With a market cap of $52.6 billion, MetLife, Inc. (MET) is a global financial services company that provides insurance, annuities, employee benefits, and asset management solutions to individuals and institutions worldwide. Operating across six business segments, it offers a broad portfolio of life, health, disability, retirement, and investment products tailored to meet diverse personal and corporate needs.

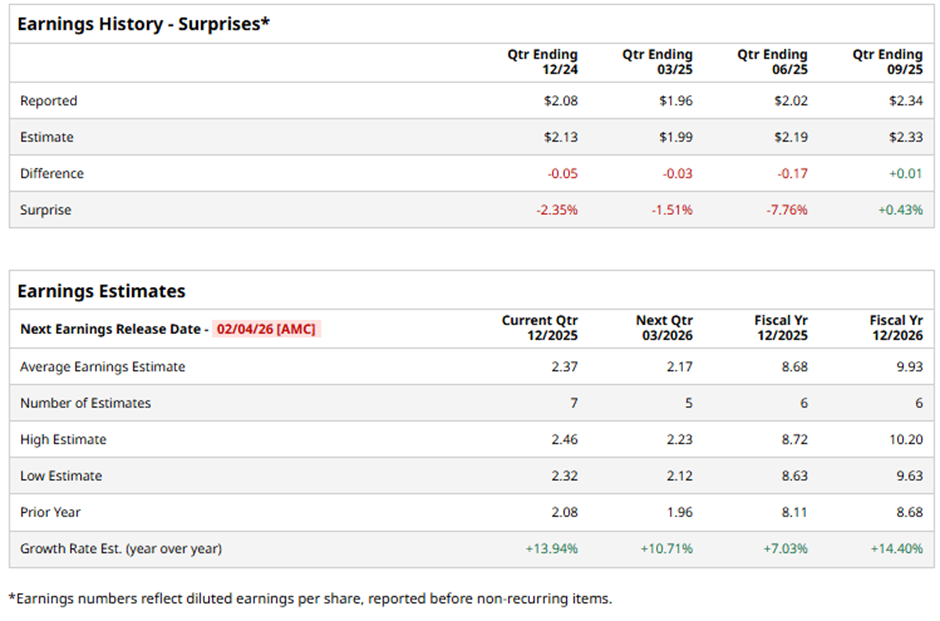

The New York-based company is set to announce its fiscal Q4 2025 results after the market closes on Wednesday, Feb. 4. Ahead of this event, analysts forecast MET to report an adjusted EPS of $2.37, an increase of 13.9% from $2.08 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in one of the last four quarters while missing on three other occasions.

For fiscal 2025, analysts expect MetLife to report an adjusted EPS of $8.68, up over 7% from $8.11 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow 14.4% year-over-year to $9.93 in fiscal 2026.

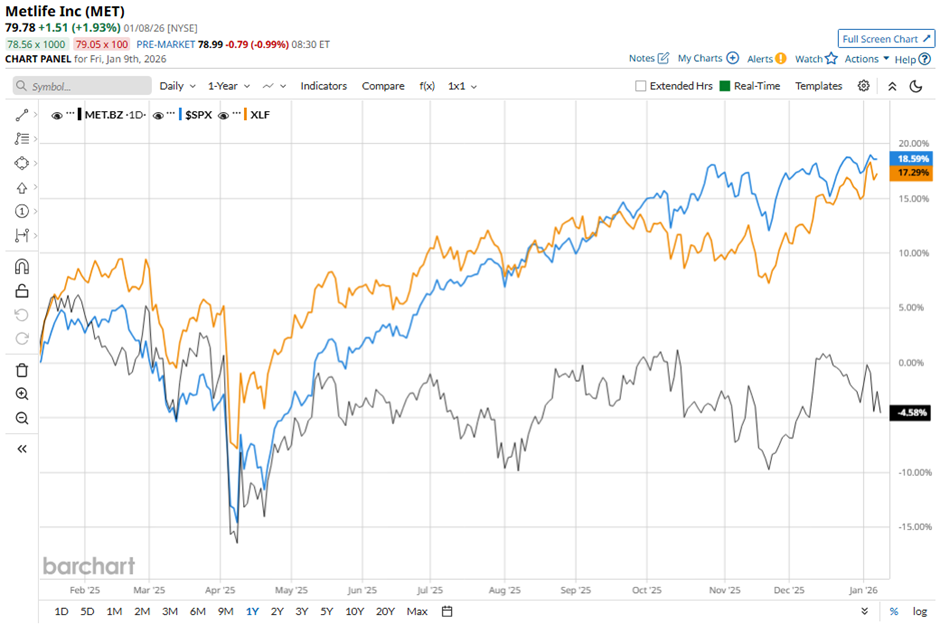

Shares of MetLife have dipped 4.6% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) nearly 17% increase and the State Street Financial Select Sector SPDR ETF's (XLF) 15.5% return over the same period.

MetLife reported strong 3Q 2025 results on Nov. 5, including net income of $818 million and adjusted EPS up 21% to $2.34. The company also delivered robust investment income, solid underwriting performance, and strong sales momentum across key regions like Asia. It further announced $875 million returned to shareholders and $12 billion in new pension risk transfer mandates. However, the stock fell 3.4% the next day.

Analysts' consensus view on MET stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 19 analysts covering the stock, 12 recommend "Strong Buy" and seven have a "Hold." The average analyst price target for MetLife is $93.50, suggesting a potential upside of 17.2% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump Just Called Out Raytheon but RTX Stock Is Holding Steady. How Should You Play the Defense Giant Here?

- 1 Analyst Is Betting That Palantir Stock Can Gain Another 20% in 2026

- Missed the AI Rally? Jefferies Says CrowdStrike and These 3 Other Cybersecurity Stocks Could Be Next

- Nvidia Is Giving Tesla a Run for Its Money with Robotaxis. Which Is the Better Stock to Buy Now?