“I love it when a plan comes together.”

These are the immortal words of John “Hannibal” Smith, the leader of The A-Team, the fictional TV series starring George Peppard and Mr. T that ran for five seasons in the mid 1980s. It’s a line I’ve never forgotten.

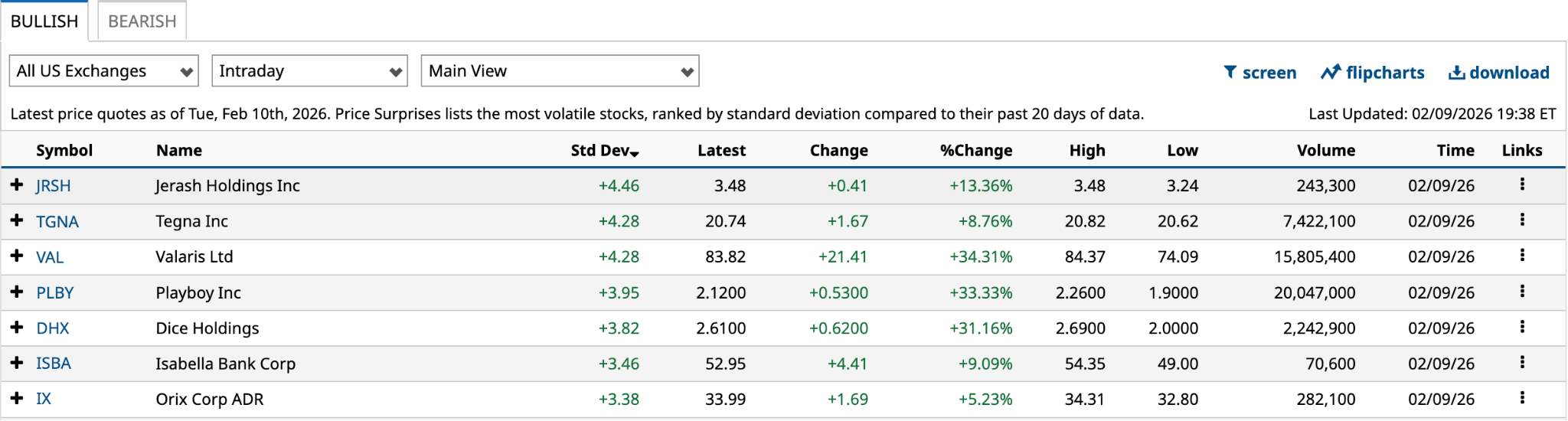

On Monday, the obscure Japanese investment firm, Orix Corp. (IX), had the seventh-highest standard deviation at 3.38, translating into a 5.23% gain on the day. More importantly, the company’s ADR (American Depositary Receipt) hit an all-time high of $34.31 before closing trading at $33.99.

I use Peppard’s favorite words because I’ve long been bullish about the Japanese company and its stock. In August 2024, I recommended its ADR despite it having just hit its 37th new 52-week high over the previous 12 months at $25.

In the 17 months since, its shares have gained 36%, which is an annualized return of 25.4%. Add in a healthy 3.0% dividend yield, and IX stock remains a very attractive long-term hold.

There are so many reasons to like Orix. Despite flying under the radar, here’s why it remains a good buy despite hitting an all-time high.

Buffett Led Me to Orix

If it weren’t Warren Buffett’s foray into five Japanese trading companies in July 2019 -- they account for 13.1% of Berkshire Hathaway’s (BRK.B) $331 billion equity portfolio -- I probably wouldn’t have focused more closely on this Japanese company that happens to do a lot of business in the U.S.

I remain fixated on businesses with lots of unrelated moving parts. Orix is definitely that.

“If you go to its investor relations site, you'll see it has 10 operating segments, so you might consider it a financial conglomerate. However, when you look at its Q2 2024 results, the diversification is relatively balanced among the 10,” I wrote.

I concluded my small blurb about Orix by stating, “This is an unknown Berkshire Hathaway.”

How’s It Doing Today?

As I mentioned, its Q3 2026 results beat Wall Street’s estimates. On the topline, revenue was $5.42 billion, $320 million above consensus, while earnings per share were $0.68, one cent above analyst expectations.

In the nine months ended Dec. 31, 2025, the company’s revenues increased by 12% to 2.41 trillion Japanese yen ($15.42 billion), while net earnings jumped 43% to 567.72 billion Japanese yen ($3.63 billion).

As I said in 2024, its largest operating segment was Insurance. In the latest nine months, its Banking and Credit business squeaked past Insurance, with 3.26 trillion Japanese yen ($20.86 billion) in assets, about 2% higher than Insurance's.

All but one of its operating segments (Orix Europe) has at least 1 trillion Japanese yen in assets.

Of the 10 operating segments, the top three for segment profits in the latest nine months are Environment and Energy, Private Equity Investment and Concession, and Corporate Financial Services and Maintenance Leasing. Together, these three accounted for segment profits of 296.35 billion Japanese yen ($1.90 billion), or 50% of the company's total.

Of course, with many moving parts, these numbers will change over time. That’s especially true for the Private Equity Investment and Concession segment, where realizations are unpredictable.

But that’s why I love it. Like a good sports team, something’s always chipping in to keep the profits pouring in.

Orix USA Contributes

Given Barchart’s largely American audience, it makes sense to focus part of my thoughts on its U.S. business, which provides alternative asset management through subsidiaries NXT Capital, Hilco Global, Boston Financial, and Lument.

Launched in 1981, it now manages nearly $95 billion in assets. While it isn’t Brookfield (BN), it does play an important role in the American middle market.

In the first nine months of 2025, Orix USA generated 13.9 billion Japanese yen ($89.5 million) in operating profits from 2.09 trillion Japanese yen ($13.35 billion) in assets, a return on assets of 0.67%, down from 1.75% a year earlier.

Consider this: Orix USA became an operating segment for reporting purposes in fiscal 2021 (March year-end). At the time, it had 1.15 trillion Japanese yen ($7.38 billion) in assets.

In 4.75 years, it’s grown to 2.09 trillion Japanese yen ($13.35 billion), with a compound annual growth rate (CAGR) of 12.7%. That’s a healthy growth rate in my book.

The Bottom Line on Orix Stock

Over the past decade, Orix’s valuation metrics have gotten more expensive.

For example, in March 2016, its enterprise value was 2.11 times the latest 12 months of revenue, according to S&P Global Market Intelligence. In March 2021, the multiple was 2.65x; today, it’s 3.50x. At the same time, its enterprise value-to-EBIT (earnings before interest, taxes, depreciation and amortization) multiple has increased from 14.49x in 2016 to 21.78x in 2021, and is now 24.59x.

However, over the past decade, while its revenues have decreased from $21.08 billion in 2016 to $19.96 billion in the 12 months ended Dec. 31, 2025, its EBIT has increased from $3.34 billion to $4.10 billion as of Dec. 31, an EBIT margin of 20.54%, 470 basis points higher.

It’s more profitable now than it’s ever been. I don’t see that changing. In my view, it deserves a higher multiple, and is most definitely NOT a bullish price surprise.

I like ORIX’s chances over the next decade a lot. Do yourself a favor and read a little on its investor relations website and in its 20-Fs. You’ll be glad you did.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘Selling Fine Businesses on Scary News is Usually a Bad Decision’: Berkshire’s Warren Buffett Warns Panic Selling Will Usually Lose You Money

- MicroStrategy Is Now Down $4.5 Billion On Its $54 Billion Bitcoin Investment: What Does This Mean For Investors?

- Why Analysts Think This Stock Is the Best AI Pick

- This Stock Will Be Bigger Than Nvidia By the End of 2026