shocking, Futuristic Reason Why Elon Musk Is Stopping Production of 2 Tesla Models

- A Utility Stock with Steady Earnings and a Dividend Higher Than a 30 Year T-Bill

- 1 Data Center Stock That Billionaire Philippe Laffont Is Buying Now