In recent weeks, crypto-related stocks have been on edge as digital-asset prices pulled back. Bitcoin (BTCUSD) fell sharply in late January amid macro headwinds, wiping out much of its gains from last year. That decline has rippled through the sector, with Coinbase Global’s (COIN) stock plunging about 32% in January. Tech and fintech stocks broadly weakened on Fed uncertainty, and crypto exchanges like Coinbase saw trading volumes wane.

Now, Coinbase has announced its Q4 2025 results will be released after the Feb. 12 market close, a date investors are circling. The upcoming earnings call will be a key catalyst, as the company’s growth prospects hinge on crypto market momentum.

About COIN Stock

With a market cap of $43 billion, Coinbase Global is the largest U.S. cryptocurrency exchange, aiming to “increase economic freedom” by offering a platform for trading, staking, and custody of digital assets. It was the first crypto-native firm to join the S&P 500 ($SPX) in 2025. Coinbase serves both retail and institutional clients, with millions of verified users and trillions of dollars in assets on its platform. Simply, Coinbase provides a trusted on-ramp for consumers and institutions to buy, sell, and hold cryptocurrencies, alongside new services like staking, wallets, and even stock trading.

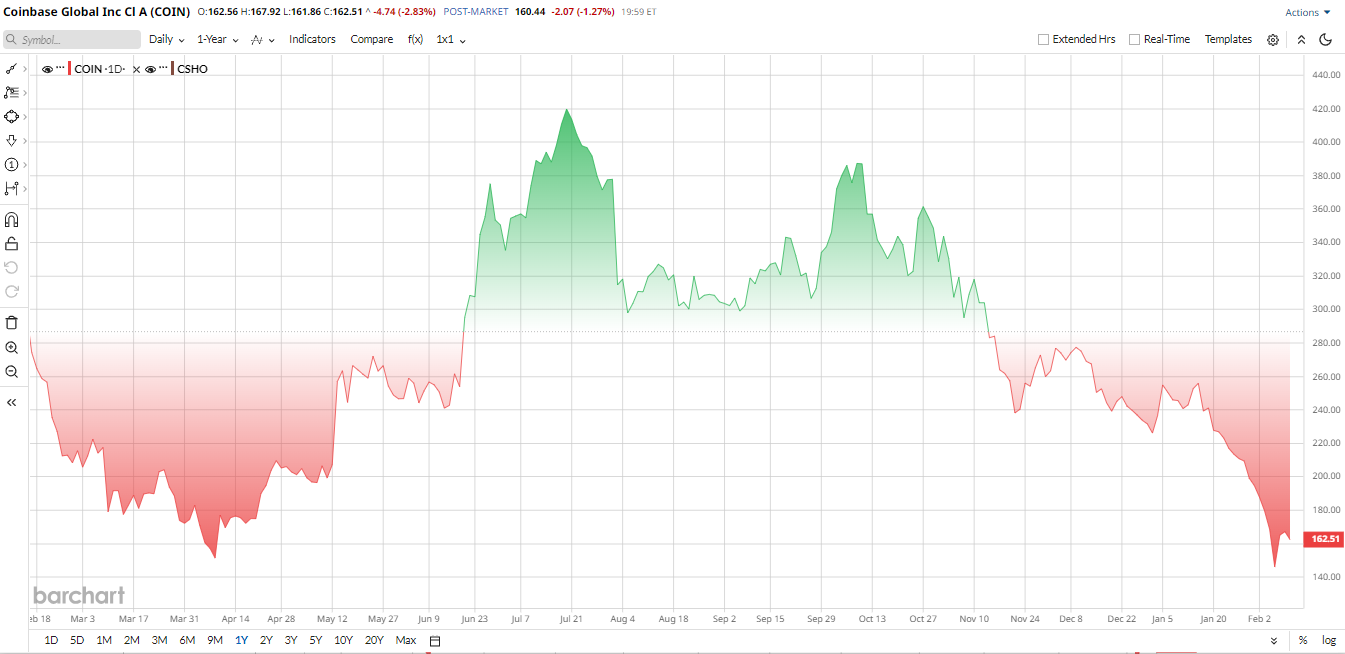

Last year, COIN stock enjoyed a big rally as crypto rebounded. Coinbase surged from early-2025 lows to a mid-July peak near $445. It later eased back toward the mid-$200s by year-end. In 2026, the slide around 28% deepened due to crypto weakness. COIN trades around $160-$165 now, modestly below its 50-day moving average, which is about $169.

Even after that sharp correction, valuation metrics suggest a different narrative may be forming. On price metrics, Coinbase looks fairly cheap relative to peers. Its forward P/E is roughly in the mid-teens, about half the 33× average for diversified fintech/brokerage peers. Similarly, Coinbase’s price/sales 6× is well below the 10× range seen at many larger exchanges. In other words, COIN trades at a notable discount to the group. Investors note this gap, and some analysts call COIN undervalued, given its growth potential if crypto volumes rebound.

What to Expect from the Upcoming Report

Coinbase confirmed last month that it will report Q4 and full-year 2025 results on Feb. 12. This timing fixes a key event on the calendar for shareholders. In recent cycles, Coinbase's stock has reacted strongly to earnings surprises, so market-watchers will scrutinize every detail on Feb. 12. Analysts expect revenue to ease after last year’s boom: consensus forecasts point to roughly $1.84 billion in Q4 revenue, down about 20% year-over-year (YoY). EPS estimates are around $0.99, well below Q4 2024’s $3.50, reflecting the sharp drop in trading fees.

