The December quarter earnings season for “Magnificent 7,” barring Nvidia (NVDA), which reports outside the usual reporting season, is over. Only Meta Platforms (META) saw significant gains following the confessional, while Microsoft (MSFT) and Amazon (AMZN) plunged as markets get wary of tech companies loosening their purse strings for artificial intelligence (AI) capex.

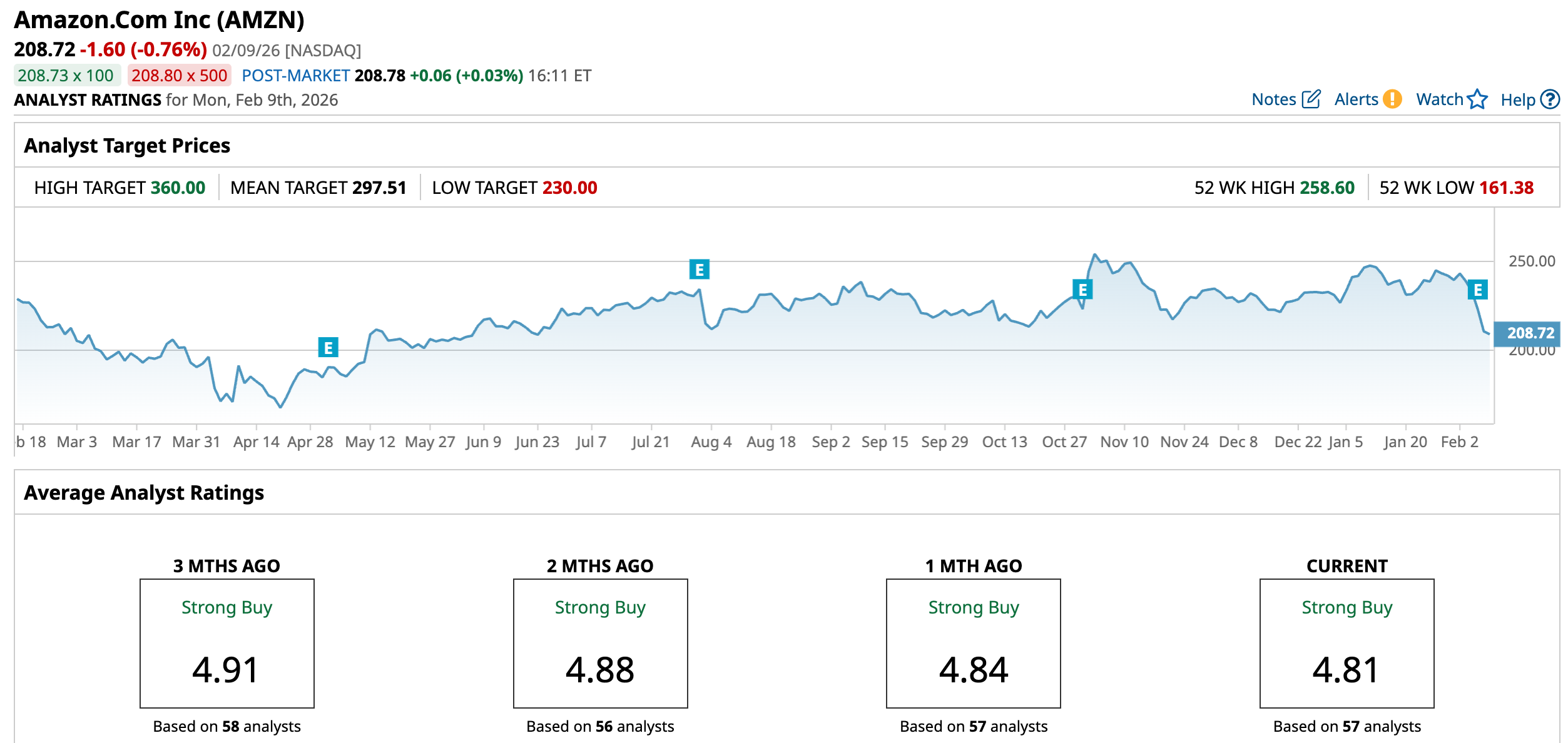

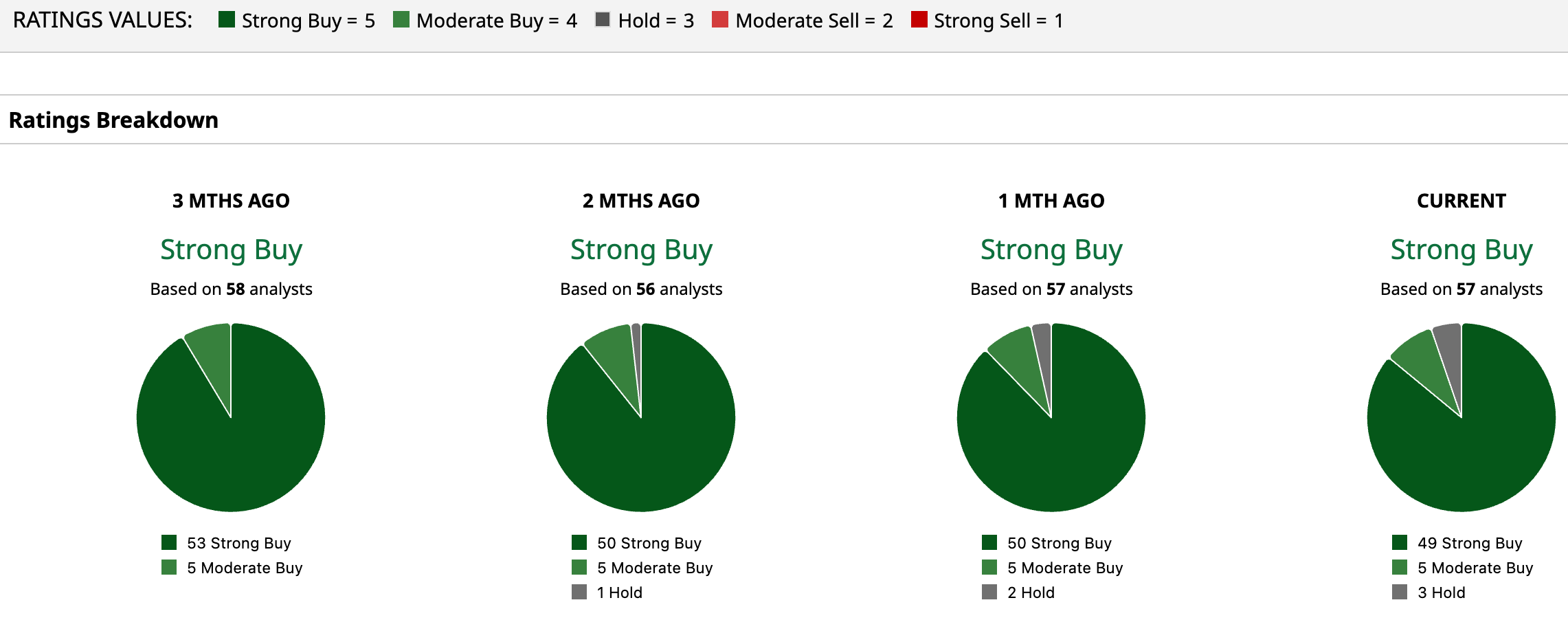

Specifically, Amazon almost fell to the $200 price level on Friday, Feb. 6, as markets were spooked by its mixed earnings, which were further compounded by the massive increase in its 2026 capex. Many of the bulls also turned their back on Amazon, and Scotiabank, Oppenheimer, Piper Sandler, Morgan Stanley, and Cantor Fitzgerald were among the brokerages that lowered the stock’s target price. DA Davidson went a step further and downloaded AMZN from a “Buy” to a “Hold” while lowering its target price to $175. The firm’s analyst Gil Luria said that Amazon is “losing the lead” in cloud computing and is “now scrambling to catch up through escalating investment.”

Amazon’s mean target price is $297.51, which is over 42.5% higher than the current price levels. In this article, we’ll examine whether Amazon – which was the worst-performing Magnificent 7 stock in 2025 – can defy the pessimism and rise towards what the average sell-side analyst thinks it is worth.

