With a market cap of $12.8 billion, Host Hotels & Resorts, Inc. (HST) is the largest lodging real estate investment trust, with a premier portfolio of luxury and upper-upscale hotels. It owns 79 properties totaling approximately 42,500 rooms across the U.S. and internationally, and partners with leading global hotel brands through a disciplined capital allocation and asset management strategy.

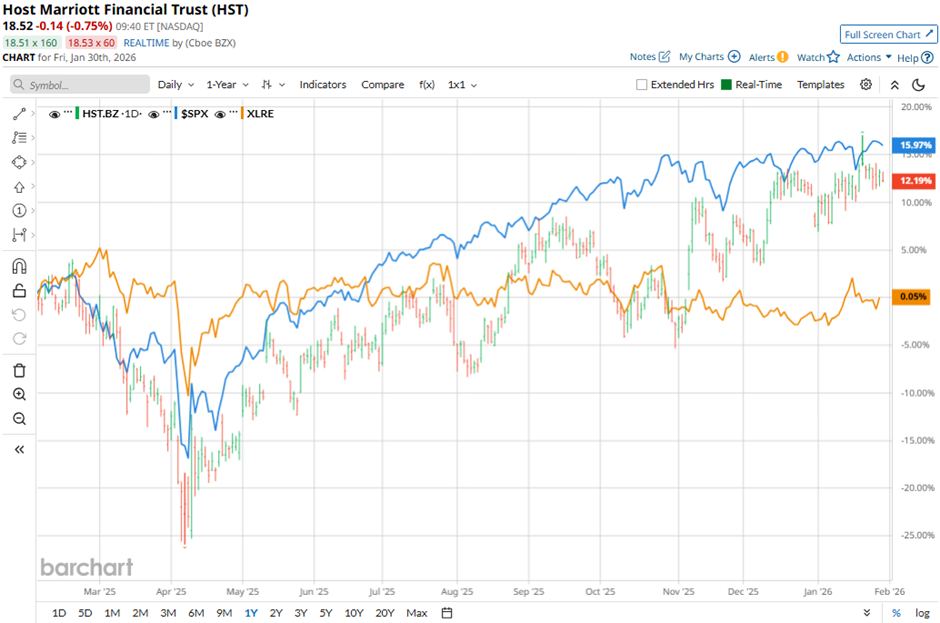

Shares of the Bethesda, Maryland-based company have underperformed the broader market over the past 52 weeks. HST stock has soared 11.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. However, shares of HST are up 4.9% on a YTD basis, outpacing SPX’s 1.8% rise.

Zooming in further, shares of the lodging REIT have outperformed the State Street Real Estate Select Sector SPDR ETF’s (XLRE) marginal decline over the past 52 weeks.

Shares of Host Hotels & Resorts surged 6.9% following its Q3 2025 results on Nov. 5 as the company beat expectations with AFFO of $0.35 per share and delivered revenue of $1.33 billion in line with forecasts. The stock also benefited from improved full-year guidance, highlighted by higher net income expectations of $780 million, Adjusted EBITDAre of $1.73 billion, and a strong balance sheet reinforced by Moody’s credit upgrade to Baa2.

For the fiscal year that ended in December 2025, analysts expect HST’s AFFO to rise 4.6% year-over-year to $2.06 per share. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

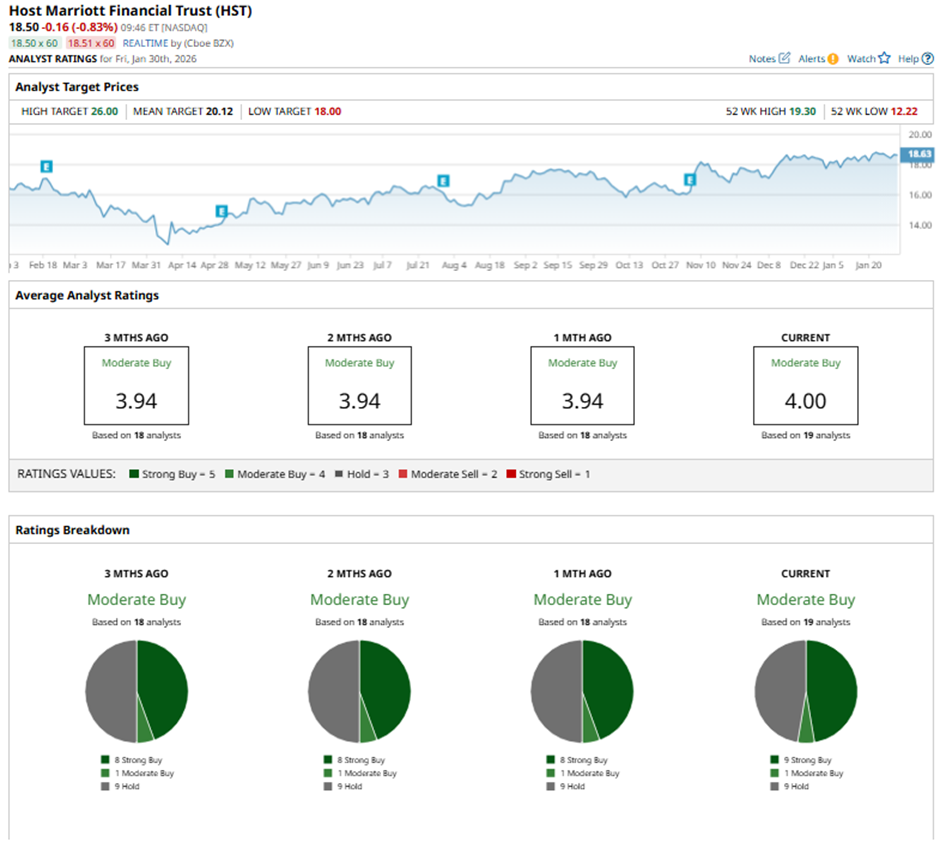

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” and nine “Holds.”

This configuration is slightly more bullish than three months ago, with eight “Strong Buy” ratings on the stock.

On Jan. 16, Morgan Stanley analyst Stephen Grambling raised its price target on Host Hotels to $18 and maintained an “Equal Weight” rating.

The mean price target of $20.12 represents a 8.8% premium to HST’s current price levels. The Street-high price target of $26 implies a potential upside of 40.5% from the current price.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Buffett’s 1994 Advice That Still Destroys Most Investors’ Portfolios: He’d Rather ‘Own a Significant Portion of the Hope Diamond than 100% of a Rhinestone’

- Tesla Is All About ‘Amazing Abundance’ From Here on Out. What Does That Really Mean for TSLA Stock?

- Golden Dome Missile Defense: What’s Next After $23B Approved Without a Plan?

- BlackRock Is Betting Big on This Platinum and Gold Stock. Should You?