Palantir (PLTR) has been caught in a broader software rout, with shares losing more than 15% in recent weeks as valuation concerns continue to push investors out of the expensive tech names. The selloff seems to be accelerating after industry giant, Microsoft (MSFT) issued lackluster cloud guidance, sparking fears that artificial intelligence (AI) software monetization isn’t keeping pace with infrastructure spending.

The subsequent weakness in PLTR stock has crashed its relative strength index (14-day) to nearly 28. While this technical “oversold” condition often precedes a bounce, the AI data analytics firm remains a high-risk investment ahead of its Q4 earnings scheduled for Feb. 2.

Ahead of the quarterly release, Palantir Technologies is down about 28% versus its record high.

Palantir Stock’s Valuation Leaves No Room for Error

Despite a meaningful decline since November, PLTR stock remains unusually expensive by all conventional valuation metrics.

Trading at a price-to-sales (P/S) multiple of about 100x, the Denver-headquartered firm is already priced for perfection.

Still, Palantir’s earnings (GAAP) are expected to remain sequentially flat at $0.17 per share. Given the current market environment and its stretched valuation, this may be far from enough.

Software firms are being decimated this year for anything less than exceptionally strong earnings and a notable raise on guidance.

PLTR Shares Continue to Face Concentration Risk

While Palantir’s Artificial Intelligence Platform (AIP) is a legitimate growth engine, the company still leans heavily on lumpy government contracts, which account for more than 50% of its sales.

With federal budgets under intense scrutiny in 2026, any delay in contract renewals poses a material headwind.

According to some analysts, even if PLTR maintains a robust 40% compound annualized growth rate, it could take as much as half a decade for its underlying fundamentals to catch up to its current market cap.

In short, if the upcoming earnings show even a slight deceleration in U.S. commercial growth or if 2026 outlook fails to justify its triple-digit multiple, the technical oversold may turn into a trap door for Palantir shares’ investors.

How Wall Street Recommends Playing Palantir

Despite aforementioned risks, however, Wall Street firms continue to see significant further upside in Palantir Technologies.

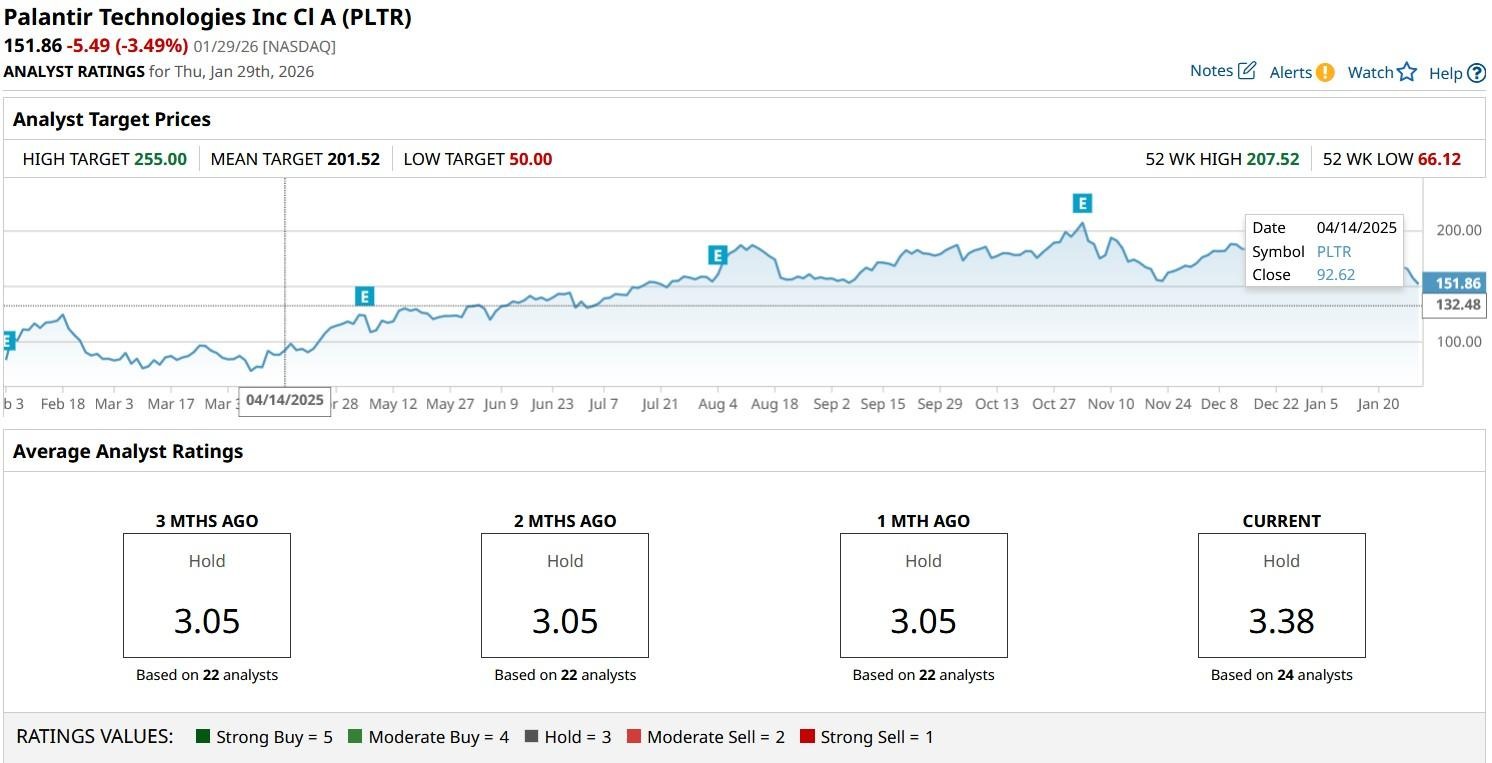

While the consensus rating on PLTR shares remains at a “Hold," the mean target of about $201 signals potential upside of nearly 35% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.