Mobile technology company AppLovin Corporation (APP) has caught the attention of Needham analyst Bernie McTernan, who upgraded the stock from “Hold” to “Buy” with a price target of $700. The analyst cited the company’s additional work on its e-commerce operations to propel its e-commerce revenue growth this year. In addition, McTernan raised the 2026 e-commerce revenue estimate from $1.05 billion to $1.45 billion, assuming growth in advertisers from its self-service launch and increased expenditures.

Moreover, in the bull case, this e-commerce ramp is expected to propel AppLovin’s top line growth trajectory, similar to that of social media giant TikTok. Just for comparison, ByteDance, TikTok’s parent company, expects 20% increase in 2025 sales to a whopping $186 billion.

Should you consider investing in AppLovin’s stock now?

About AppLovin Stock

AppLovin is a leading mobile technology company that helps app developers and businesses with advertising, marketing, analytics, and monetization tools. Headquartered in Palo Alto, California, the company relies on AI-powered platforms to connect brands with daily active users across mobile apps, streaming TV, gaming, e-commerce, and more.

The firm supports developers in promoting, analyzing, and publishing apps while optimizing ad performance for growth in gaming, media, and finance. With offices worldwide, AppLovin thrives in the ad tech space through strategic initiatives. AppLovin has a market capitalization of $183.7 billion.

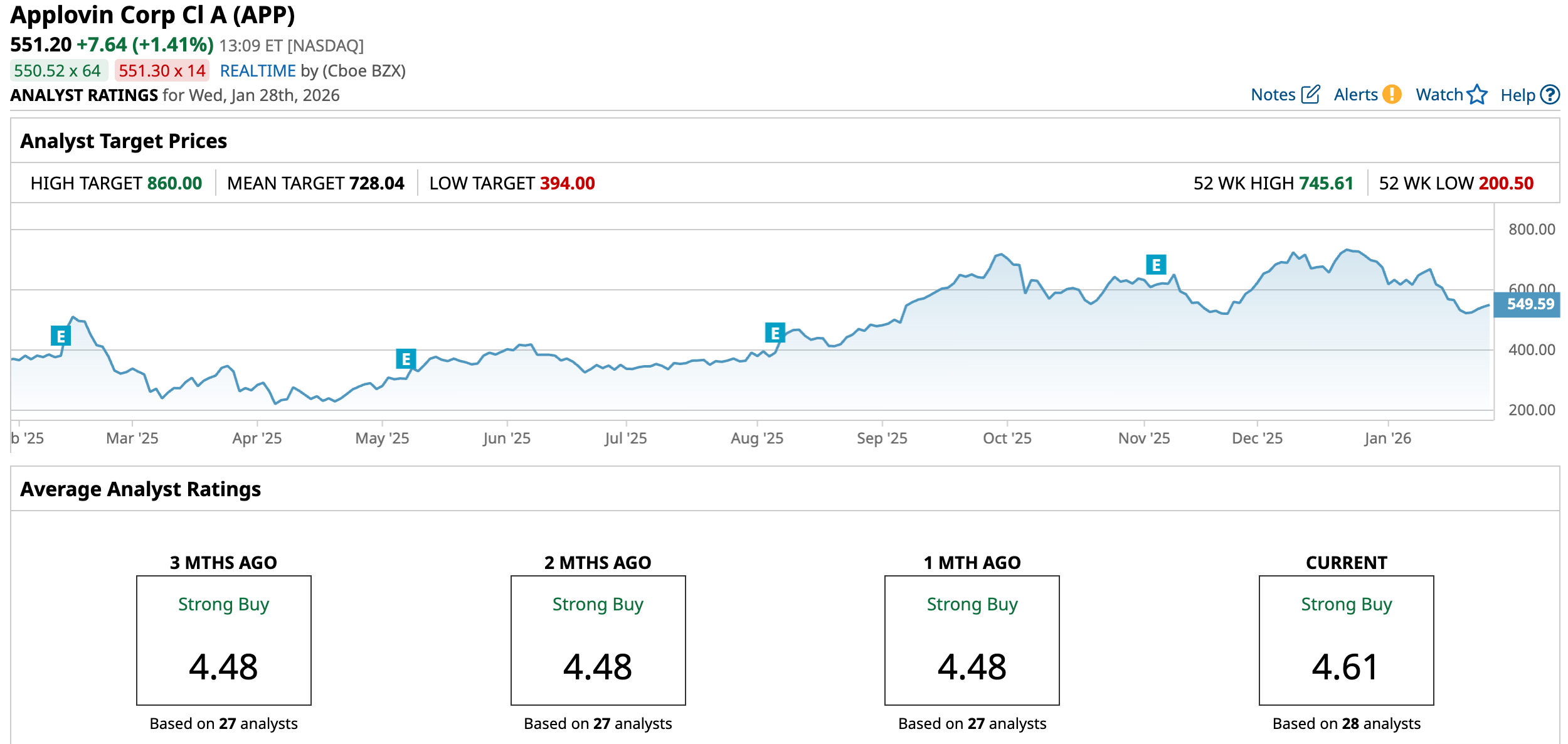

Over the past 52 weeks, the stock has gained 52.5%, while it has risen 48.3% over the past six months. It had reached a 52-week high of $745.61 in late September, but is down 26% from that level.

AppLovin’s stock is trading at a stretched valuation. Its price-to-earnings ratio of 66x is significantly higher than the industry average of 32.66x.

AppLovin’s Q3 Results Were Better Than Expected

On Nov. 5, AppLovin reported strong growth in its third-quarter results for fiscal 2025. The company’s revenue increased 68% year-over-year (YOY) to $1.41 billion, which was higher than the $1.35 billion that Wall Street analysts had expected. The robust growth was also reflected in the company’s bottom-line financials.

AppLovin’s net income climbed by a solid 92% annually to $836 million, while net income from continuing operations increased 93% YOY. Its adjusted EBITDA for the quarter was $1.16 billion, 79% higher than the year-ago value. Its quarterly EPS of $2.45 was 96% higher YOY and topped the $2.37 that Street analysts had expected.

The company also repurchased and withheld 1.3 million shares of its class A common stock, valued at $571 million. Given strong results and confidence in its future prospects, AppLovin increased its share repurchase authorization by $3.2 billion, bringing its total remaining authorization to $3.3 billion as of the end of October.

For the fourth quarter of 2025, the company expects its revenue to be in the range of $1.57 billion - $1.60 billion, while its adjusted EBITDA margin is projected to be 82% - 83%.

Wall Street analysts are optimistic about AppLovin’s future earnings. They expect the company’s EPS to climb 67.1% YOY to $2.89 in the fourth quarter (to be reported on Feb. 11, after the market closes). For fiscal 2025, EPS is projected to surge 105.7% annually to $9.32, followed by a 62.5% growth to $15.14 in fiscal 2026.

What Do Analysts Think About AppLovin’s Stock?

Apart from Needham analysts, other Wall Street analysts have become overwhelmingly positive on AppLovin’s stock. In January, analysts at Evercore ISI initiated coverage on the stock with a bullish “Outperform” rating and an $835 price target. Evercore analysts have a positive outlook on AppLovin’s growing operations. They expect the company’s mobile gaming ad spend to grow at a 23% CAGR through 2028, while its mobile gaming and e-commerce segments could sustain more than 30% of revenue and EBITDA CAGRs between 2025 and 2028.

This month, Morgan Stanley analysts also maintained their “Overweight” rating on AppLovin’s stock, while raising the price target from $750 to $800. Analysts at the firm believe that 2026 will be “thematically similar” to 2025 in the internet sector. The price target rise demonstrates that analysts see positive prospects for the company. In the same month, Wells Fargo analyst Alec Brondolo maintained an “Overweight” rating while raising the price target on the stock from $721 to $735.

Last month, analysts at Jefferies maintained their “Buy” rating on the stock while raising the price target from $800 to a Street-high $860. Jefferies analysts see AppLovin as an emerging name in the mobile advertising market, with confidence in the company’s ability to scale its margin and expand beyond the gaming space.

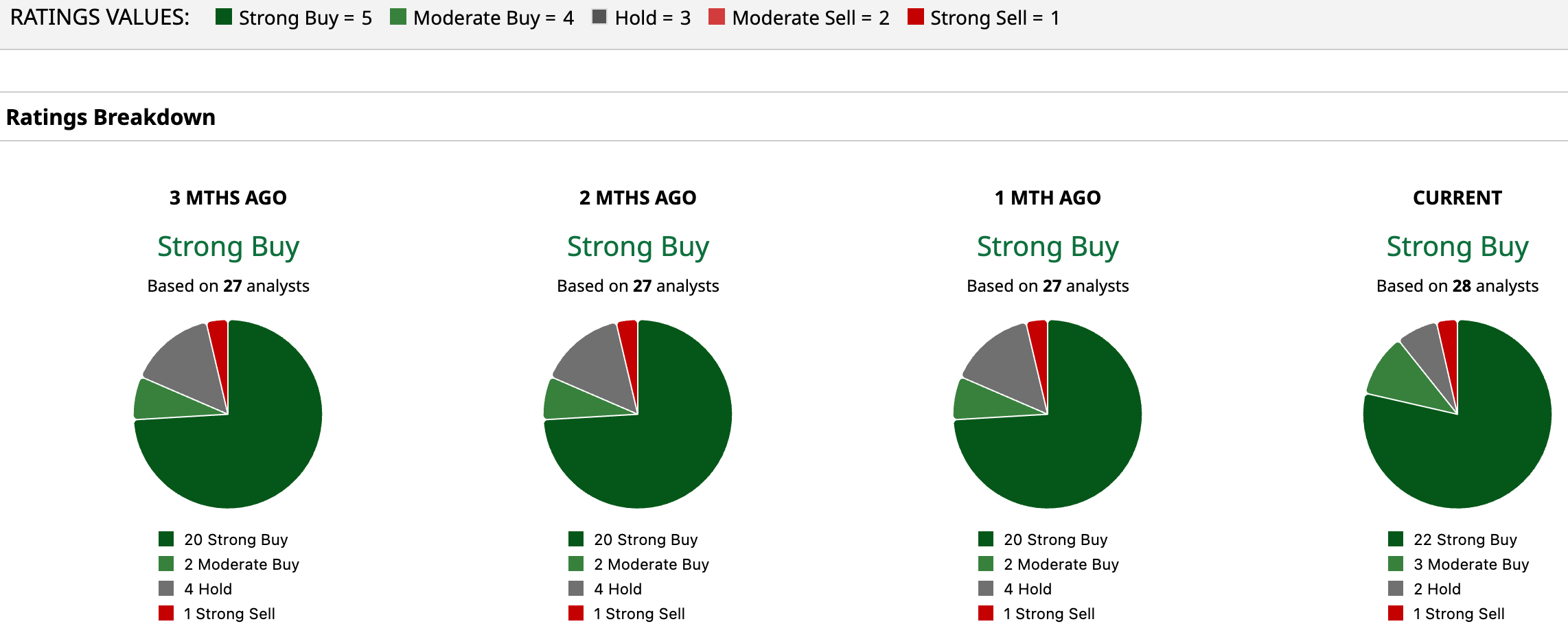

AppLovin is becoming a popular name on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 28 analysts rating the stock, 22 analysts have rated it a “Strong Buy,” three analysts suggest a “Moderate Buy,” two analysts suggested a “Hold” rating, and one analyst gave a “Strong Sell” rating. The consensus price target of $728.04 represents a 32% upside from current levels. The Street-high Jefferies-given price target of $860 indicates a 56% upside.

Key Takeaways

AppLovin is growing at a robust pace, and its e-commerce operations are expected to be highly accretive to its growth. Therefore, with positive sentiment surrounding the stock, it might be worth investing now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Data Stocks to Buy as Experts Call for Massive Growth Ahead

- Is Apple Stock A Buy Ahead of Q1 Earnings on Jan. 29?

- Ark Invest Is Betting on Netflix Stock Amid Warner Bros. Deal Drama. Should You?

- Nancy Pelosi Is Giving Nvidia Another Go as She Buys NVDA Stock. Should You Follow the Congresswoman and Buy Nvidia Too?