Entertainment giant The Walt Disney Company (DIS) is set to report its first-quarter results for fiscal 2026 on Feb. 2. For the quarter (to be reported before the market opens), Wall Street analysts expect the company’s earnings per share (EPS) to decline by 10.8% year-over-year to $1.57.

However, the company is actively working to reach more customers and stay ahead of its competitors. For instance, recently, Disney announced the creation of a new enterprise marketing and brand organization. The organization would adopt a collective approach to reach more customers and advance its business goals.

About Disney Stock

Disney operates across media networks, streaming platforms, parks and resorts, studio entertainment, and consumer products. The company produces films, TV shows, and experiences that blend creativity with technology, generating billions in annual revenue. Disney has a market capitalization of about $199 billion.

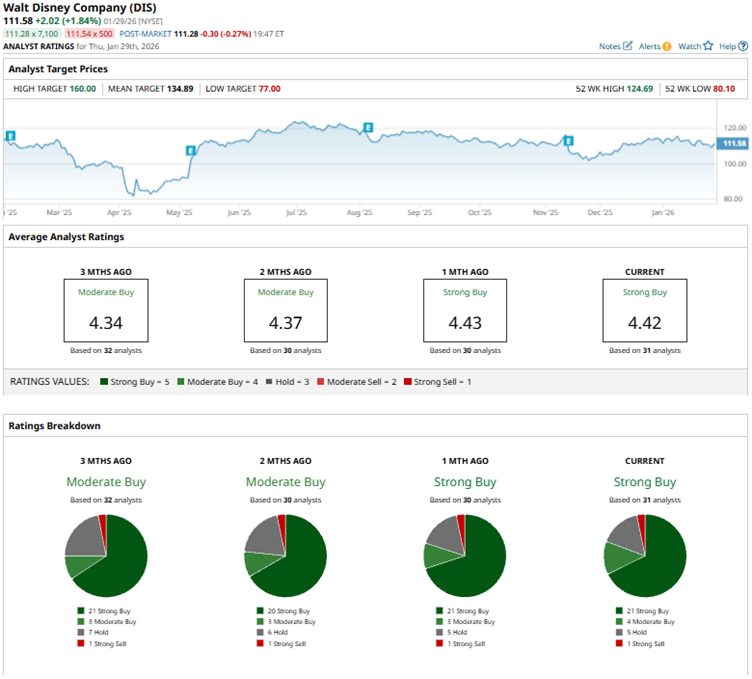

There is a range of factors affecting Disney’s stock, including persistent issues in its legacy linear TV segment, which has seen sharp declines in profits due to cord-cutting and other threats, such as the YouTube blackout threat. Over the past 52 weeks, Disney’s stock has declined 0.6%, while over the past six months, it has dropped nearly 6%. Toward the end of 2025, the stock experienced some slight recovery, gaining about 1% over the past three months. It had reached a 52-week high of $124.69 in June 2025, but is down significantly from that level.

Disney’s stock is trading at an attractive valuation. Its price-to-earnings (P/E) ratio of 16.29x is modestly lower than the industry average of 17.45x.

Disney Q4 Earnings: Adjusted EPS Beats Estimates Despite Revenue Miss

On Nov. 13, 2025, Disney reported its fourth-quarter results for fiscal 2025. The company’s revenue was flat year-over-year at $22.46 billion, which narrowly missed the $22.86 billion that Wall Street analysts had expected.

In the Sports segment, Disney’s revenue grew 2% year-over-year to $3.98 billion, while the Experiences segment’s revenue increased 6% annually to $8.77 billion. Disney’s Entertainment segment was dragged down by a 16% decline in revenue from linear networks, as well as a 26% drop in content sales/licensing and other revenue.

However, the company’s paid customer count is growing. The total Disney+ customer count increased by 3% sequentially to 131.6 million, while total Hulu paid customers grew 15% from the prior period to 64.1 million.

However, the company’s operating income was subdued across all three of its broad segments. Disney’s total segment operating income was $3.48 billion for the quarter, down 5% YOY. Excluding certain items, the company’s EPS dropped 3% from its year-ago value to $1.11. However, this was higher than the $1.03 that Street analysts had expected.

For the current fiscal year, Wall Street analysts expect Disney’s EPS to grow by 11% YOY to $6.58, followed by EPS growing 11.1% to $7.31 in the following fiscal year.

What Do Analysts Think About Disney Stock?

This month, Citigroup analyst Jason Bazinet maintained a “Buy” rating for Disney. However, the analyst also showed some concerns, lowering the price target from $145 to $140.

Wells Fargo analysts maintain an “Overweight” rating on Disney’s shares, with a price target of $152. The firm’s analysts have also added DIS to its Q1 2026 “Tactical Ideas” list. Analysts expect Disney’s theme parks to see strong attendance on peak days, signaling solid consumer demand and alleviating investor concerns. Additionally, Wells Fargo expects Disney’s box office success to drive higher EPS in fiscal 2026.

In November, after Disney’s quarterly earnings release, analysts at Evercore ISI raised the price target on the stock from $140 to $142, while maintaining an “Outperform” rating. Guggenheim analyst Michael Morris reaffirmed his “Buy” rating on Disney’s shares, maintaining the price target at $140, exhibiting continued confidence in its potential.

Disney has long been a popular name on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 31 analysts rating the stock, a majority of 21 analysts have given it a “Strong Buy” rating, four analysts rated it “Moderate Buy,” while five analysts are taking the middle-of-the-road approach with a “Hold” rating, and one analyst rated it “Strong Sell.” The consensus price target of $134.89 represents roughly 20% upside from current levels. The Street-high price target of $160 indicates 43% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Up 77% in the Past Year, This Analyst Says More Upside Is Still in Store for Applied Materials Stock

- This Trump Stock Just Announced a $100 Million Catalyst. Should You Buy Its Shares Now?

- Apple Is Reportedly Looking to Partner with Intel Foundry. Does That Make INTC Stock a Buy Here?

- Dear Disney Stock Fans, Mark Your Calendars for February 2