Health insurance stocks have felt the squeeze from shifting policy and reimbursement signals, and investors are growing cautious about near-term earnings and margins.

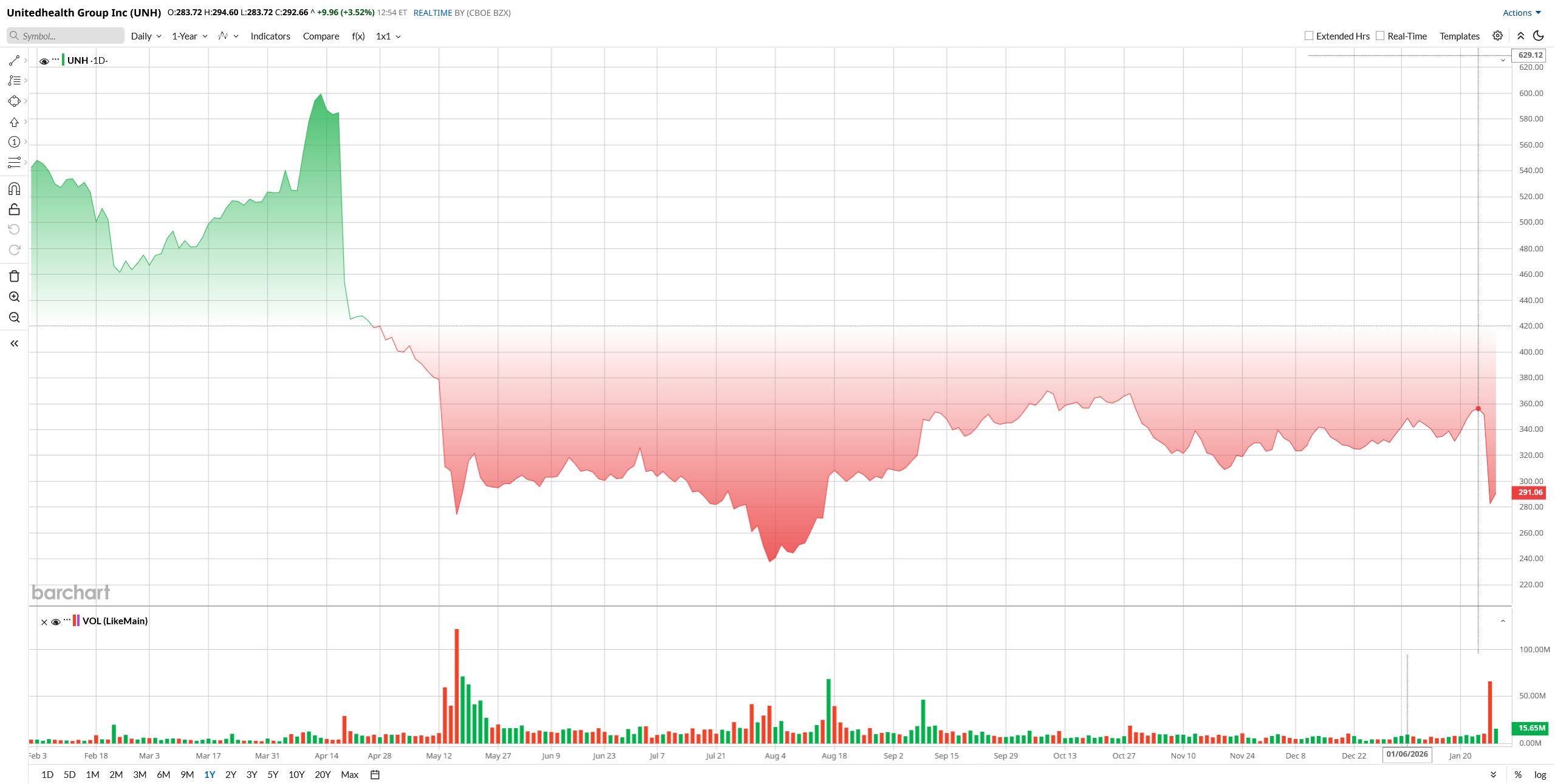

UnitedHealth (UNH) sits squarely in the crosshairs. The stock is down about 46% over the past year and sank nearly 20% on Tuesday after fourth-quarter revenue missed expectations, and the company recorded multi-billion-dollar restructuring charges. The sharp selloff shows how sensitive the healthcare sector remains to any hint of margin pressure.

Regulatory noise isn’t helping. CMS’s proposal for near-flat Medicare Advantage reimbursements, together with a rising medical-care ratio, adds another layer of uncertainty for insurers’ profitability outlook.

That leaves investors with only one question: will Optum’s underlying momentum and cost actions be enough to offset reimbursement headwinds, or is trimming exposure the prudent move until guidance clears up?

About UnitedHealth Stock

With a market value of $300 billion, UnitedHealth Group is a diversified healthcare giant that provides health insurance to tens of millions of Americans, while Optum delivers data-driven services, analytics, pharmacy, and technology solutions to providers and insurers. The company’s size and recurring revenues have historically made it a defensive, dividend-paying stock. UnitedHealth pays a quarterly dividend of $2.21 per share. That works out to a yield of about 2.5% as of late January 2026, giving investors modest income while the stock digests near-term headwinds.

Through late January 2026, UNH shares have declined roughly a third from January 2025 levels. This underperformance came with several shocks: an unprecedented earnings miss in the past two quarters and a CEO succession in late 2024, along with broad healthcare cost pressures. Technically, UNH trades around $293 now, below its 50-day moving average of $337, indicating negative momentum. Analysts note the downturn was magnified by expensive one-time charges and cautious guidance, overshadowing the company’s still-healthy fundamentals.

Following the dip, UNH looks inexpensive relative to its history and peers. It trades at about 22.8× forward earnings and only 0.69× forward sales. Both multiples sit well below sector medians and below UNH’s own five‑year averages, suggesting shares are “in bargain territory” in many analysts’ view.

Medicare Advantage News and Market Impact

The latest headlines for the health care company have been changes to government policy on Medicare Advantage (MA) and UNH’s Q4 guidance. In late January, the U.S. Centers for Medicare & Medicaid Services (CMS) announced a 0.09% increase for 2027 MA plans, far below the analysts' 5% to 6% consensus. UnitedHealth immediately warned that 2026 revenue will decline year-over-year (YoY) for the first time in decades. Investors sold off hard as UNH shares plunged 19% on the news, wiping out about $60 billion in market cap.

Moreover, the company flagged challenges with falling Medicare Advantage enrollments, projecting about 1.3 to 1.4 million fewer MA members in 2026, and continuing Medicaid funding cuts. Nonetheless, management said it has repriced products and expects MA margins to improve by about 50 basis points versus 2025 despite lower volume. The 2026 outlook is therefore one of stabilization, with revenue roughly flat to down and profit growth modest, barring policy surprises.

So, missing the MA payment expectations and guiding conservatively heightened fears that UNH’s cost base may grow faster than revenues, at least in the short term. This news flow left many wondering if the stock could bounce back once fundamentals again drive the narrative.

UnitedHealth Missed Revenue Forecast

UnitedHealth reported full-year 2025 revenue of $447.6 billion, up about 12% YoY, with UnitedHealthcare revenues up about 16% and Optum up about 7%. Premiums rose due to higher membership and prices. However, fourth-quarter revenue was $113.2 billion, roughly 12% YoY and about 0.5% below consensus.

On the bottom line, adjusted EPS for full-year 2025 was $16.35, slightly above guidance, but GAAP EPS was skewed by heavy charges, a roughly $1.6 billion after-tax restructuring and cyberattack reserve that left Q4 net EPS at just $0.01.

Profitability is notably compressed. The medical cost ratio rose to about 89.1% in 2025, up from about 85.5% the prior year, reflecting higher care utilization. Operating costs were 13.3% of revenue, relatively disciplined given the headwinds. Overall net income fell; UnitedHealthcare’s operating margin dropped to about 2.7% from 5.2% in 2024, weighed down by the one-offs and utilization surge.

However, the positive thing is that free cash flow remained healthy. UNH generated $19.7 billion of operating cash, roughly 1.5 times net income in 2025, sustaining dividends and buybacks.

Looking ahead, management kept 2026 guidance modest. UNH expects about $439 billion in revenue, roughly 2% below 2025, and adjusted EPS of more than $17.75, implying about 8% to 10% growth.

What Do Analysts Think About UNH Stock?

