SoFi (SOFI) stock fell more than 6% on Friday, Dec. 5, after the company announced a $1.5 billion capital raise the previous day. The move was unexpected, as SoFi doesn't appear to be in any real need of cash, given its regulatory capital requirements. SoFi has also been diversifying into a capital-light business, and in the third quarter, 56% of its revenue came from its Financial Services and Technology Platform businesses, which are not capital-intensive like its lending business. In its announcement, SoFi said it intends to use the funds for “general corporate purposes,” which is as cursory a disclosure as a company can provide.

Meanwhile, while the stock sale was surprising, the price action wasn’t. Stock sales are usually dilutionary, and shares tend to fall after such offerings. Plus, SoFi priced shares at $27.50, which was below their trading price at the time.

Why Is SoFi Raising Capital?

This is not SoFi's first capital raise this year. The company announced a similar offering in July and raised $1.7 billion. Commenting on that offering, CFO Chris Lapointe said during the Q3 earnings call that the “opportunistic raise significantly increased our capital levels and allowed us to reduce our higher cost debt by $1.2 billion, making our balance sheet even stronger and giving us great flexibility to pursue growth opportunities.”

While the company hasn’t explicitly said so, this more recent capital raise is also opportunistic, as it capitalizes on the recent rally to raise fresh funds. It also further strengthens SoFi’s balance sheet and will help the company invest in growth.

SoFi has several growth avenues in the short- to medium-term. These include its recently relaunched cryptocurrency trading business. It has also been betting on blockchain and plans to integrate SoFi Pay with the yet-to-be-launched SoFi USD stablecoin.

The company's growth story is still in its beginning stages, as its brand recognition remains quite low and the total addressable market is gigantic. SoFi has been growing at the expense of banks, most of which lack the agility of fintech.

SoFi Has Been Disciplined With Capital

While I am often wary of a company doing frequent “opportunistic” capital raises, context and perspective matter. It ultimately boils down to how efficiently the capital is deployed. I would argue that SoFi has been quite disciplined on that front, and I have no reason to believe otherwise with this new round.

Among growth companies, one example I can think of is Tesla (TSLA), which raised about $12 billion across three rounds in 2020. Incidentally, the first of these announcements came less than two weeks after CEO Elon Musk denied the need for capital issuance during the company’s Q4 2019 earnings call. While that was a different era for electric vehicle (EV) companies, markets actually cheered the capital raises, and despite the massive stock sales, the stock ended up rising more than 8x that year.

While not an apples-to-apples comparison, SoFi stock is also up sharply from July, when it announced the last capital raise. I would bet on SoFi reclaiming the levels at which it traded before the stock sale sooner rather than later.

Why It Makes Sense To Buy the Dip in SoFi Stock

While the stock sale is opportunistic, I also believe it can help fund the company's growth endeavors. In the past, the $30 price level has been somewhat of a ceiling for SoFi, and it has failed to move decisively past that level. As SoFi continues to execute well, I believe the stock has the potential to go much higher in 2026, especially as the valuations don’t look all that demanding.

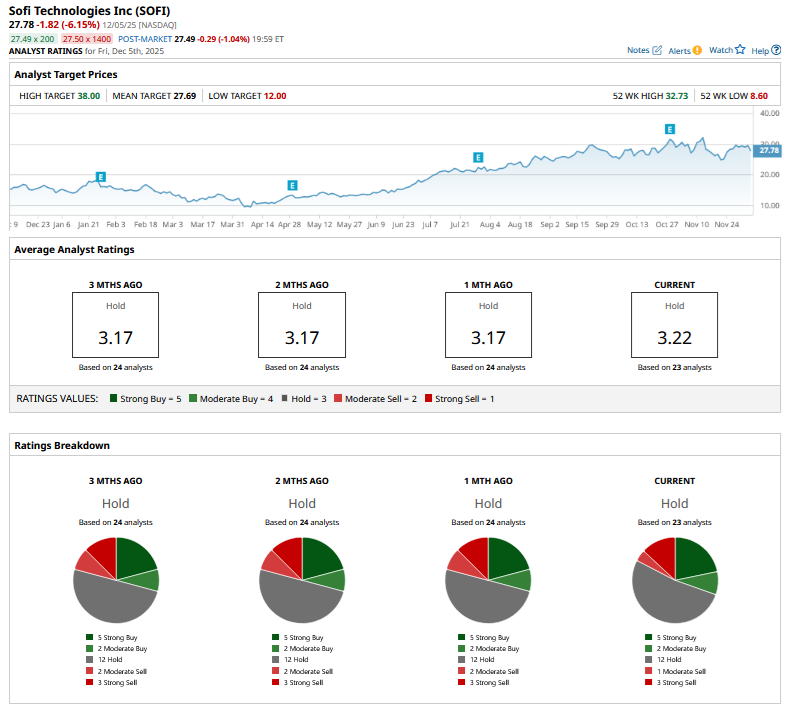

The average sell-side analyst is not on the same page, though, and the stock trades at levels similar to its mean target price. However, it's worth remembering that most Wall Street analysts missed the SoFi story, as the stock soared 6x in three years, despite most looking the other way.

SoFi has always looked expensive compared to banks, which I suspect is among the key reasons some analysts are bearish on the stock. I believe it will continue to look that way, given the profitable growth it brings to the table compared to legacy banks. SoFi aspires to be among the top financial institutions in the U.S., and given its current growth trajectory, I don’t see that as an unreasonable ambition.

On the date of publication, Mohit Oberoi had a position in: SOFI , TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart