Nike (NKE) spent much of 2025 repairing investor confidence after repeated disappointments pushed NKE stock well below prior highs and behind peers. Over the past 52 weeks, shares have fallen 14%. However, momentum briefly turned positive on Dec. 31, 2025, when shares rose about 4% following notable insider buying near year-end.

Apple (AAPL) CEO Tim Cook, a Nike director, acquired roughly 50,000 shares, increasing his stake by about 90%. Board member Robert Holmes Swan also stepped in, purchasing approximately 8,700 shares, which expanded his position by 24%. Separately, Nike CEO Elliott Hill acquired nearly 16,400 shares in a $1 million transaction. The purchase lifted his personal stake by more than 7%.

These transactions arrive after a bruising stretch for investors. Nike stock has lost nearly half its value over the past three years, pressured by slowing demand in China and tariff-related headwinds.

Despite these pressures, Wall Street continues to anticipate a recovery. The optimism rests on Nike’s brand power, operational scale, and management’s renewed focus on execution. Understanding that outlook requires a closer look at the company’s fundamentals.

About Nike Stock

Headquartered in Beaverton, Oregon, Nike began as Blue Ribbon Sports, distributing Japanese Onitsuka Tiger sneakers, before evolving into the global athletic powerhouse we know now. Today, it designs, markets, and distributes athletic footwear, apparel, equipment, and accessories worldwide, serving a broad range of sports and fitness categories with unmatched reach.

The company carries a market capitalization of approximately $93.5 billion, yet scale has not insulated NKE stock from declines. Shares have dropped 17% over the past six months and 15% over the past three months.

From a valuation perspective, NKE stock trades at 40.5 times forward adjusted earnings and 2 times sales. Both metrics exceed industry averages, signaling a premium valuation.

Nike also continues to reward shareholders through consistent capital returns. The company has increased its dividend for 24 consecutive years and currently pays $1.64 annually, yielding 2.57%. Its most recent dividend of $0.41 per share was scheduled for Jan. 2, payable to shareholders of record as of Dec. 1, 2025.

Nike Surpasses Q2 Earnings

On Dec. 18, 2025, Nike reported fiscal 2026 second-quarter results that mixed headline beats with deeper concerns. Revenue marginally rose year-over-year (YOY) to $12.4 billion, topping the $12.22 billion analyst estimate. EPS fell 32% to $0.53 but exceeded the Street’s expectations of $0.38.

Investors, however, focused less on the beats and more on profitability erosion. Gross margin contracted 300 basis points to 40.6%, driven largely by higher North American tariffs. Looking forward, management expects tariffs to remain a meaningful drag, though Nike aims to limit the impact of tariffs in fiscal 2026.

Regional performance added to the unease. Revenue in Greater China plunged 16% YOY, undermining a critical long-term growth engine. North American sales rose 9%, but strength at home failed to offset international weakness, keeping pressure squarely on management’s turnaround credibility.

Nike’s management has outlined a longer-term recovery plan centered on product innovation, operational efficiency, and its “sport offense” strategy. Executives stressed that progress will vary by region and brand, signaling a measured, uneven recovery rather than a rapid snapback in financial performance.

Analysts now expect fiscal 2026 third-quarter EPS to decline 33% YOY to $0.36. For the full fiscal year, forecasts call for a 28% drop in earnings to $1.57, followed by a sharp rebound in fiscal 2027, with EPS projected to surge 56% to $2.43.

What Do Analysts Expect for Nike Stock?

On the Street, Guggenheim has assigned NKE stock a “Buy” rating with a $77 price target, acknowledging that retail remains “structurally sick” but noting that the holiday season revived demand. The firm also added that tariffs have stayed manageable so far.

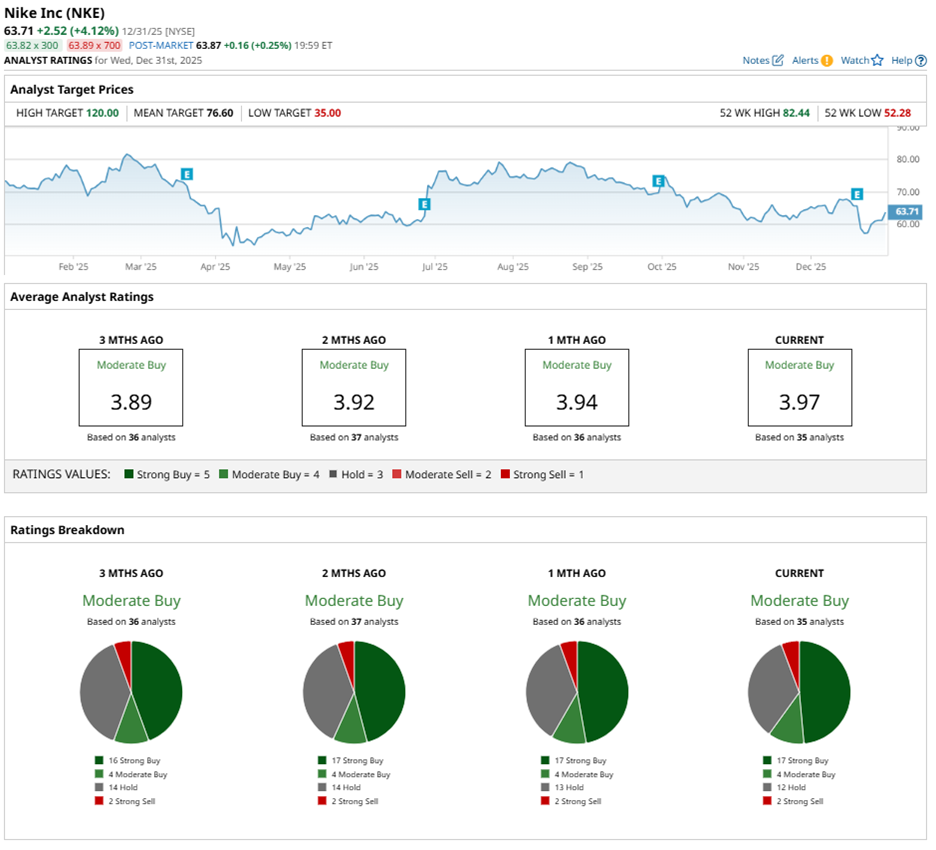

Wall Street shares the stance, assigning NKE stock a “Moderate Buy” overall rating. Among 35 analysts, 17 call it a “Strong Buy,” four recommend a “Moderate Buy,” 12 suggest “Hold,” and two flag a “Strong Sell.”

NKE stock’s mean price target of $76.60 implies a potential gain of 22%. Meanwhile, the Street-high target of $120 suggests potential upside of 90% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart