SLB N.V. (SLB), formerly known as Schlumberger Limited, is a leading global oil-field services company that provides technology, drilling, evaluation, well-construction and production systems to upstream oil and gas companies worldwide. The firm is headquartered in Houston, Texas. SLB’s market cap stands at $75.7 billion.

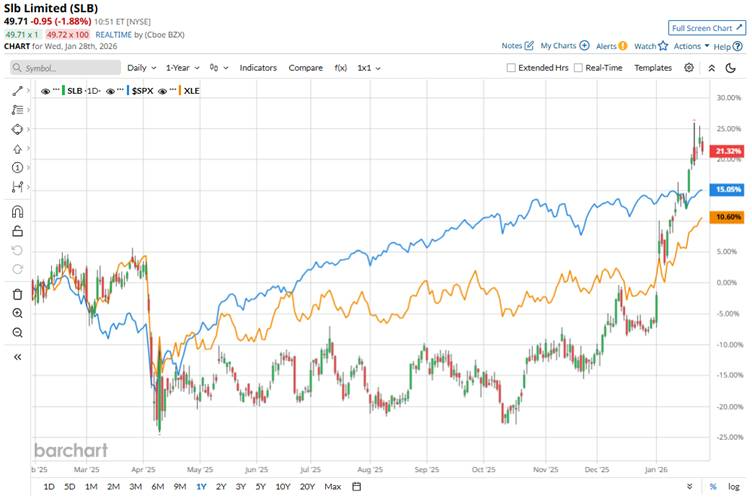

The stock has significantly outperformed the broader market over the past year. SLB has already surged 29.2% on a year-to-date (YTD) basis and around 20% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 2.1% surge in 2026 and 15.2% gains over the past year.

Zooming in further, SLB has also surpassed the Energy Select Sector SPDR Fund’s (XLE) 11.4% uptick in 2026 and 11.3% gains over the past 52 weeks.

SLB performance was boosted by a stronger-than-expected financial performance. SLB released its fourth-quarter 2025 earnings on Jan. 23. For the quarter ended Dec. 31, SLB reported revenue of $9.8 billion, which was up about 5% year-over-year. SLB posted an adjusted EPS of $0.78, a 15% decrease from Q4 2024, but ahead of the consensus estimate.

Also, the successful integration of the ChampionX acquisition and strategic positioning to benefit from potential growth in regions like Venezuela has further lifted sentiment.

For the full fiscal 2026, analysts expect SLB to deliver an EPS of $2.94, up marginally year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates once over the past four quarters, it has surpassed the projections on three other occasions.

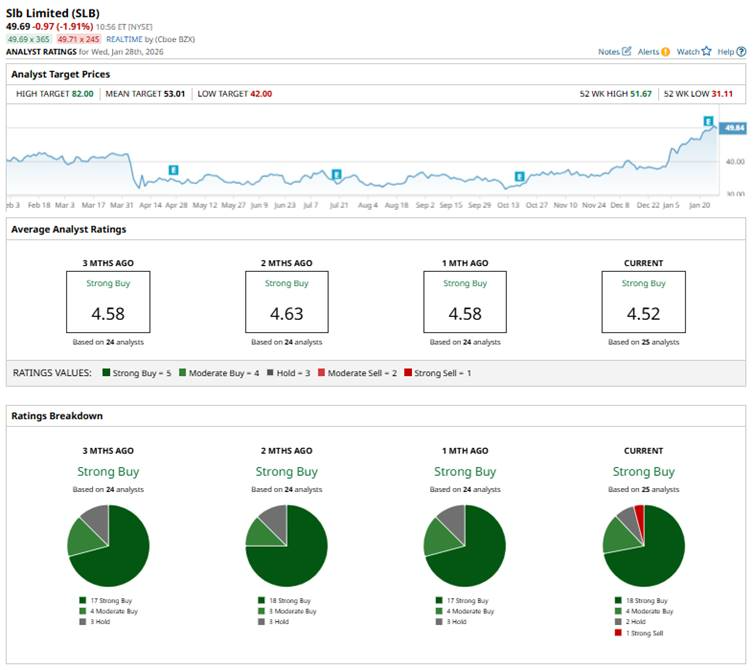

The stock holds a consensus “Strong Buy” rating overall. Of the 25 analysts covering the stock, opinions include 18 “Strong Buys,” four “Moderate Buys,” two “Holds,” and one “Strong Sell” rating.

This configuration is less bullish than it was one month ago, when there was no “Strong Sell” rating. However, there has been a rise in “Strong Buy” ratings as well, compared to one month ago, when the count was 17.

Recently, Stifel raised its price target on SLB to $56 from $52 and reaffirmed a “Buy” rating after the company beat Q4 2025 earnings expectations.

SLB’s mean price target of $53.01 represents just a 4.6% premium to current price levels, while the Street-high target of $82 suggests a 61.9% upside potential.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Data Stocks to Buy as Experts Call for Massive Growth Ahead

- Is Apple Stock A Buy Ahead of Q1 Earnings on Jan. 29?

- Ark Invest Is Betting on Netflix Stock Amid Warner Bros. Deal Drama. Should You?

- Nancy Pelosi Is Giving Nvidia Another Go as She Buys NVDA Stock. Should You Follow the Congresswoman and Buy Nvidia Too?