Amazon Q4 2025 Earnings Snapshot

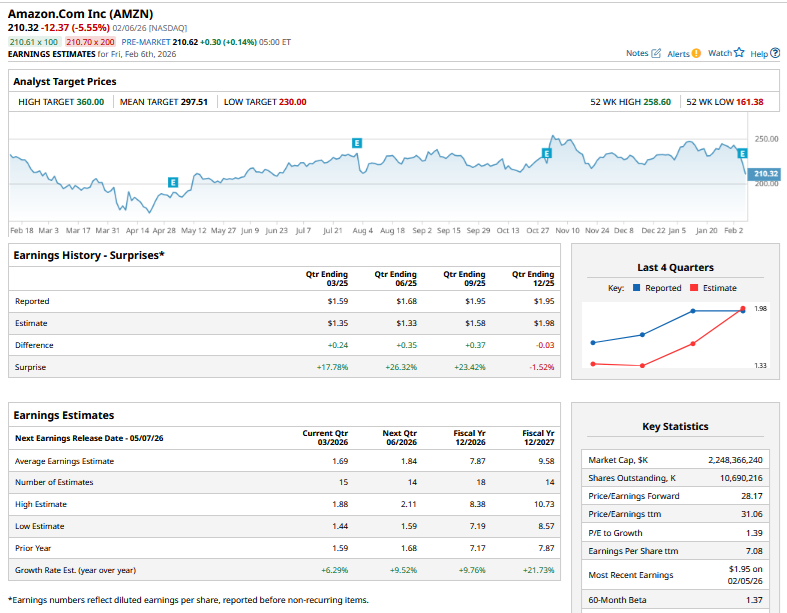

To be sure, Amazon’s post-earnings price action was contrary to what I had expected. While the company beat on top line with revenues rising 14% year-over-year (YOY) to $213.4 billion – landing above Street estimates as well as the company’s guidance – its earnings per share (EPS) came in at $1.95, which was slightly below estimates.

However, I believe the post-earnings crash wasn’t due to the three cents that Amazon fell short of the EPS estimates, but rather the massive increase in its 2026 capex budget. The Andy Jassy-led company forecast 2026 capex at $200 billion – well ahead of last year’s $131 billion and over $50 billion higher than what the Street was expecting.

Markets have been pretty unforgiving of tech companies that are increasing their capex without showing a commensurate growth in earnings, and Amazon is no different. While the company’s top line growth remains in the mid-teens, and Amazon Web Services (AWS) is growing much slower than its peers in percentage terms, the company tried its best to justify the $200 billion capex.

At the very beginning of the Q4 earnings call, Jassy said, “We're seeing strong growth and with the incremental opportunities available to us in areas like AI, chips, low earth orbit satellites, quick commerce and serving more consumers' everyday essentials needs, we have a chance to build an even more meaningful business in Amazon in the coming years with strong return on invested capital, and we're investing to do so.”

However, the management dodged questions over whether it has set any free cash flow target amid the soaring AI capex, with Jassy saying that the company would continue to “invest aggressively” so that it can “be the leader in this space.”

Jassy pointed to the 24% rise in AWS revenues, which was the fastest growth in 13 quarters, and highlighted how the company’s cloud business is growing faster than peers in absolute dollar terms. Also, Jassy talked about the growth in the grocery and chips business, with the latter running at a $10 billion annualized revenue run rate. Amazon also provided color on its Prime business and said that it now has 315 million ad-supported viewers.

The company tried to address concerns over the increase in depreciation on account of the burgeoning capex and said that it plans to offset them through efficiencies and cost cuts. However, markets did not buy into the management's optimism and sent the stock southward following the confessional.

Should You Buy the Dip in Amazon Stock?

The crash in Amazon stock post the Q4 earnings came in as a disappointment to me, as I have been gradually building positions after having previously booked some profits at higher levels last year. However, I see the post-earnings slump as a buying opportunity and loaded up on AMZN shares and plan to add more if it falls further.

I believe the concerns over third-party AI agents being a threat to Amazon’s lucrative digital ads business are a bit overblown, and its own shopping agent Rufus is gaining traction with over 300 million people using it last year.

As Amazon ramps up ads on Prime, its digital ad business should see further momentum. While the concerns over the 2026 capex budget rising to $200 billion are concerning and would likely push its 2026 free cash flows into negative territory, these investments would pay off in the long term.

From a valuation perspective, Amazon’s forward price-to-earnings (P/E) multiple has fallen to 28.2x, which is quite lucrative. While Amazon is no longer the kind of free cash flow engine it has been in the past, the company is laying the ground for long-term growth.

Overall, I believe the post-earnings dip in AMZN is a golden buying opportunity, and it is not often that we get a quality name like Amazon at such depressed valuations. I would put my two cents on Amazon stock rising towards $300 over the next two years as its AI investments start paying off, while the core business continues to grow in double digits.

On the date of publication, Mohit Oberoi had a position in: AMZN , NVDA , META , MS . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Hims & Hers Gets Hit With Major Wegovy Loss, Should You Buy the Dip in Deeply Oversold HIMS Stock?

- Can Amazon Stock Defy the Bears and Rise to $300?

- Hungry for Consumer Data? 3 Critical Stocks to Watch Ahead of Earnings on February 11.

- This 1 Little-Known Stock Could Be the Real Winner from the SpaceX-xAI Merger