Billionaire investor Bill Ackman has thrown a bold new idea into the debate over how SpaceX might eventually go public—and it’s one that could directly reward Tesla (TSLA) shareholders along the way. As speculation intensifies around a potential SpaceX IPO in 2026, Ackman has suggested bypassing the traditional Wall Street playbook in favor of a far less conventional structure known as a SPARC. The proposal immediately grabbed attention not just because of its novelty, but because it ties together two of Elon Musk’s most influential companies in a way public-market investors have never seen before.

But how likely is this plan to move forward? And perhaps most importantly for investors: does the proposal strengthen the investment case for Tesla stock today? In this article, we’ll break down how SPARCs work, what Ackman is proposing, and whether now is the right time to consider buying TSLA stock.

About Tesla Stock

Tesla is a prominent innovator dedicated to accelerating the global transition to sustainable energy. The Elon Musk-led powerhouse designs, develops, manufactures, leases, and sells high-performance, fully electric vehicles, solar energy generation systems, and energy storage products. It also offers maintenance, installation, operation, charging, insurance, financial, and various other services related to its products. In addition, the company is increasingly focusing on products and services centered around AI, robotics, and automation. TSLA’s market cap currently stands at $1.58 trillion.

Shares of the EV maker have climbed 15% on a year-to-date (YTD) basis. Last week, TSLA stock retreated after hitting an intraday high of $498.83 last Monday, failing to break above the key $500 level. Safety concerns took center stage around the stock after the U.S. auto safety regulator opened an investigation on Tuesday into the mechanical door release on the 2022 Model 3.

Bill Ackman Floats SPARC Merger as Alternative Path for SpaceX IPO

As speculation builds around a potential SpaceX initial public offering next year, billionaire investor Bill Ackman has recently proposed an innovative route for the company to go public. He suggested merging SpaceX with Pershing Square SPARC Holdings, a special purpose acquisition rights vehicle created by Pershing Square Capital Management, which would give Tesla shareholders priority access to invest in SpaceX.

A SPARC is a novel, investor-friendly investment vehicle designed as an alternative to the traditional Special Purpose Acquisition Company (SPAC). The primary difference lies in the timing of capital raising. SPACs raise funds through an IPO before selecting a target company to acquire. The proceeds are placed in a trust account until an acquisition is made. At the same time, SPARCs do not raise capital upfront. SPARCs raise capital only after they’ve found a target. Instead of shares, SPARCs distribute “acquisition rights,” or SPARs, for free that grant the holder the option to invest at a fixed price after an acquisition target is identified. In other words, investors are not required to provide funds until they choose to exercise their SPARs after a deal is announced.

Pershing Square secured approval for the SPARC structure in September 2023 after a two-year review and soon after began distributing SPARs to former Pershing Square SPAC holders, granting them the right to invest in future deals. The structure eliminates common dilutive elements such as founder stock and shareholder warrants while linking sponsor incentives to the post-merger company’s performance, creating better alignment with public investors. In addition, SPARCs can have up to 10 years to find a target, compared with the typical two to three years for a SPAC, easing pressure on sponsors to rush into unfavorable deals.

Here’s How SpaceX’s IPO Through a SPARC Structure Would Benefit Tesla Stockholders

Ackman’s plan is distinctive not only for its use of the SPARC structure but also because it puts Tesla shareholders at the front of the line. Under the proposal, SPARs would be distributed to Tesla shareholders, giving them the opportunity to invest directly in SpaceX. In other words, owning TSLA stock would give you a free “right” to buy SpaceX shares at the starting price. Shareholders who choose not to participate could sell their SPARs to someone else for immediate cash. “This would reward loyal Tesla shareholders with the opportunity to invest in SpaceX, while totally democratizing the IPO process,” Ackman wrote on X.

Ackman said SpaceX could raise as much capital as needed by adjusting the SPARs’ exercise price. He assumed that Pershing Square SPARC Holdings would distribute 0.5 SPARs for each Tesla share, resulting in roughly 1.723 billion SPARs outstanding, including about 61.1 million already issued. Each SPAR would be exercisable for two SpaceX shares, implying a total share count of 3.446 billion. With that, if the SPAR exercise price were set at $11.03, SpaceX would raise about $42.0 billion, $38 billion from SPAR exercises and an additional $4 billion committed by Pershing Square as part of the deal. If the exercise price were set at $42, total proceeds would jump sharply to around $148.7 billion.

Ackman noted that the structure removes underwriting fees, founder stock, and shareholder warrants while preserving a 100% common stock capital structure. Pershing Square would also forgo its sponsor warrant rights. As a result, SpaceX could reach public markets with virtually no transaction costs beyond modest legal fees, which SPARC would cover using its existing cash. Mr. Ackman, responding to comments beneath his post, said he believes the approach is superior to a traditional IPO in every way.

The hedge fund investor suggested that due diligence and a definitive agreement could be finalized within 45 days, potentially allowing for an announcement by mid-February.

Should You Buy TSLA Stock Now?

Putting it all together, Ackman’s proposal is a very intriguing one. Typically, the main goal of an IPO is simply to find buyers and ensure the capital is raised. Ackman’s proposal addresses both of those issues without relying on Wall Street banks. Moreover, it rewards TSLA shareholders.

However, I think it’s unlikely that SpaceX will go public via the SPARC structure, which is why it doesn’t strengthen the case for buying TSLA stock. I believe SpaceX is likely to pursue a traditional path to going public, and as noted in my previous article, the company has reportedly started selecting Wall Street banks to advise on its IPO.

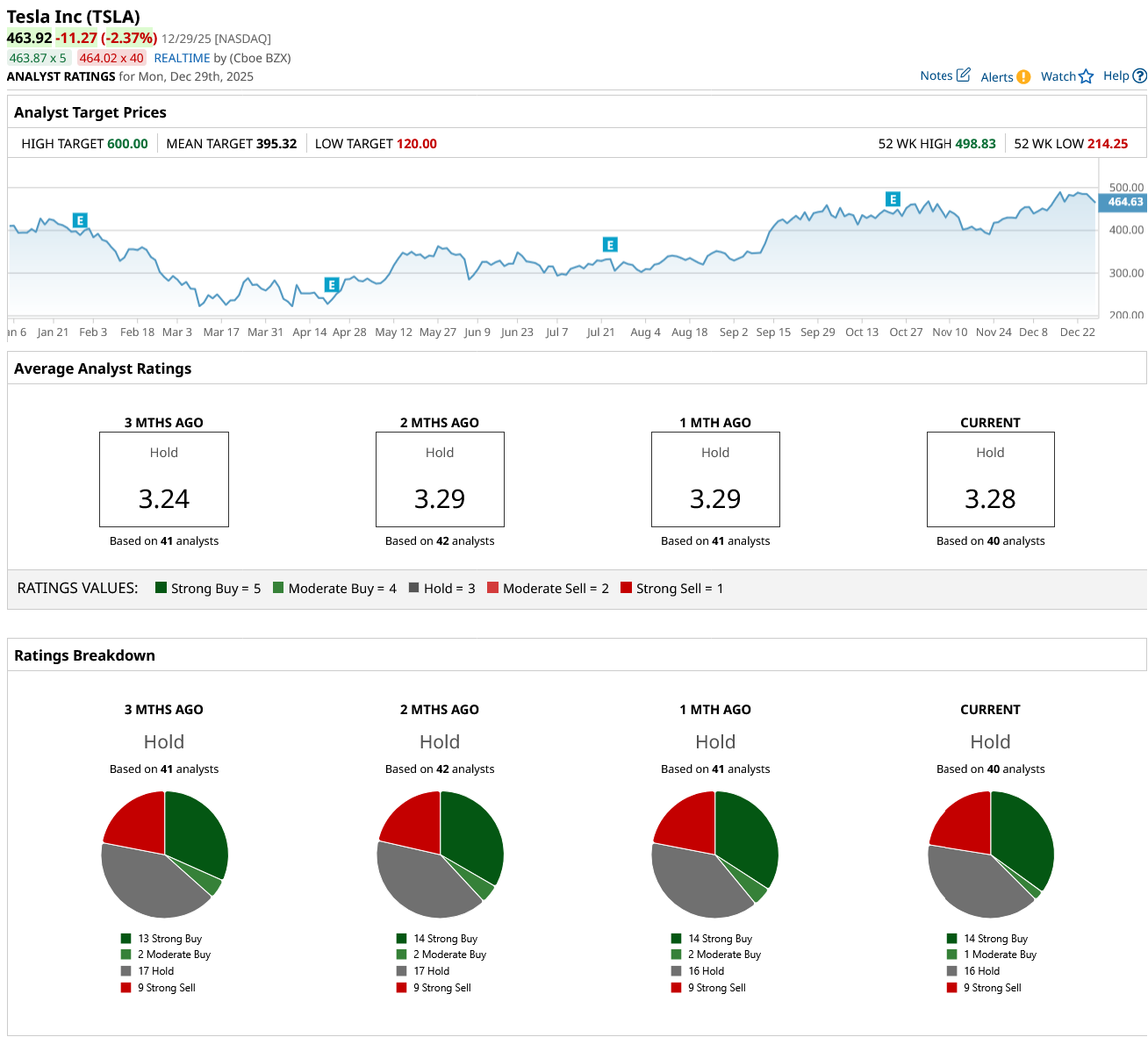

Meanwhile, Wall Street analysts remain split on Tesla. Of the 40 analysts covering the stock, 14 give it a “Strong Buy” rating, one assigns a “Moderate Buy,” 16 recommend holding, and nine rate it a “Strong Sell.” This results in a consensus “Hold” rating. TSLA shares currently trade well above their average price target of $395.32, though they still offer solid upside potential to the Street-high target of $600.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.