New York-based The Estee Lauder Companies Inc. (EL) is one of the world’s leading manufacturers, marketers, and sellers of skincare, makeup, fragrance, and hair care products, and is a steward of outstanding luxury and prestige brands globally. With a market cap of $34.1 billion, Estee Lauder’s products are sold in approximately 150 countries and territories.

Companies worth $10 billion or more are generally described as "large-cap stocks." Estee Lauder fits this bill perfectly. Given the company’s extensive brand portfolio and longstanding name in the cosmetic industry, its valuation above this mark is not surprising. The company sells its products under well-known brands like Estee Lauder, BALMAIN, Clinique, Jo Malone London, TOM FORD, and more.

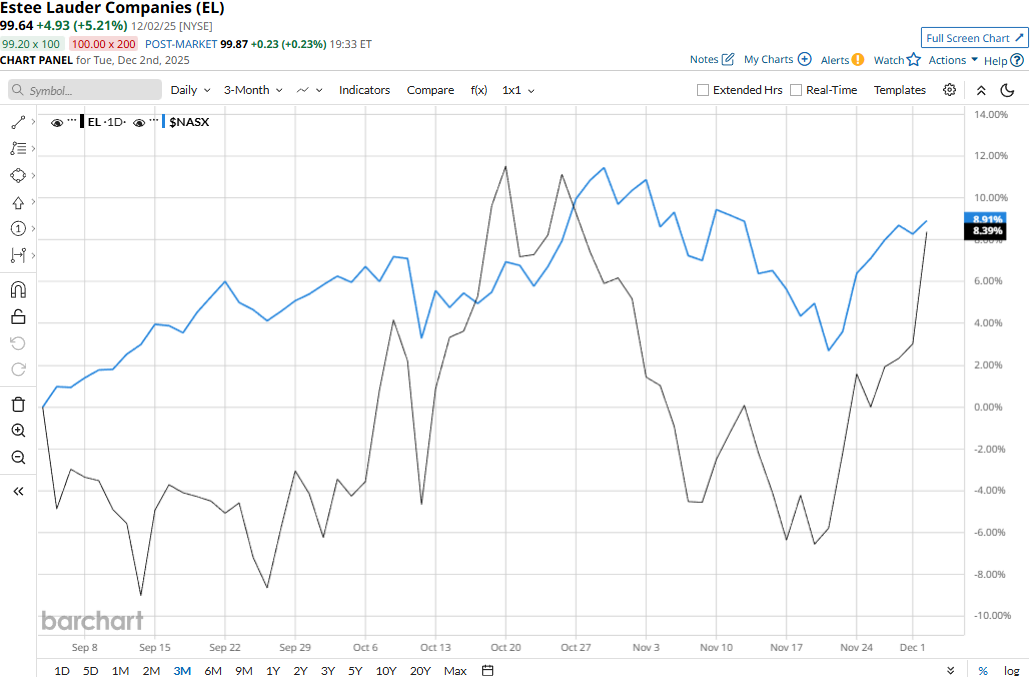

Estee Lauder touched its 52-week high of $104.53 on Oct. 20 and is currently trading 4.7% below that peak. Meanwhile, EL stock prices gained 9.8% over the past three months, marginally lagging behind the Nasdaq Composite’s ($NASX) 10% gains during the same time frame.

Estee Lauder’s performance has remained impressive over the longer term. EL stock prices have soared 32.9% on a YTD basis and 31.1% over the past 52 weeks, outpacing the Nasdaq’s 21.3% gains in 2025 and 20.7% returns over the past year.

EL stock has traded consistently above its 200-day moving average since mid-June and mostly above its 50-day moving average since mid-May, underscoring its bullish trend.

Estee Lauder’s stock prices observed a marginal uptick in the trading session following the release of its better-than-expected Q1 results on Oct. 30. The company’s skincare and fragrance sales have observed notable growth. Also, except for the Americas region, its sales across the globe have observed a notable uptick. Overall, its net sales grew 3.5% year-over-year to $3.5 billion, beating the Street’s expectations by 2.9%. Further, its adjusted operating income soared 77.1% year-over-year to $255 million, surpassing the consensus estimates by a significant margin.

Moreover, Estee Lauder has notably outperformed its peer Coty Inc.’s (COTY) 51.6% decline on a YTD basis and 56% plunge over the past year.

Among the 24 analysts covering the EL stock, the consensus rating is a “Moderate Buy.” Its mean price target of $100.55 suggests a marginal uptick from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Deere Got Hit by Tariffs... Again. Should You Buy the Blue-Chip Dividend Stock on the Dip?

- The Tesla Europe Sales Rout Keeps Going. Is It Time to Sell TSLA Stock?

- Dear Nuclear Energy Stocks Fans, Mark Your Calendars for December 3

- Nvidia Just Lit a Fire Under Synopsys Stock But Its Chart Is Waving Red Flags. Here’s the Only Way I’d Trade SNPS Here.