Investors' once-red-hot appetite for tech stocks and crypto is starting to fade. A stretch of weaker-than-anticipated earnings from a few major tech companies, growing risk-off sentiment, continued selling pressure in digital assets, and a clear rotation away from high-beta names have all taken a toll on investor confidence. The flagship cryptocurrency Bitcoin (BTCUSD) has tumbled roughly 21% so far in 2026, while the Technology Select Sector SPDR ETF (XLK) has also slipped into negative territory this year.

With volatility creeping back in, investors are once again leaning into defensive names. These companies sell everyday essentials that people continue to buy regardless of economic growth, unemployment trends, or swings in consumer confidence. That steady demand means their sales volumes tend to be far less cyclical than those in discretionary categories, making the sector especially attractive during uncertain times.

That said, one blue-chip dividend company firmly on investors’ radar amid this flight to safety is retail giant Walmart (WMT). Interestingly, the company has also recently entered the $1 trillion market-cap club, a rare milestone typically dominated by tech heavyweights. With its enormous scale and essential-goods focus, Walmart is increasingly seen as a stability anchor in a choppy market, making it a stock worth a closer look right now.

About Walmart Stock

Headquartered in Arkansas, Walmart operates as a people-driven, tech-enabled omnichannel retailer centered on value and convenience across physical stores, eCommerce platforms, and mobile channels. Each week, around 270 million customers and members shop across its network of more than 10,750 stores and numerous online sites serving 19 countries.

Walmart began its life in the public markets in 1972, with a listing on the New York Stock Exchange (NYSE). In the decades since, the company has posted steady long-term growth, shaped by continuous changes in retail operations, supply chain strategy, and the expansion of its digital commerce capabilities. While Walmart is still widely associated with big-box retail, behind the scenes, it has been undergoing a major technology-driven shift.

The company has invested heavily in automation, artificial intelligence (AI), and digital advertising, upgrading everything from inventory systems to fulfillment networks and customer engagement tools. That deeper tech focus contributed to its move from the NYSE to the tech-heavy Nasdaq in December last year.

In fact, the transition was followed by inclusion in the Nasdaq-100 Index, the Nasdaq-100 Equal Weighted Index, and the Nasdaq-100 Ex-Tech Sector Index ($NDXX) starting Jan. 20, milestones that underscore how the company is increasingly being viewed not just as a retail giant, but as a large-scale, tech-enabled operator in today’s market landscape.

Fresh off crossing the $1 trillion market capitalization mark earlier this month, Walmart now stands as the first major brick-and-mortar retailer to reach a valuation tier typically reserved for tech titans. The stock’s climb has been just as notable. Over the past 52 weeks, WMT shares have advanced 27.5%, and in 2026 alone, the stock is already up a striking 17.8%.

That’s well ahead of the broader S&P 500 Index ($SPX), which has risen 15% over the past year and only 1.3% so far this year. Shares recently notched a new high of $131.70 on Feb. 6 and continue to trade near that level, underscoring sustained investor demand for this defensive heavyweight even as other parts of the market wobble.

Beyond its strong share price performance, Walmart also offers a steady stream of income. The company is a Dividend King, backed by an impressive 52-year streak of consecutive dividend increases, a record that naturally draws the attention of income-focused investors. Most recently, in January, Walmart paid a quarterly dividend of $0.235 per share to its shareholders.

Walmart’s Q3 Earnings Snapshot

Walmart has also backed up its stock performance with solid fundamentals. In mid-November last year, the retailer reported fiscal 2026 third-quarter results that comfortably beat Wall Street’s expectations on both revenue and earnings, underscoring resilient demand and operational momentum. Net sales rose 5.8% year-over-year (YoY) to $179.5 billion, topping the Street’s $177.5 billion estimate.

Growth was broad-based across segments. Global eCommerce sales surged 27%, driven by strong store-fulfilled pickup and delivery as well as marketplace expansion, while the global advertising business jumped 53%. In the U.S., sales climbed 5.1% annually to $120.7 billion. Walmart International delivered even faster growth, with revenue up 10.8% YoY to $33.5 billion.

Meanwhile, Sam’s Club U.S. posted a 3.1% annual sales increase to $23.6 billion, supported by strength in grocery and general merchandise and continued market share gains. On an adjusted basis, earnings per share rose 7% YoY to $0.62, edging past the $0.60 consensus estimate.

The balance sheet and cash flow picture also showed improvement. As of Oct. 31, 2025, Walmart held $10.6 billion in cash and cash equivalents and carried total debt of $53.1 billion. Operating cash flow reached $27.5 billion, up $4.5 billion from the prior year, while free cash flow also climbed to $8.8 billion. The company returned capital to shareholders by repurchasing approximately $7 billion in shares year-to-date (YTD).

Looking ahead, management raised its outlook for fiscal 2026. The company now expects net sales growth of 4.8% to 5.1% and adjusted operating income growth of 4.8% to 5.5%, both in constant currency terms. Adjusted EPS is projected in the range of $2.58 to $2.63, which includes a modest currency headwind of $0.01 to $0.02, guidance that suggests steady momentum heading into the rest of the fiscal year.

How Are Analysts Viewing WMT Stock?

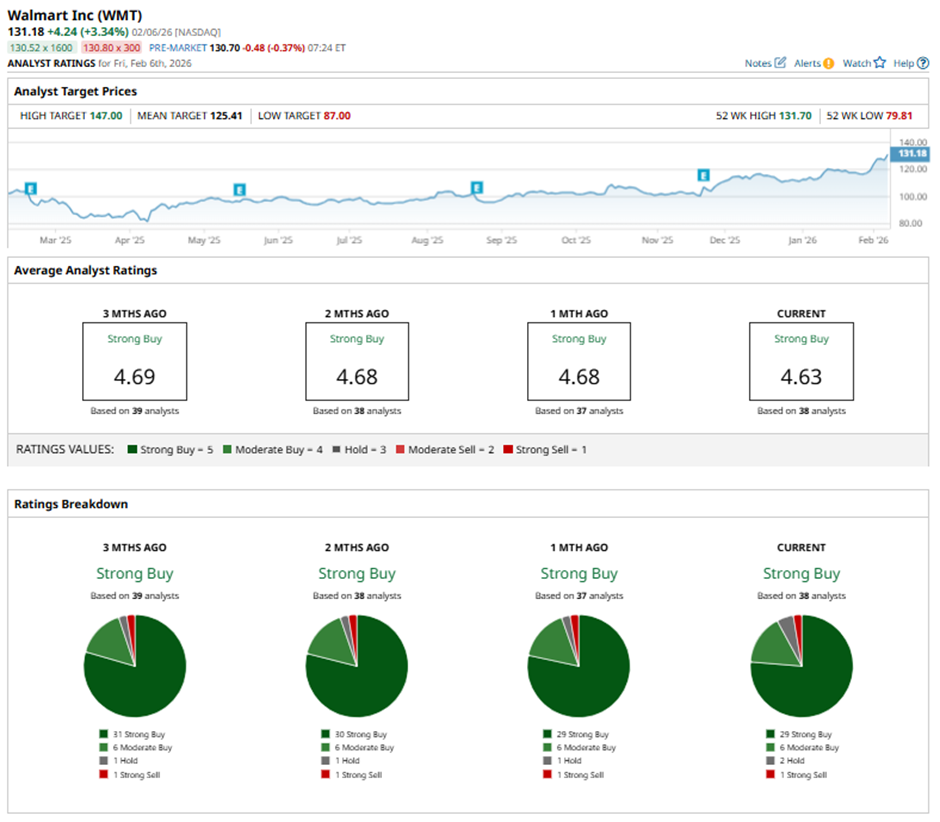

Sentiment on Walmart remains firmly tilted to the bullish side. WMT stock currently holds a consensus “Strong Buy” rating from Wall Street, reflecting broad confidence in the retailer’s outlook. Of the 38 analysts covering the company, 29 rate it a “Strong Buy,” six recommend a “Moderate Buy,” two suggest “Hold,” and just one analyst lands on a “Strong Sell.”

Even after its recent rally, analysts still see room to run. While the shares have already pushed past the average price target of $125.41, the Street-high target of $147 implies a further potential upside of about 12.1% from current levels, a sign that many believe the stock’s momentum may not be over just yet.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart