The unprecedented demand for global data centers isn’t slowing down anytime soon, according to Global X, which now sees annual expansion of 14% all the way until 2030. This translates to an additional 100 GW of capacity, twice the current data center power load across the world.

A quarter of the existing demand is represented by AI workloads. Within this, the share of inference tasks (the ones that use AI-trained models to give real-time outputs like chatbots) has, for the first time, surpassed the share of AI training tasks (the ones that require compute to train AI models). That's not all; companies are now prioritizing key geographical locations for data center setups, not only to improve energy efficiency but also to reduce latency, which is instrumental in providing a real-time AI experience, such as through AI smart glasses or AI assistants.

The above has resulted in growth across various industries, with chipmakers, energy infrastructure companies, and, most recently, memory chip providers experiencing outstanding growth prospects. To benefit from this growth, we have identified three stocks that should be on the investors’ radar in 2026.

Data Stock #1: Amazon (AMZN)

Amazon (AMZN) is a global tech company that has its tentacles in multiple industries, including retail, cloud computing, e-commerce, streaming, and AI. The company is headquartered in Seattle, Washington, with another corporate headquarters in Arlington, Virginia.

The company’s stock has been volatile in 2025, with relative stability in the second half of the year. As a result, it underperformed the broader market significantly, registering a modest 2% gain in the last 12 months.

Amazon is currently trading at a trailing twelve-month P/E of 33.68x, significantly lower than its five-year average of 55.86x. On a forward P/E basis, it is trading at a massive 80% discount to its five-year average. On a forward EV/EBIT basis, there is a similar 35% discount. There is no doubt that as a hyperscaler, Amazon is well-placed to catch data center and AI growth and is currently trading at a discounted valuation.

The company is set to announce its earnings on Feb. 5 after markets close. According to estimates from 15 different analysts, an EPS of $1.97 is expected, which reflects a 5.91% YoY growth in earnings. This seems modest and explains the stock performance. However, things are expected to improve significantly, with an EPS growth of 11% expected by 2026, 21.71% expected by 2027, and 24.5% expected by the end of 2028.

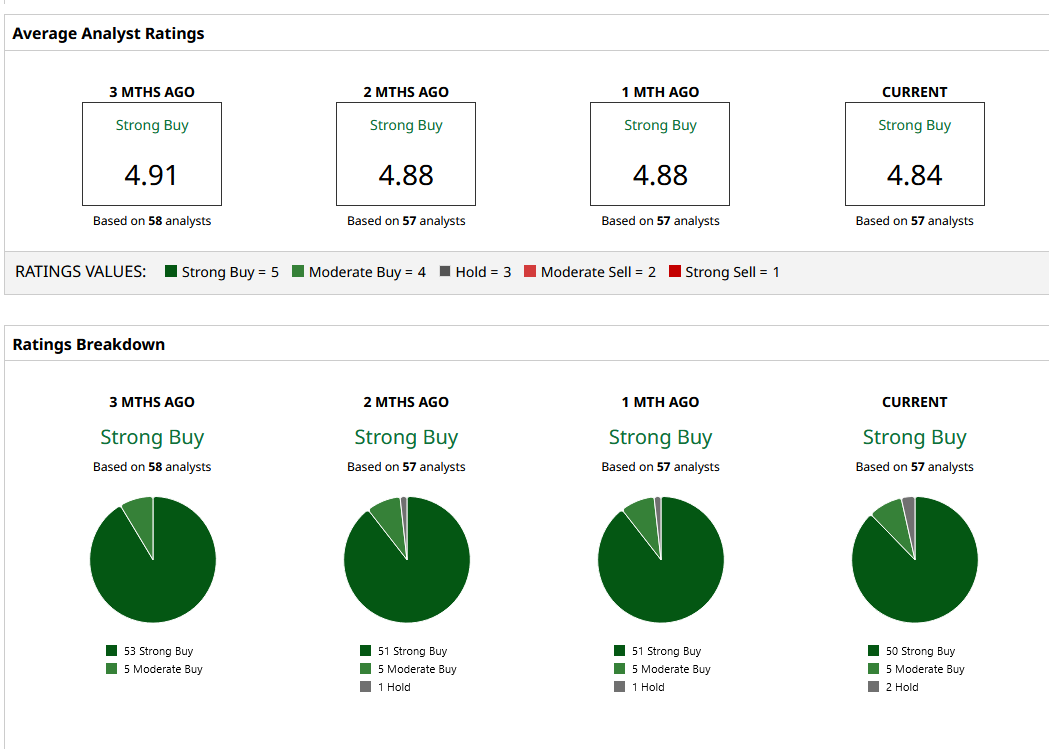

Analysts are extremely bullish on the stock, with 50 out of 57 analysts calling AMZN stock a “Strong Buy.” The stock is still trading 23% below the mean target price of $297.44, with the most bullish estimate predicting the price of $360.

Data Stock #2: Broadcom (AVGO)

Broadcom (AVGO) makes semiconductor equipment, including networking and software to support this infrastructure. It has emerged as a crucial player in AI, especially due to its expertise in custom chipmaking necessary for high-performance computing workloads like AI training. The company is headquartered in Palo Alto, California.

AVGO has returned 60% in the last 12 months, almost mirroring the iShares Semiconductor ETF’s (SOXX) 68% returns during the same period. So far this year, however, the stock is significantly underperforming the index. This may have something to do with the demand shifting from AI training to AI inference. This doesn't mean Broadcom is behind the curve. It just means one growth story for the company may be ending while another begins. AVGO announced a strategic collaboration with OpenAI last year and produces custom AI accelerators that target the high-efficiency, low-latency inference market. The company stands to benefit from the second chapter of AI growth after being a major beneficiary of the first.

AVGO announced its Q4 earnings on Dec. 11 and posted a double beat. Revenue of $18.02 billion beat estimates of $17.49 comfortably. Similarly, the EPS of $1.95 was well above the expected $1.86. Going forward, the company expects $19.1 billion in revenue in the ongoing quarter, so the growth engine is still going strong. At a forward P/E of 42.1x, the company is certainly expensive compared to its own five-year average. Even the dividend yield has fallen to 0.74% from the five-year average of 2.04%. However, when growth prospects are so strong, one cannot expect a major beneficiary to trade at a discount.

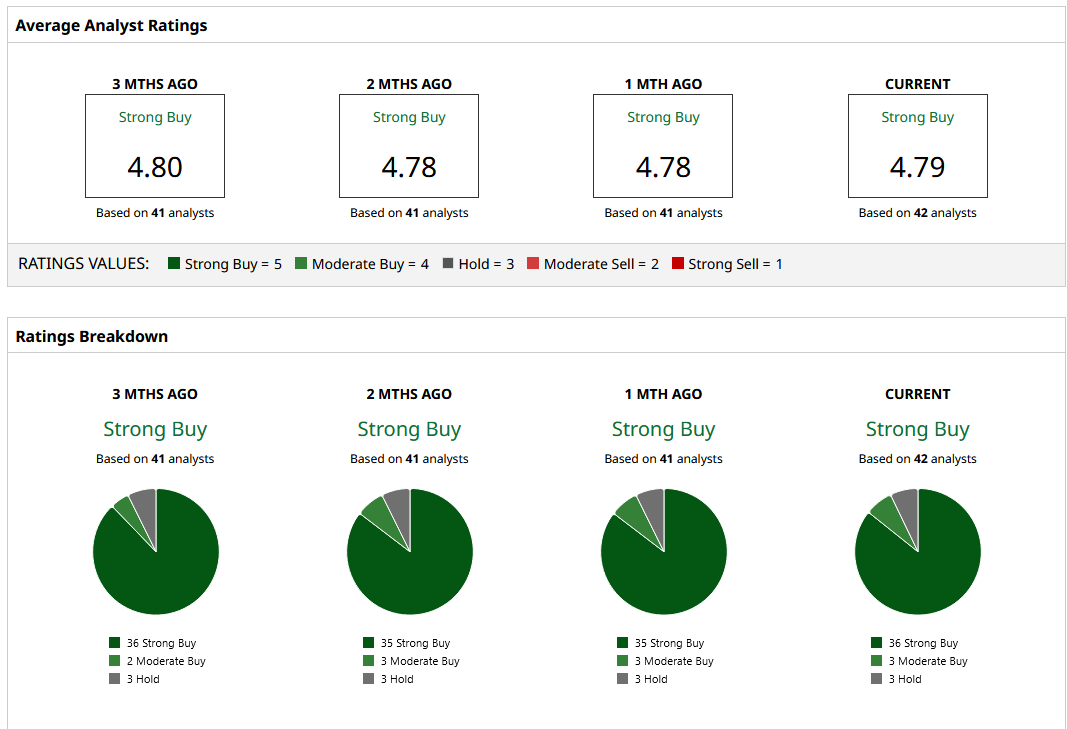

Analysts are extremely bullish on AVGO stock, with 36 “Strong Buy” ratings and a median target price of $455.22, which still offers 38% upside from here on. The highest price target of $535 offers 63% upside from current levels. This analyst sentiment has stayed consistent over the past three months and is unlikely to change considering how vital the company is to building AI infrastructure.

Data Stock #3: Nvidia (NVDA)

Headquartered in Santa Clara, California, and led by Jensen Huang since 1993, Nvidia (NVDA) is still a founder-led company that is undoubtedly the most important player in the quest for achieving AI supremacy. Its AI chips are so strong that the U.S. government has restricted exports to China in a bid to stall the Asian country’s AI progress.

NVDA stock has returned 49% in the last 12 months. But this is nothing compared to the 1,287% five-year return, thanks mainly to the emergence of AI in 2022.

Nvidia is currently trading at a 29% discount to its five-year average on a forward P/E basis. The fear is that Nvidia’s run as the primary chipmaker might be over. But that isn’t stopping the earnings growth engine. It is expected to grow its earnings by 56.93% in 2026 and 63.34% in 2027. Just last month, Nvidia dished out $20 billion to license AI startup Groq’s AI inference technology. Investors might be thinking Nvidia could fall behind in inference, especially in the presence of Advanced Micro Devices’ (AMD) technical leadership in System-on-Chip (SoC) technology. However, Jensen Huang is unlikely to slow down.

Huang’s leadership was on full display when the company announced outstanding earnings on Nov. 19 and then followed up with strong guidance. In the ongoing quarter, the company expects $65 billion in revenue even when analysts were only forecasting $61.66 billion. The demand for NVDA’s AI chips is through the roof right now, and if there’s one man who knows how high this demand is, it's Jensen, and he’s guiding higher and higher quarter after quarter.

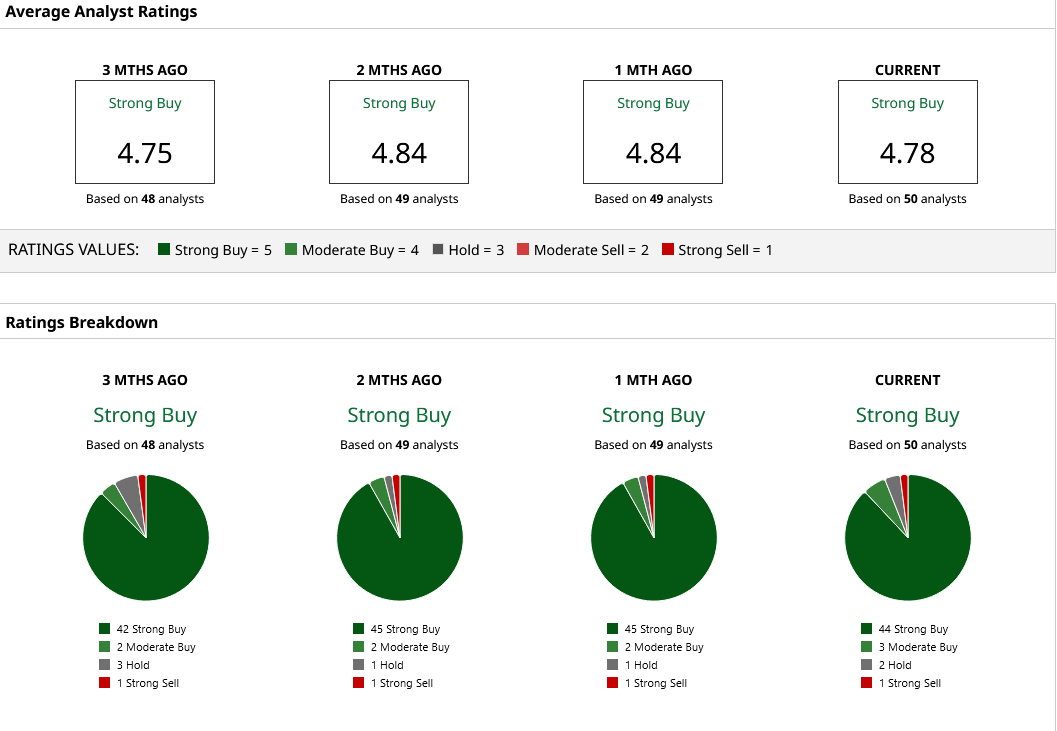

Analysts aren’t oblivious to this Nvidia pattern. They have a consensus “Strong Buy” rating on NVDA stock with a mean target price that still offers 35% upside!

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Kenvue Is Headed for a Merger Vote on January 29. How Should You Play KVUE Stock Here?

- Is This Little-Known Defense Stock the Next Palantir?

- Intel Stock Just Got a New Street-High Price Target. Should You Buy INTC Here?

- ‘If You Suffer, We Will Suffer’: The Open Secret Behind Warren Buffett’s 62-Year, 6,088,800% Berkshire Hathaway Success Story