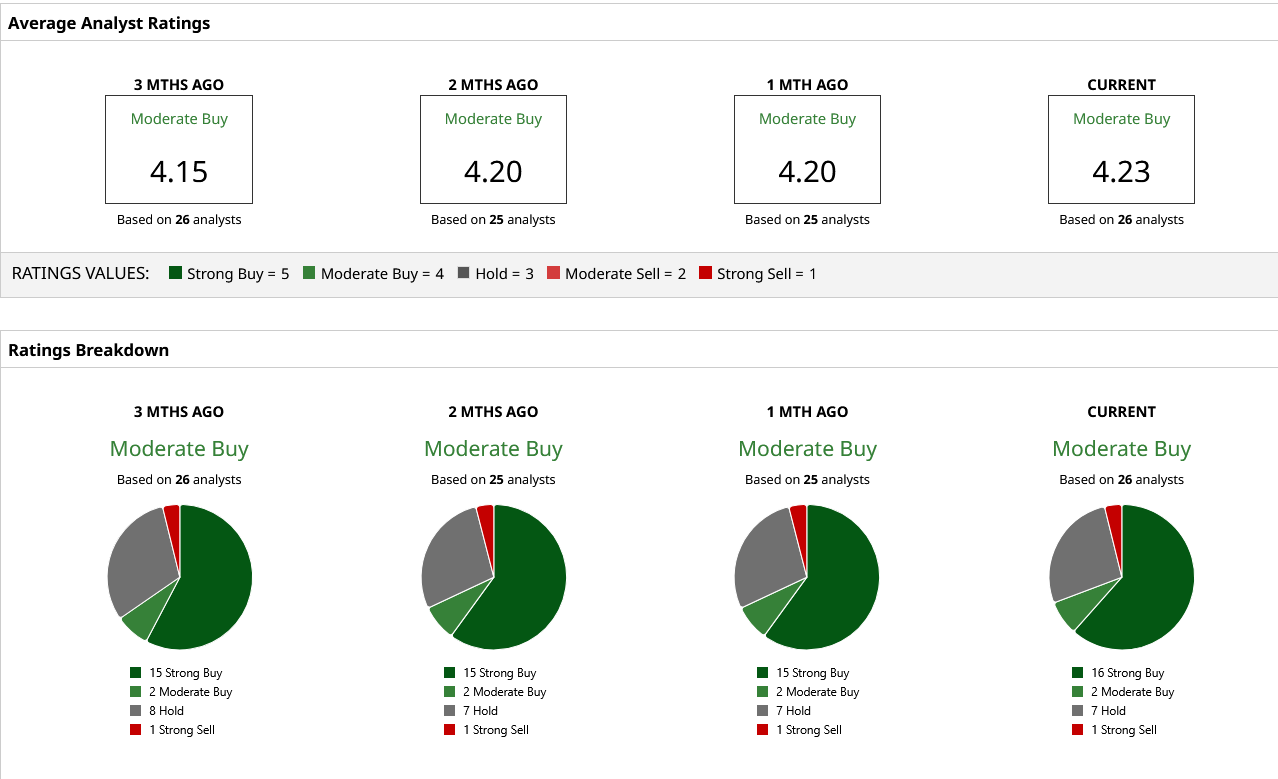

The Wall Street opinion on UNH is mixed but hopeful. Morgan Stanley did not go “Underweight” on this but reinstated it to “Overweight” with the reduction of their 12-month target to $409 because the short-term headwinds are largely already priced in.

Goldman Sachs followed in late 2025 with a "Buy" rating and a target of $406. On the other hand, Piper Sandler reduced its target to $396 with an “Overweight” rating, citing the ongoing headwinds in Medicare Advantage funding.

The consensus among 26 analysts is “Moderate Buy,” and the average price target is approximately $396 by the end of January 2026, and this has an upside of approximately 40% remaining.

The bottom line is that UNH's core brand is still deemed to be sound according to most analysts, but they have recalculated their near-term figures back. They refer to large upside items such as Medicare rate reductions, effective cost management, or evidence that usage patterns are stabilizing.

In my opinion, when the company starts reporting revenues and profits that exceed the slimmer projections, UNH's long-term position as a market leader provides ample room. Otherwise, it could be a risky bet.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Apple Stock A Buy Ahead of Q1 Earnings on Jan. 29?

- Ark Invest Is Betting on Netflix Stock Amid Warner Bros. Deal Drama. Should You?

- Nancy Pelosi Is Giving Nvidia Another Go as She Buys NVDA Stock. Should You Follow the Congresswoman and Buy Nvidia Too?

- This Gold and Silver Stock Is Up 2,369% Over the Past Year