Recently, the ARK Next Generation Internet ETF (ARKW) purchased more than 83,000 shares of Netflix (NFLX), a $7 million investment. This is notable, as the shares are significantly undervalued from their highs, the sentiment is mixed given the continued speculation on the Warner Brothers deal, and the landscape is as competitive as ever.

The investment speaks to Ark's confidence in Netflix and suggests that the company should be seen as a global subscription business that is improving its margins, increasing its optionality, and bolstering its cash-flow profile. The key, from the investment perspective, is whether this is a premature call.

About Netflix Stock

Netflix is the largest subscription streaming service in the world, with more than 325 million paid subscriptions across the globe. It is headquartered in Los Gatos, California, and operates in the entertainment, streaming, advertising, and live content business, as well as several early stage initiatives, including gaming and video podcasts. Netflix has a market capitalization of about $363 billion, cementing its position as one of the largest consumer internet stocks in the world.

In the last 52 weeks, the stock has traded between a low of around $82 and highs above $130. This represents a significant range as investors' expectations have shifted with respect to the durability of the company's growth and the increased competition. The stock has underperformed the market over the last 52 weeks as the valuation has compressed and the company has faced increased headwinds from the consolidation within the industry. However, this has also helped the company's stock reset its expectations significantly from the past.

From a valuation perspective, the company currently trades at a forward price-to-earnings (P/E) multiple of around 27x and a price-to-sales (P/S) multiple of around 8x. This is lower than the peak valuation multiples the company has traded at previously and is closer to its larger-platform peers than its high-growth peer group within the media disruption space. The company also has a return on equity above 43%, and its valuation is a function of a mature and profitable subscription-based business.

Netflix Beats on Earnings and Lays Out 2026 Roadmap

Netflix had a great closing year to 2025. The company reported a strong year with $45.2 billion in revenue, up 16% year-over-year. It has also expanded its operating margins by 3 points to 29.5% for the year. Its revenue was up 18% year-over-year in the fourth quarter, while its operating income was up 30% year-over-year. It also reported that its paid membership count was above 325 million during the quarter.

One of the more important updates was regarding the advertising revenue. Ad revenue was up more than 2.5x to over $1.5 billion in 2025. This confirms that the company's advertising product is scaling without impacting its subscription business. It also reported a healthy trend with respect to engagement as viewing hours were up 2% year-over-year in the second half of the year, driven by a resurgence in branded original content.

Looking forward, the management guided revenue for 2026 to be between $50.7 billion and $51.7 billion, or 12% to 14% growth, and an operating margin target of 31.5%. Ad revenue is set to roughly double again, and new initiatives such as live events, cloud-first games, and new content categories all provide incremental upside potential. It also confirmed that it is working toward completing its acquisition of Warner Bros., which could change the competitive dynamics but also brings execution and regulatory risk.

What Do Analysts Expect for Netflix Stock?

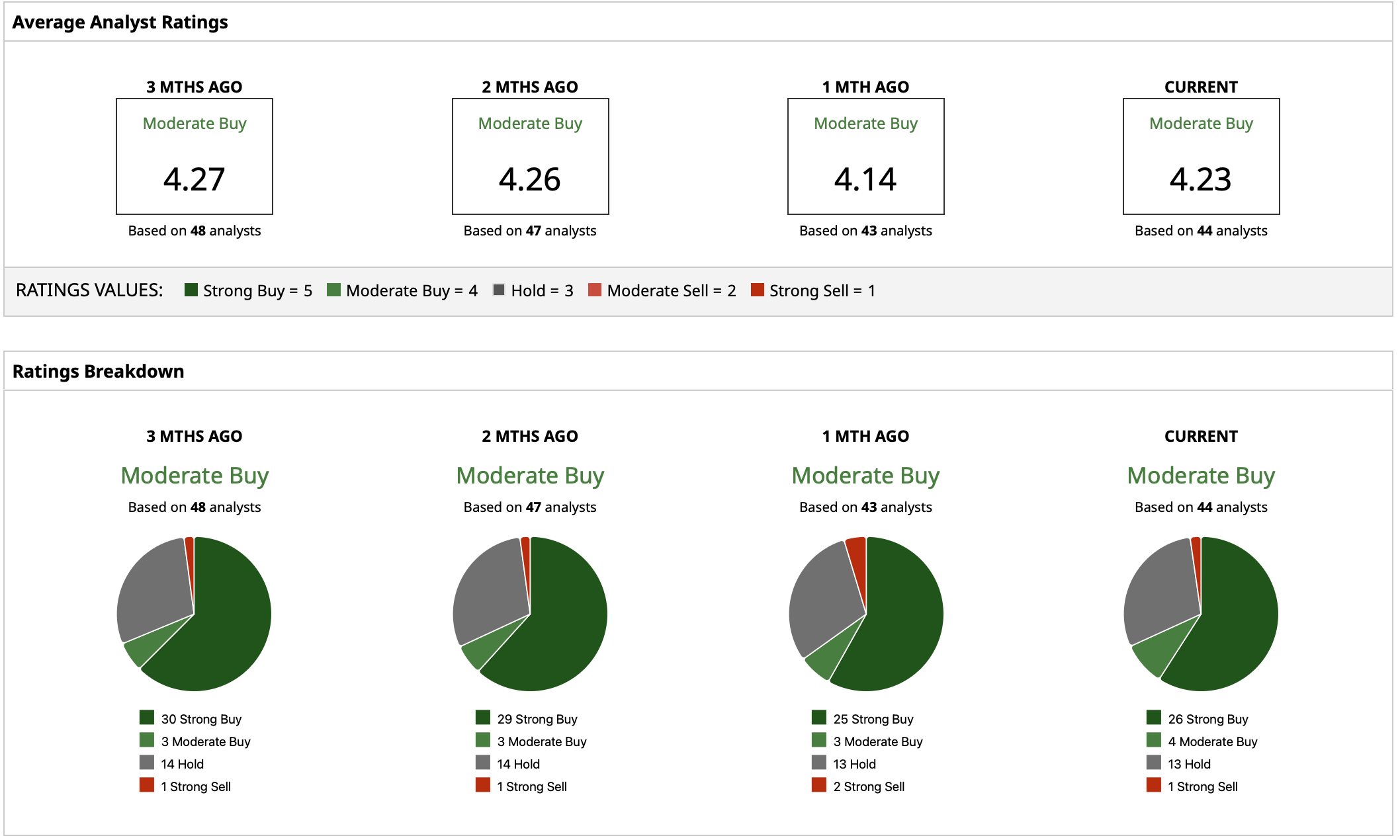

Wall Street analysts are overall positive but cautious about the stock with a “Moderate Buy” consensus rating. Analysts seem divided between their confidence in the company’s ability to continue to generate cash in the long term and the uncertainty of the near term, particularly in relation to the company’s ability to deal with the increasing competition. The analysts' target prices for the stock center around the current levels, indicating that there is limited upside potential in the near term, although the downside risk has improved from the recent reset.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Intel Stock Just Got a New Street-High Price Target. Should You Buy INTC Here?

- ‘If You Suffer, We Will Suffer’: The Open Secret Behind Warren Buffett’s 62-Year, 6,088,800% Berkshire Hathaway Success Story

- This Chip Giant Is Set Up for a Strong 2026. Should You Buy the Dip Now?

- 3 Data Stocks to Buy as Experts Call for Massive Growth Ahead