Amazon’s (AMZN) third-quarter results, announced last night, exceeded expectations, with its cloud and advertising businesses showcasing significant strength and resilience. Thus, the market responded positively, sending AMZN stock up about 13% in the pre-market session.

The post-earnings jump in AMZN stock reflects the market's optimism about the company’s prospects in the cloud space and its ability to generate billions in revenue from its artificial intelligence (AI) chip and advertising businesses.

The key catalyst is the acceleration in Amazon Web Services (AWS), its cloud computing business. Management revealed that AWS experienced its fastest growth in the last three years, accelerating to 20.2% year-over-year growth in Q3.

Another major bright spot was Amazon’s AI chip business. The company’s Trainium2 chips, custom-designed for AI workloads, are gaining rapid traction. Amazon disclosed that Trainium2 has become a multibillion-dollar business, growing an extraordinary 150% from the previous quarter and now fully subscribed. This signals robust demand and strengthens Amazon’s position in the AI infrastructure market, an area witnessing exponential growth.

Beyond the cloud and AI, Amazon’s advertising division continues to perform exceptionally well, benefiting from the company’s unmatched reach and data-driven insights. Coupled with ongoing improvements in delivery speed and operational efficiency, Amazon is firing on all cylinders.

Amazon Poised for Stronger Growth

Amazon appears well-positioned for another phase of robust growth, with its cloud and advertising businesses showing strength. The company’s AWS segment continues to gain impressive momentum, reflected in a growing backlog that reached $200 billion by the end of the third quarter. Notably, this figure does not yet account for several new, unannounced deals closed in October. Together, these deals surpassed the total deal volume for the entire third quarter. This robust pipeline indicates accelerating growth ahead.

During the third quarter, AWS generated $33 billion in revenue, representing a 20.2% increase from the prior year and a 270-basis-point acceleration compared to the previous quarter. This was driven by continued demand for AI and core cloud services, as well as expanded capacity. Operating income climbed to $11.4 billion, up from $10.4 billion in Q3 2024, reflecting the segment’s profitable growth and operational discipline.

To support this demand, Amazon is investing heavily in infrastructure, particularly in power capacity for its data centers. Over the past 12 months, the company has added 3.8 gigawatts of power, doubling AWS’s capacity from 2022, and is on pace to double it again by 2027.

Management stated that Trainium is currently used by a small group of major customers. However, with the upcoming Trainium3 chips, Amazon anticipates broadening availability, setting the stage for even greater AI-driven growth.

Advertising has been a key driver of growth for Amazon. Ad revenue climbed to $17.7 billion in Q3, with the growth rate accelerating for the third consecutive quarter. With expanding partnerships and integrations with platforms like Spotify (SPOT) and SiriusXM (SIRI), Amazon is enhancing advertiser reach and unlocking new opportunities, particularly in live sports streaming through Prime Video.

Beyond cloud and advertising, Amazon continues to refine its retail operations. By improving inventory placement, advancing robotics and automation, expanding product selection, and maintaining competitive pricing, the company is positioning itself for continued e-commerce strength. Together, these strategic initiatives strengthen Amazon’s ability to grow across multiple high-margin businesses, suggesting that the company’s next phase could be profitable.

AMZN Stock Could Hit $305

Amazon’s third-quarter results and management’s commentary indicate that the company’s growth trajectory remains strong. With AWS’s backlog swelling, advertising growth accelerating, strength in the e-commerce business, and infrastructure investments paving the way for long-term scalability, Amazon’s fundamentals remain compelling.

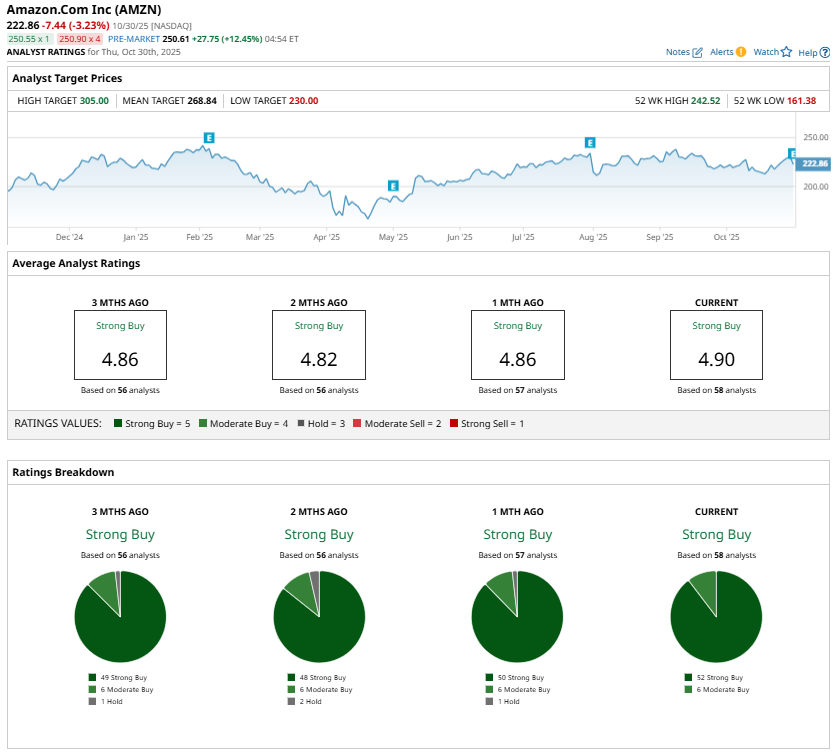

Given these powerful growth catalysts, Amazon stock is an attractive long-term investment. Analysts are bullish and maintain a “Strong Buy” consensus rating on AMZN stock. Moreover, the highest price target for Amazon stock is $305, implying about 37% upside potential from its closing price of $22.86 on Oct. 30.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla’s New Focus Isn’t on Cars, But on ‘Sustainable Abundance.’ What Does That Mean for TSLA Stock and Buy-and-Hold Investors?

- Amazon's Revenue Beat Surprises Analysts and Its Cash Flow Surges (Not FCF) - AMZN Stock Could Still Be Undervalued

- As Apple Turns the Corner With the iPhone 17, Should You Buy AAPL Stock for 2026?

- This Stock Lets You Profit from Building the Power Grid