- Hycroft Mining (HYMC) operates one of the world’s largest gold and silver deposits in Nevada.

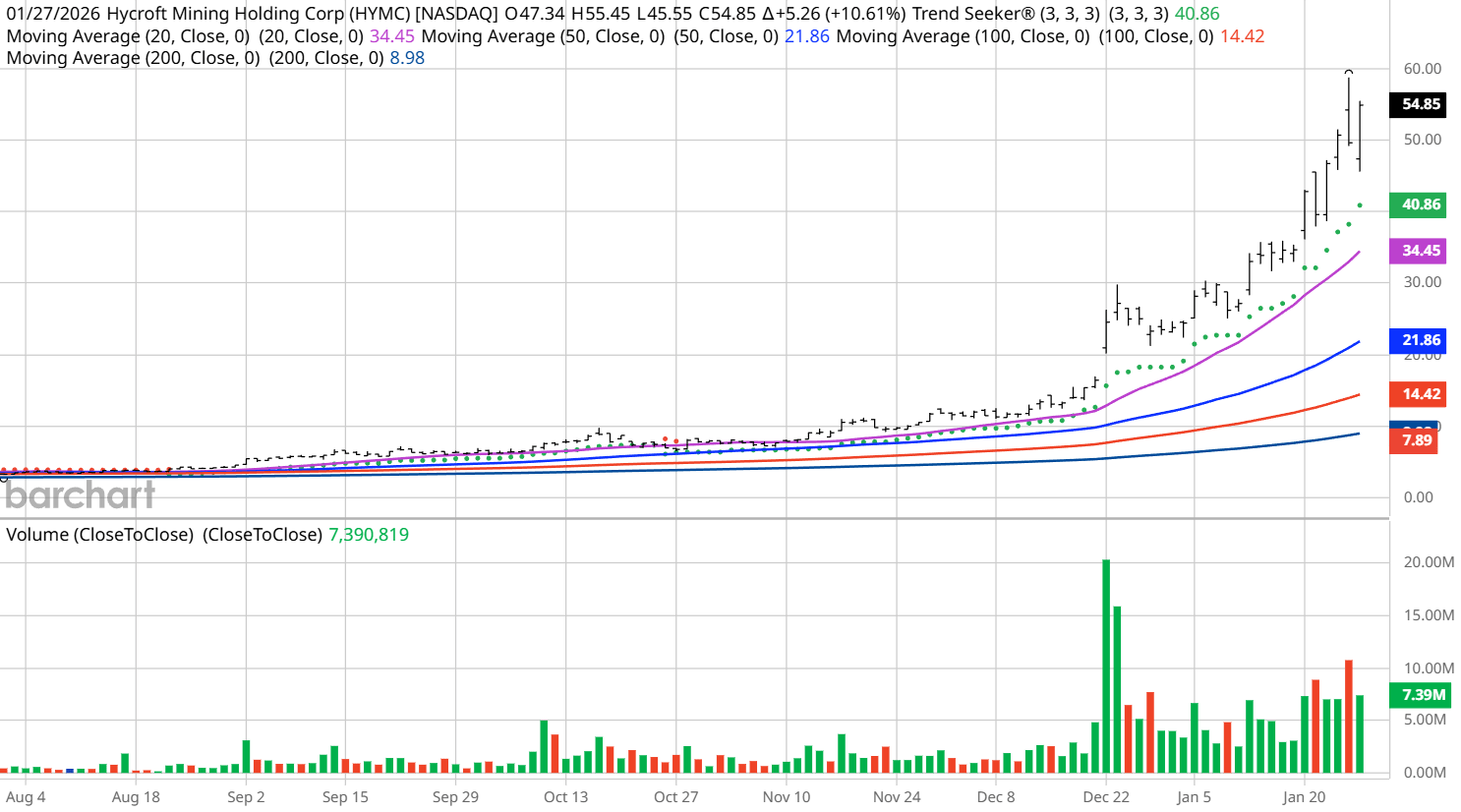

- HYMC has surged 2,369% over the past year, recently hitting a 3-year high of $58.73.

- The stock maintains a 100% “Buy” technical opinion from Barchart.

- Despite technical momentum, Morningstar considers HYMC 67% overvalued and CFRA rates it a “Hold.”

Author’s Note: Please do not try to buy this stock at these levels, but study it as a learning experience.

Today’s Featured Stock

Valued at $4.55 billion, Hycroft Mining (HYMC) is a U.S.-based, gold and silver producer operating the Hycroft mine located in the world-class mining region of northern Nevada. The Hycroft mine features one of the largest gold and silver deposits in the world with a low-capital, low-cost process and a 34-year mine life.

What I’m Watching

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. HYMC checks those boxes. Since the Trend Seeker issued a new “Buy” on Oct. 28, shares are up 562.92%.

Barchart Technical Indicators for Hycroft Mining

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Hycroft scored a new 3-Year high of $58.73 on Jan. 26.

- HYMC has a Weighted Alpha of +1,554.89.

- Hycroft has a 100% “Buy” opinion from Barchart.

- The stock has gained 2,369% over the past 52 weeks.

- HYMC has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $52.22 with a 50-day moving average of $22.72.

- Hycroft has made 13 new highs and is up 112.32% over the past month.

- Relative Strength Index (RSI) is at 77.44.

- There’s a technical support level around $48.45.

Don’t Forget the Fundamentals

- $4.55 billion market capitalization.

- Wall Street is not following this stock, so there are no revenue and earnings projections.

Analyst and Investor Sentiment on Hycroft

- CFRA’s MarketScope rates the stock a “Hold.”

- Morningstar thinks the stock is 67% overvalued

- Short interest is moderate at 5.01% of the float.

The Bottom Line on Hycroft

So why is Hycroft so interesting? Eric Sprott, a Canadian investor, has been accumulating shares over time. He invested in Hycroft Mining because he perceives the combination of high-grade mineral potential, strategic insider positioning, and market momentum as a rare opportunity to capture substantial upside.

Sprott may seem like a speculator, but he is a value investor. He found a company where he calculated the assets owned (gold and silver ore in the ground) exceeded the market capitalization of the company.

Are there other value investing opportunities out there? Prospectors willing to put in the effort to read the footnotes of annual reports may find some, but it takes a lot of work.

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart