Stable Replacement Cycles and Start-Stop Vehicle Penetration Sustain Growth in a Mature Energy Storage Market

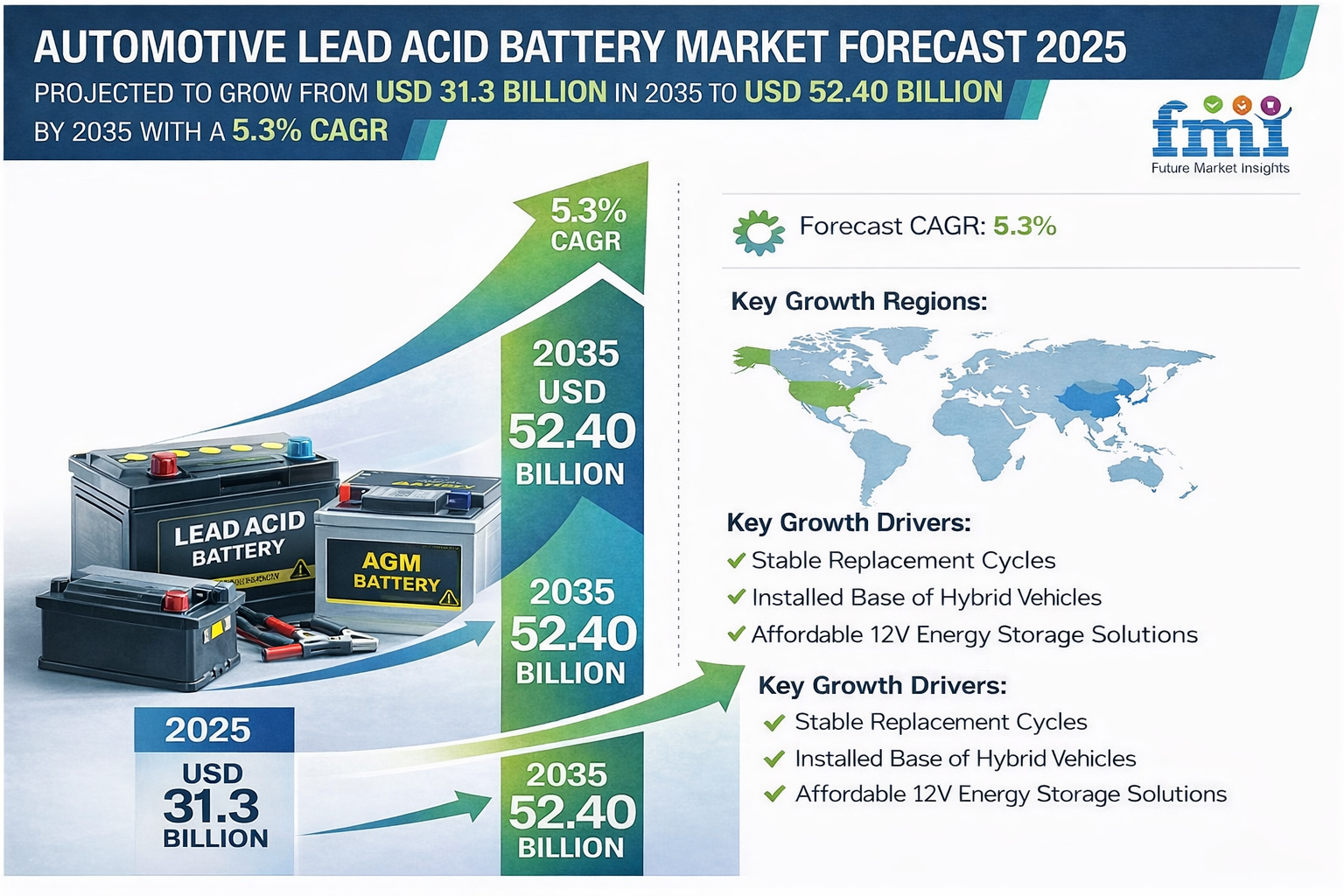

NEWARK, DELAWARE / ACCESS Newswire / February 11, 2026 / The global automotive power storage ecosystem is evolving steadily rather than explosively. Amid accelerating electrification narratives, the Automotive Lead Acid Battery Market-valued at USD 31.3 billion in 2025-is projected to reach USD 52.40 billion by 2035, expanding at a compound annual growth rate (CAGR) of 5.3% over the forecast period.

According to analysis by Future Market Insights (FMI), this growth reflects the enduring relevance of lead-acid batteries across conventional, start-stop, and hybrid vehicle platforms, where cost efficiency, proven reliability, and mature recycling infrastructure continue to outweigh disruptive substitution risks. Rather than peaking or declining, the market follows a stable, gently ascending curve, underpinned by predictable replacement cycles and incremental technology upgrades.

A Market Defined by Stability, Not Disruption

Unlike emerging battery chemistries driven by speculative adoption curves, the automotive lead-acid battery market is anchored in installed vehicle population fundamentals. With the global vehicle fleet exceeding 1.5 billion units, lead-acid batteries benefit from replacement cycles averaging 3-5 years, ensuring recurring aftermarket demand independent of new vehicle production volatility.

"The growth profile here is structural, not speculative," notes an industry analyst. "Lead-acid batteries have quietly transitioned from commodity components to engineered systems capable of supporting increasingly complex vehicle electrical architectures."

From 2025 to 2030, the market is expected to show a steady incline, driven primarily by replacement demand in mature automotive markets and expanding vehicle ownership in developing economies. Between 2030 and 2035, the curve steepens modestly as AGM and Enhanced Flooded Battery (EFB) adoption accelerates, supported by higher start-stop vehicle penetration and rising electrical loads.

OEM Dominance Anchors Demand While Aftermarket Ensures Resilience

Structurally, the market is segmented into Original Equipment Manufacturers (OEMs) and the aftermarket.

OEMs account for approximately 62.38% of market share, benefiting from long-term supply contracts, preferred vendor relationships, and consistent integration of lead-acid batteries in vehicle production lines. These partnerships provide manufacturers with predictable volume demand and enable incremental technology upgrades aligned with evolving vehicle specifications.

The aftermarket, representing roughly 18.19% of the market, serves as the sector's stabilizing force. As vehicles age and battery replacement becomes inevitable, the aftermarket delivers recurring, counter-cyclical revenue streams, particularly in regions with aging vehicle fleets and extreme climatic conditions that accelerate battery wear.

Technology Evolution: From Flooded Batteries to AGM Leadership

The automotive lead-acid battery market reflects a clear technology hierarchy rather than rapid displacement.

Flooded Batteries maintain dominance with a 60.0% market share, supported by low manufacturing costs, universal vehicle compatibility, and strong presence in price-sensitive emerging markets. Their proven performance in traditional Starting, Lighting & Ignition (SLI) applications ensures continued volume leadership.

Absorbent Glass Mat (AGM) Batteries, accounting for 30.0% of market share, represent the fastest-growing and highest-value segment. AGM batteries are now mandatory in start-stop vehicles, where cycling demands exceed conventional battery capabilities by three to four times. Their premium positioning is reinforced by superior charge acceptance, vibration resistance, and maintenance-free operation.

Enhanced Flooded Batteries (EFB) occupy a strategic middle ground, enabling cost-effective start-stop functionality in mass-market vehicles and expanding the addressable market for advanced lead-acid solutions.

Regional Performance: Fleet Scale and Regulation Drive Growth

Region |

Forecast CAGR (2025-2035) |

Key Growth Drivers |

|---|---|---|

United States |

5.4% |

Large vehicle fleet exceeding 280 million units; well-established aftermarket infrastructure; rising start-stop system penetration in domestic vehicle production; extreme climate conditions driving frequent battery replacements |

European Union |

5.3% |

Near-universal start-stop adoption; stringent emission and fuel-efficiency regulations; high electrical content in passenger vehicles; strong AGM battery demand across Germany, France, and the UK |

South Korea |

5.3% |

Advanced automotive manufacturing ecosystem; rapid integration of start-stop systems; strong OEM demand from Hyundai and Kia vehicle platforms |

Emerging Markets (India, Southeast Asia, Latin America, Africa) |

Moderate-High Growth |

Rising vehicle ownership; expanding commercial vehicle fleets; cost-sensitive demand favoring flooded lead-acid batteries; improving automotive aftermarket networks |

Market Headwinds: Competition and Cost Pressures

Despite its resilience, the market faces several constraints. Raw material price volatility, particularly for lead and plastics, impacts manufacturing margins. Environmental regulations governing battery production and recycling add compliance costs, especially for smaller players.

Meanwhile, lithium-ion batteries pose a long-term competitive threat in select auxiliary applications and future high-voltage architectures. However, lead-acid batteries retain decisive advantages in cost, recyclability (over 99% lead recovery), and global infrastructure readiness, limiting near-term displacement.

Competitive Landscape: Scale, Distribution, and Recycling as Moats

The market is moderately concentrated, with leading players controlling 55-65% of global share. Key participants include:

Johnson Controls (Clarios)

Exide Technologies

GS Yuasa Corporation

East Penn Manufacturing

EnerSys

Competitive differentiation centers on OEM relationships, aftermarket reach, recycling integration, and brand trust, rather than radical product innovation. Closed-loop recycling systems provide both environmental compliance and cost advantages, reinforcing barriers to entry.

Outlook: A Market Built for Endurance

By 2035, the Automotive Lead Acid Battery Market will not be defined by disruption but by durability and adaptability. As vehicle electrification increases system complexity rather than eliminating 12V requirements, lead-acid batteries remain essential for auxiliary power, safety systems, and start-stop functionality.

The result is a market characterized by moderate but reliable growth, incremental innovation, and strong aftermarket fundamentals-forming a smooth upward curve rather than a volatile spike.

Quick Stats - Automotive Lead Acid Battery Market

Market Value (2025): USD 31.3 Billion

Forecast Value (2035): USD 52.40 Billion

Forecast CAGR: 5.3%

Leading Battery Type: Flooded Batteries (60.0% share)

Advanced Technology Segment: AGM Batteries (30.0% share)

Key Growth Regions: United States, European Union, South Korea

For an in-depth analysis of evolving formulation trends and to access the complete strategic outlook for the Automotive Lead Acid Battery Market through 2035, Full Report Request - https://www.futuremarketinsights.com/reports/automotive-lead-acid-battery-market

Related Reports:

Lead Acid Battery Market - https://www.futuremarketinsights.com/reports/global-lead-acid-battery-market

Lead Acid Battery Recycling Market - https://www.futuremarketinsights.com/reports/lead-acid-battery-recycling-market

Flooded Lead Acid Battery Market - https://www.futuremarketinsights.com/reports/flooded-lead-acid-battery-market

Advanced Lead Acid Battery Market - https://www.futuremarketinsights.com/reports/advanced-lead-acid-battery-market

Stationary Lead Acid Battery Storage Market - https://www.futuremarketinsights.com/reports/stationary-lead-acid-battery-storage-market

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. Headquartered in Delaware, USA, with a global delivery center in India and offices in the UK and UAE, FMI delivers actionable insights to businesses across industries including automotive, technology, consumer products, manufacturing, energy, and chemicals.

An ESOMAR-certified research organization, FMI provides custom and syndicated market reports and consulting services, supporting both Fortune 1,000 companies and SMEs. Its team of 300+ experienced analysts ensures credible, data-driven insights to help clients navigate global markets and identify growth opportunities.

For Press & Corporate Inquiries

Rahul Singh

AVP - Marketing and Growth Strategy

Future Market Insights, Inc.

+91 8600020075

For Sales - sales@futuremarketinsights.com

For Media - Rahul.singh@futuremarketinsights.com

For web - https://www.futuremarketinsights.com/

SOURCE: Future Market Insights, Inc.

View the original press release on ACCESS Newswire