In October’s Q3 call, management laid out Q4 guidance to match slimmed-down volume. It guided subscription and services revenue of $710 to $790 million, up from $676 million in Q3, and pointed to higher spending on operations. For example, it expected Q4 sales/marketing expenses of $215 to $315 million and tech & admin costs around $925 to $975 million. Street analysts are modeling revenue and EPS roughly in that ballpark

Beyond raw numbers, investors will pay close attention to management’s tone and guidance. If Coinbase can stabilize assets-under-custody or subscriptions, e.g., Coinbase One, staking rewards, that could ease concerns. Conversely, any surprise warning of softening demand would likely pressure the stock. In short, the Feb. 12 call is seen as make-or-break for setting 2026 expectations.

At the same time, analysts expect Coinbase’s fast-growing businesses, such as USDC stablecoin balances, staking, and new products, to partly offset the decline in spot trading.

Recent Developments and News

Coinbase has been busy beyond just earnings. It announced a number of new offerings last year. On Dec. 17, the company rolled out a stock-trading service and a prediction-markets platform, making Coinbase a more broker-like firm, such as Robinhood (HOOD) and Interactive Brokers (IBKR).

Moreover, it is also acquiring The Clearing Company, which is a prediction market startup. The acquisition was announced Dec. 22, making it the 10th acquisition of Coinbase in the year. Analysts observe that the motive behind these actions is to expand the reasons to open its application, not limited to crypto, and introduce new sources of revenue.

At the regulatory level, Coinbase CEO Brian Armstrong publicly criticized a Jan. 15 Senate attempt to pass cryptocurrency legislation that would have set rules of conduct. This stems from the fact that, despite the continued ambiguity surrounding crypto regulation in the United States, his objections regarding stable-coin regulations and SEC regulation are notable.

What Do Wall Street Analysts Think About COIN Stock?

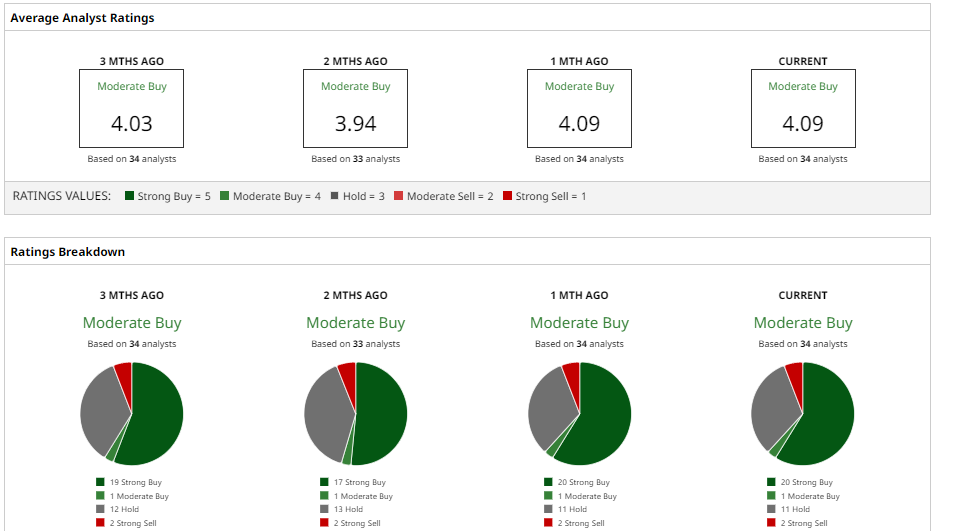

Wall Street’s view on Coinbase is mixed to positive. The consensus is roughly a “Moderate Buy” with an average 12-month target near $337, implying more than 100% upside from current levels.

Major firms’ price targets span a wide range, reflecting uncertainty. For example, Goldman Sachs lifted its target to $310 with a "Buy" rating in January, highlighting expectations of renewed growth.

By contrast, Cantor Fitzgerald recently cut its target to $320 from $459 on 2025 weakness, and Mizuho set a lower $280 goal last December. Recent reports note analysts see COIN trading well below its earlier forecasts, mainly due to crypto-market headwinds.

In their research notes, analysts emphasize the importance of Coinbase’s new initiatives. J.P. Morgan analysts wrote that Coinbase’s launches of stock trading and prediction markets should “encourage and incentivize customer engagement,” potentially addressing the episodic volatility of crypto trading.

Similarly, Benchmark analysts observed that these products add “high-frequency” user activity and give more reasons for people to open the Coinbase app. In summary, analysts argue that if these features drive higher user engagement, they could justify a richer valuation.

For now, most observers agree on one thing. Coinbase’s fate remains tied to cryptocurrency trends, and Feb. 12’s earnings will be a major test of whether this battered crypto-exchange stock has found a bottom or has more room to fall.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Coinbase Stock Fans, Mark Your Calendars for February 12

- Michael Saylor Isn’t Backing Down from Buying Bitcoin. Why MSTR Stock Investors Don’t Like That.

- 'If People in the Rest of the World Knew What I Know': MicroStrategy's Michael Saylor's Viral Message About MSTR Stock and Bitcoin to $10 Million

- As Crypto Prices Plunge, Cathie Wood Is Selling This 1 Bitcoin Stock