Intel (INTC) shares soared on Wednesday after a senior analyst at Tigress Financial issued a bullish note in favor of the semiconductor giant that’s been striving to stage a comeback. Investors also cheered INTC today because reports suggest Nvidia (NVDA) is interested in using Intel's foundry services to build its GPUs scheduled for 2028.

Following today’s surge, Intel stock is up more than 23% versus the start of this year.

Tigress Financial Announces $66 Price Target on Intel Stock

Tigress Financial analyst Ivan Feinseth announced a Street-high price target of $66 on Intel this morning, citing a “compelling multi-year upside story,” driven by its manufacturing and artificial intelligence (AI) pivot.

In his research note, Feinseth said the company’s recent update that its 18A process has entered high-volume production reinforces its commitment to reclaiming its silicon leadership.

Additionally, Intel’s strong Q4 results — marked by a 9% increase in data center and AI revenue — signal “real traction” in high performance compute (HPC) and the AI PC refresh cycle.

A robust balance sheet confirms Intel is successfully executing its turnaround and scaling for sustained profitability, which makes INTC stock worth owning at current levels, Feinseth concluded.

Why Nvidia News Warrants Buying INTC Shares Today

Intel shares also remain attractive because Nvidia is reportedly considering the company’s foundry services for its 2028 “Feynman” GPUs is a massive strategic win.

For years, the inability to land a major external customer has been a key overhang on INTC, fueling skepticism about its turnaround.

But if the undisputed AI leader — and Taiwan Semiconductor’s (TSM) biggest customer — is willing to diversify its supply chain toward Intel’s 18A and 14A nodes, it really is the ultimate seal of approval for the Nasdaq-listed firm.

This validation effectively de-risks the semiconductor firm’s roadmap, likely triggering a follow-the-leader effect among other chip designers and positioning INTC as a must-own recovery play.

What’s the Consensus Rating on Intel Corp for 2026?

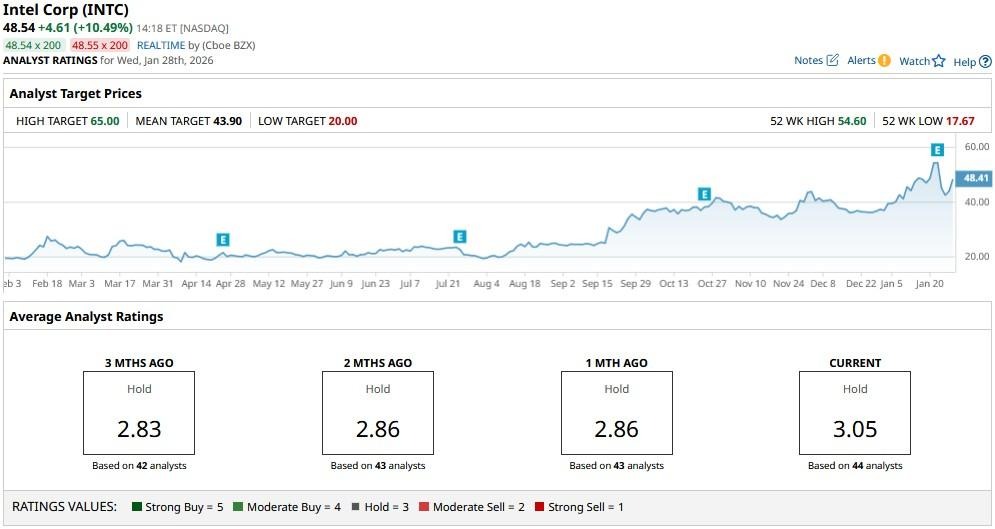

Other Wall Street analysts, however, aren’t as bullish on Intel as Tigress Financial.

The consensus rating on INTC shares sits at a “Hold," with the mean target of roughly $44 signaling potential downside of about 10% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Kenvue Is Headed for a Merger Vote on January 29. How Should You Play KVUE Stock Here?

- Is This Little-Known Defense Stock the Next Palantir?

- Intel Stock Just Got a New Street-High Price Target. Should You Buy INTC Here?

- ‘If You Suffer, We Will Suffer’: The Open Secret Behind Warren Buffett’s 62-Year, 6,088,800% Berkshire Hathaway Success Story