VICI Properties Inc. (VICI) is an experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip. The company is valued at $30 billion by market cap.

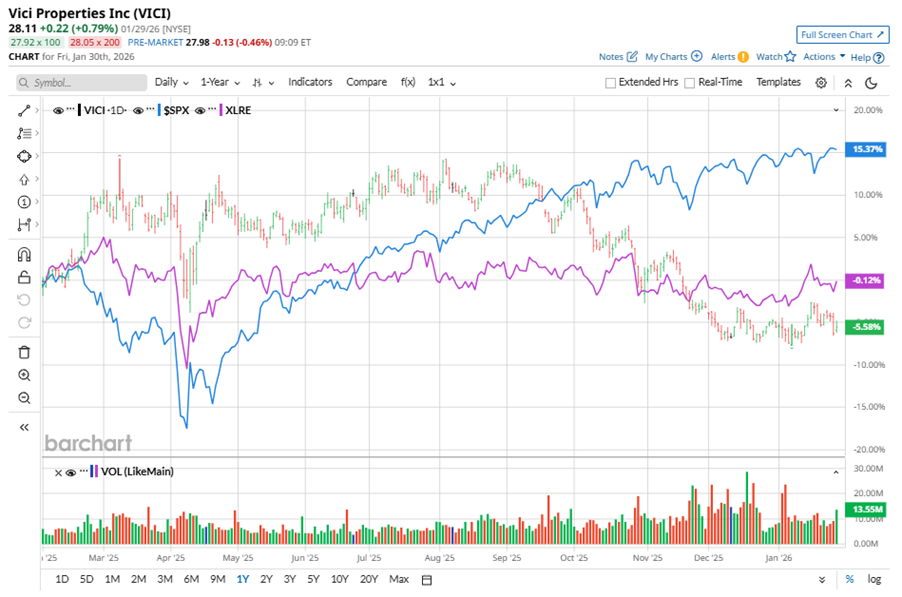

Shares of this diversified commercial REIT have underperformed the broader market over the past year. VICI has declined 6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.4%. In 2026, VICI stock is down marginally, compared to the SPX’s 1.8% rise on a YTD basis.

Narrowing the focus, VICI’s underperformance is also apparent compared to the Real Estate Select Sector SPDR Fund (XLRE). The exchange-traded fund has declined marginally over the past year. Moreover, the ETF’s 2.3% returns on a YTD basis outshine the stock’s marginal dip over the same time frame.

On Oct. 30, 2025, VICI shares closed down marginally after reporting its Q3 results. Its revenue stood at $1 billion, up 4.4% year over year. The company’s AFFO per share increased 5.3% from the year-ago quarter to $0.60.

For the current fiscal year, ended in December 2025, analysts expect VICI’s FFO to grow 4.9% to $2.37 per share on a diluted basis. The company’s earnings surprise history is impressive. It beat or matched the consensus estimates in each of the last four quarters.

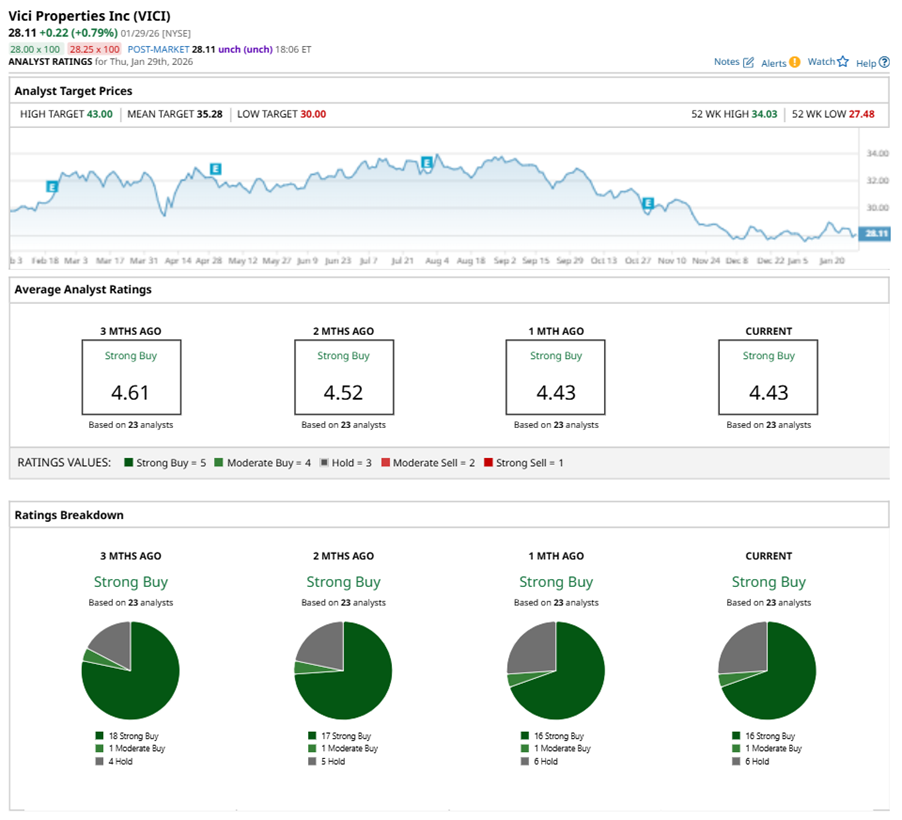

Among the 23 analysts covering VICI stock, the consensus is a “Strong Buy.” That’s based on 16 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

This configuration is less bullish than two months ago, with 17 analysts suggesting a “Strong Buy.”

On Jan. 13, Barry Jonas from Truist Financial Corporation (TFC) maintained a “Buy” rating on VICI with a price target of $27.89.

The mean price target of $35.28 represents a 25.5% premium to VICI’s current price levels. The Street-high price target of $43 suggests an ambitious upside potential of 53%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla Is All About ‘Amazing Abundance’ From Here on Out. What Does That Really Mean for TSLA Stock?

- Golden Dome Missile Defense: What’s Next After $23B Approved Without a Plan?

- BlackRock Is Betting Big on This Platinum and Gold Stock. Should You?

- Why Apple’s iPhone Boom Isn’t Enough to Buy the Stock Yet