Sandisk (SNDK) shares have already rallied more than 100% this month, but a Cantor Fitzgerald analyst believes they could push much higher from here through the remainder of 2026.

Christopher Muse’s bullish note on SNDK arrives on the heels of its blockbuster Q2 financials that came in miles above Street estimates on Jan. 29.

Investors cheered the flash memory storage company this morning as it guided for $13 a share of earnings for its current quarter, well over double the $5.11 that Wall Street had forecast.

Following the post-earnings rally, Sandisk stock is trading at nearly 20x its price in April of 2025.

How High Could Sandisk Stock Fly in 2026?

According to Christopher Muse, NAND flash prices could climb another 50% in Sandisk’s fiscal Q3, maintaining its pricing power at a level that can only be described as “rare” for the memory sector.

This structural tailwind could boost SNDK’s gross margin to a formidable 67% this year compared to under 35% only a few months ago, he told clients in a research note today.

The Cantor Fitzgerald analyst dubbed the firm’s enterprise SSDs critical enablers for hyperscale artificial intelligence infrastructure, adding its stock could stretch further to $800 by the end of 2026.

Muse’s revised price target on SNDK stock signals potential upside of another 35% from here.

SNDK Shares Aren’t Particularly Expensive to Own

In his report, Muse also said customers are now opting for multi-year agreements with Sandisk, instead of quarterly price negotiations, which could help reduce the cyclicality of its stock.

Additionally, the company’s shares are relatively inexpensive to own at a forward price-to-earnings (P/E) multiple of about 34x, given Nvidia (NVDA) is trading at 43x at writing.

The Cantor Fitzgerald analyst sees SNDK earning $77 on a per-share basis this year, and boost it further to $91 in 2027.

Note that Sandisk shares are currently trading sharply above its major moving averages (MAs), reinforcing that bulls remain firmly in control across multiple timeframes.

Wall Street Remains Bullish on Sandisk

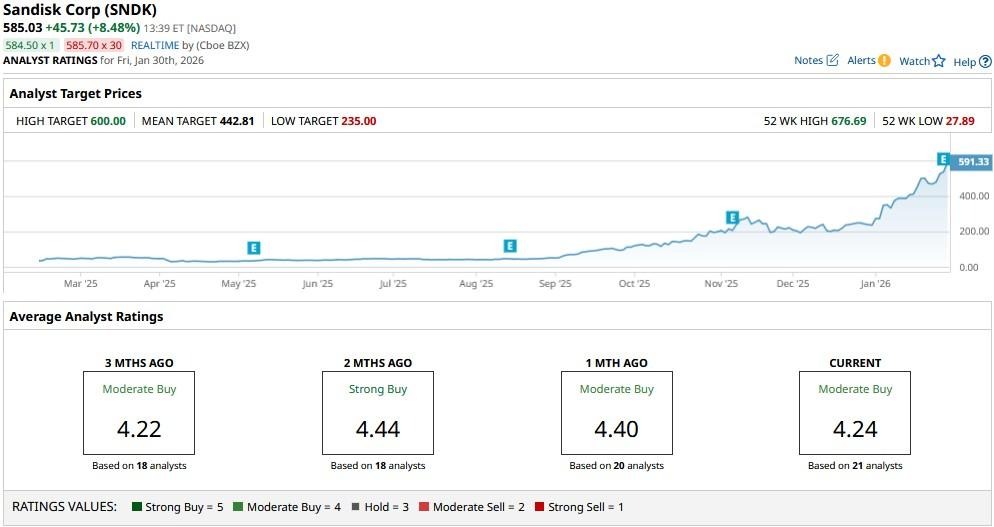

What’s also worth mentioning is that Wall Street maintains a consensus “Moderate Buy” rating on SNDK shares.

While the mean target sits at about $443 only, it’s conceivable that significant upward revisions are to follow after the company’s blockbuster earnings release on Jan. 29.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart