The Comex gold (GCJ26) futures market overnight hit another record high of $5,345.00 an ounce. In just one week the precious yellow metal tacked on around $500.00. For perspective, the entirety of 2014 through 2018 saw a high-low trading range in gold futures of around $100.

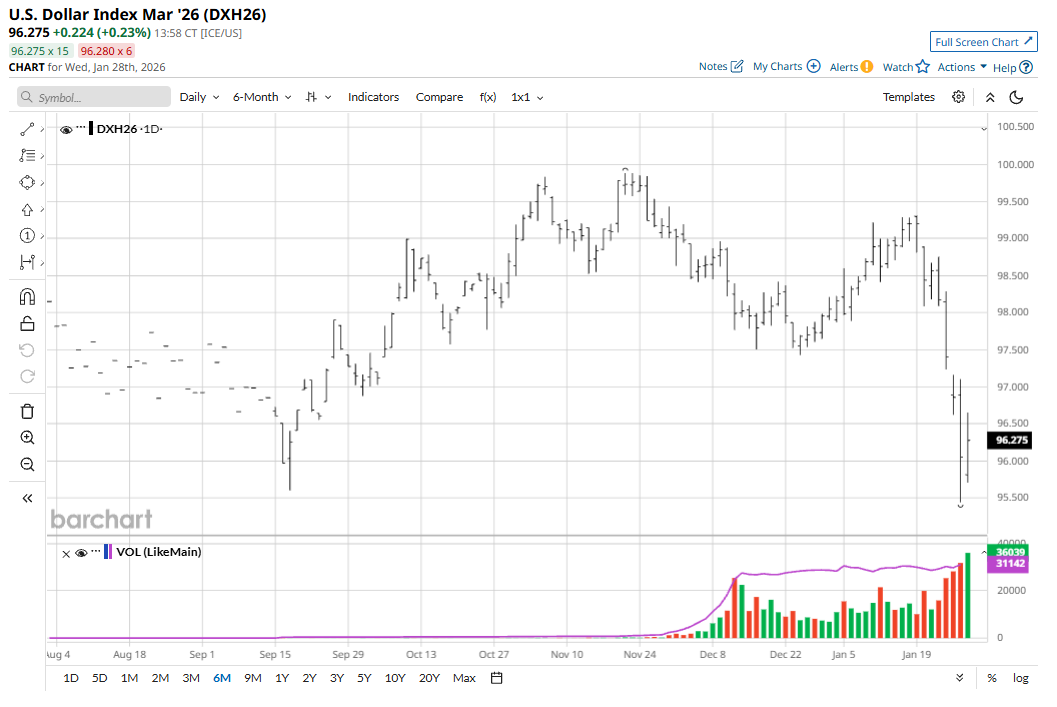

A very active and uncertain geopolitical environment at present is driving unprecedented safe-have demand for gold and silver. This situation is not likely to change anytime soon. President Donald Trump added fuel to the precious metals fire on Tuesday when he said a weaker U.S. dollar is good for U.S. business. That sent the U.S. dollar index ($DXY) to a four-year low. The dollar may continue to depreciate for the rest of the year, what with Trump wanting lower U.S. interest rates while at the same time seeing a U.S. economy that is growing at a healthy pace — suggesting the possibility of problematic price inflation.

Thus, the moonshots in gold and silver (SIH26) continue, with no strong, early technical or fundamental clues that market tops are close at hand.

Last year at this time, gold was trading around $2,650 an ounce. If I had told you then that gold prices in January 2026 would be nearly double that, not many of you would have believed me. And if I had told you silver prices, at around $29.50 an ounce, would be nearly quadrupled in one year’s time, many of you would have asked me what the heck I was smoking!

With the aforementioned price gains in mind, I’m going to throw out some wild predictions (or maybe not so wild) on gold and silver’s price action the rest of this year.

- Silver may reach $150 an ounce as soon as next month.

- Gold may reach $10,000 by the end of the year, or sooner.

- The new price floor for silver is $65.00 to $70.00.

- The new price floor for gold is $3,500 to $4,000.

- In one trading day, gold could drop over $500 on a downside price correction.

- In one trading day silver prices could drop over $20 on a downside price correction.

- By the end of 2026, gold and silver prices could be down over 30% from their record highs scored this year.

There you have my wild, or not-so-wild predictions. Tell me your wild, or maybe not-so-wild ones. I read every one of your emails. My email address is jim@jimwyckoff.com. I enjoy getting feedback from all of you, my valued Barchart readers.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart